By Keith Waters, Ph.D. and Terry Clower, Ph.D.

The Northern Virginia Association of Realtors® region housing market has shown remarkable resiliency in spite of the economic downturn caused by the COVID-19 pandemic.

The Northern Virginia Association of Realtors® region housing market has shown remarkable resiliency in spite of the economic downturn caused by the COVID-19 pandemic.

Although low inventory in the NVAR region has continued to limit the number of sales, the strength of any housing market is fundamentally determined by the strength of the local labor market.

This article examines the job changes in Northern Virginia and several surrounding jurisdictions to explain recent housing market trends and suggest what may be expected in 2021. While the local labor market has suffered severe job losses, the sub-sector of jobs that has been driving the housing market over the past few decades remained strong – likely signaling a robust housing market in 2021.

2020 – Professional Job Growth Supported the NVAR Housing Market

"The residential real estate industry was an economic sector leader in adapting to the challenges of COVID-19. This adaptability has allowed many regional residents to realize their dreams of homeownership."

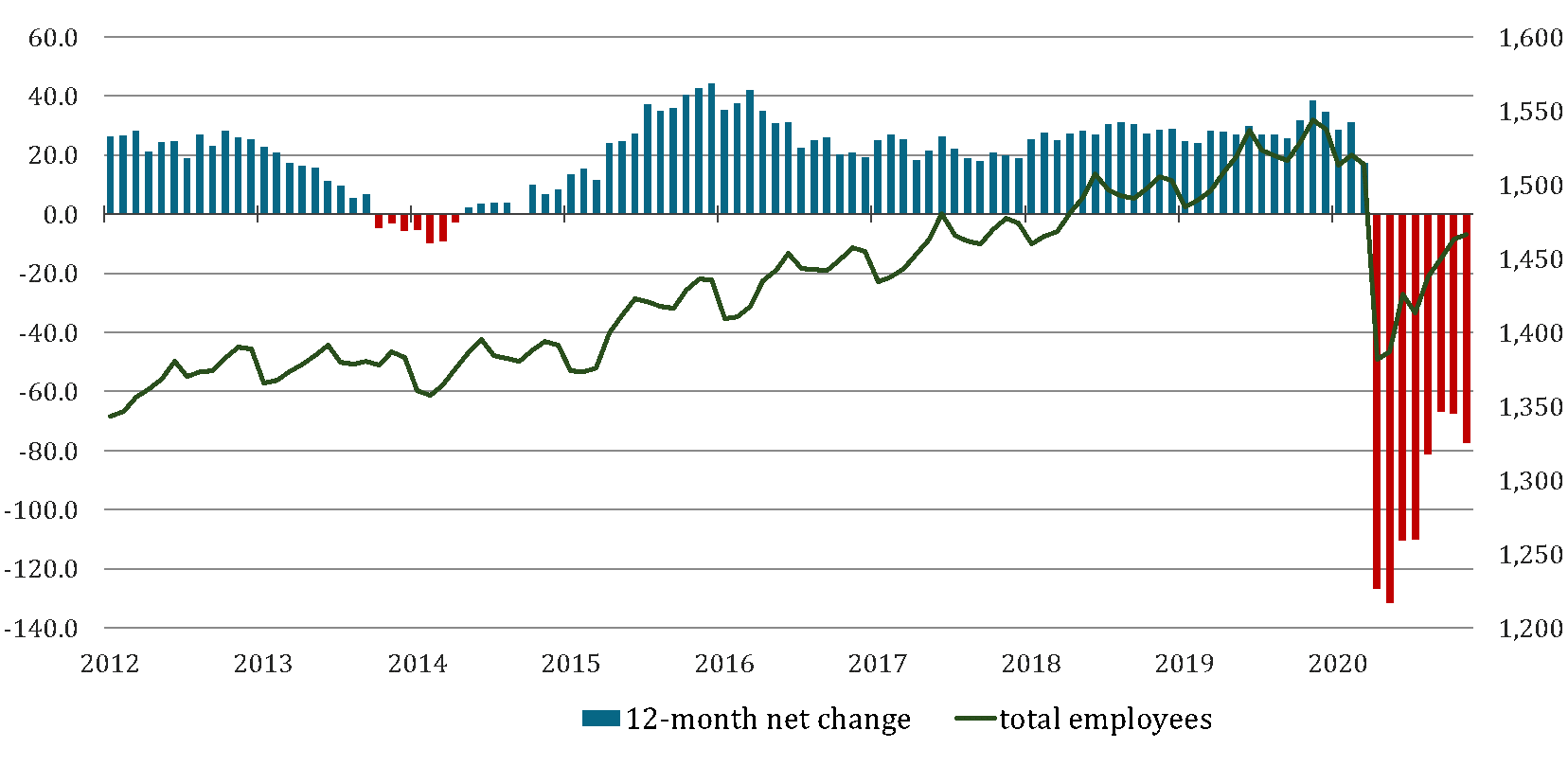

As with the rest of the nation, the pandemic caused unprecedented job losses in Northern Virginia (Figure 1). Between April 2019 and April 2020, Northern Virginia recorded a loss of almost 127 thousand jobs (-8.4%). Year-over-year job losses were even more severe the following month; there were 131.5 thousand fewer jobs in May 2020 than in May 2019 (-8.7%). Data dating back to 2012 have been provided for context.

As state and local business restrictions eased in the summer of 2020, job numbers rebounded but still at depressed levels. The number of jobs was down 110.6 thousand year-over-year in June and 110.1 thousand in July. The recovery in regional jobs continued through the end of summer but stalled out in the fall as the infection rate worsened. In percentage terms, the number of jobs in Northern Virginia was down 7.3%in July 2020 from July 2019. In September and August, the number of jobs were down 4.4% and 4.3% from the same months in 2019. By November, COVID-19 infections caused tighter business restrictions and a resulting upswing in job losses between October and November. For November, total jobs in the Northern Virginia were 5% lower than the previous year.

Figure 1. Job Change Jan. 2012 to Oct. 2020, Northern Virginia

(in thousands)

Source: U.S. Bureau of Labor Statistics

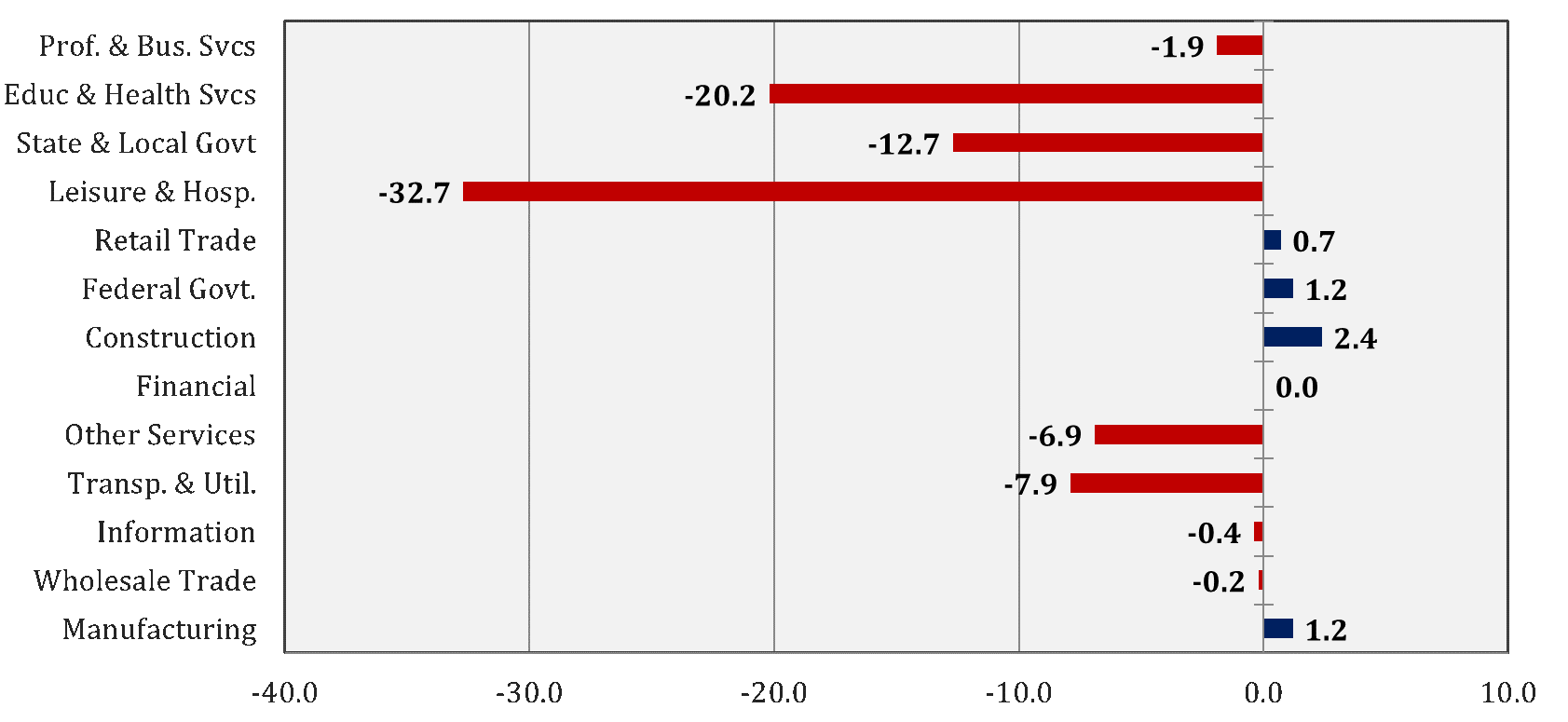

Although the region has lost a tremendous number of jobs, the losses have not been evenly distributed throughout the economy. The leisure and hospitality sector has borne the brunt of this crisis. There were 32.5 thousand fewer leisure and hospitality jobs in Northern Virginia in October 2020 than October 2019 – nearly double the next hardest hit sector of education and health services (Figure 2).

The 32.7 thousand jobs lost in the leisure and hospitality sector in Northern Virginia represent a 21.9% decline. Fortunately, the November 2019 to November 2020 decline is a marked improvement from the 43.4% year-over-year decline recorded in April. Unfortunately, due to the aforementioned increases in business restrictions in the fall of 2020, leisure and hospitality began dropping again and lost one thousand net jobs between October and November.

In contrast to the leisure and hospitality sector, the professional and business services sector, which is the largest industry sector in the region, saw a relatively small drop in total jobs with November 2020 employment levels just 1,900 jobs lower than the previous November.

Figure 2. Job Change by Industry from Oct. 2019 to Oct. 2020, Northern Virginia

(in thousands)

Source: U.S. Bureau of Labor Statistics

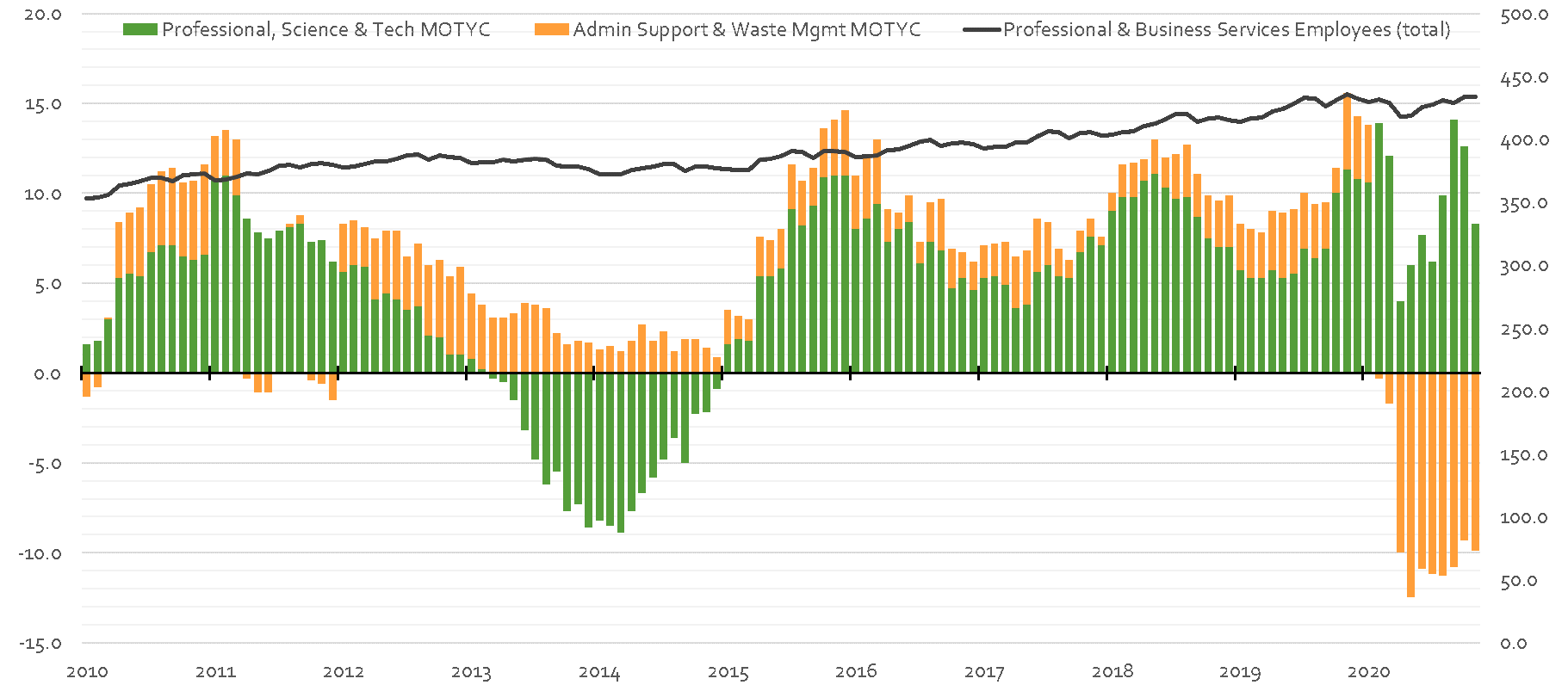

Importantly for the local housing market, a more detailed examination of job change in professional and business services illustrates a key characteristic of the pandemic-induced recession – it has been K-shaped. In this K-shaped recession, companies in relatively high wage sectors of the economy, on average, have continued to do well – think lawyers, architects, engineers and computer programmers, among others. Moreover, federal spending going to Northern Virginia services contractors has continued to increase.

Figure 3 shows job trend comparisons between the professional, scientific and technical services sub-sector (high wage) and the administrative, building services, travel arrangements and waste management sub-sector (lower wage). Overall, the subsector with comparatively higher wages has continued to grow throughout the pandemic adding almost 9,000 jobs compared to November 2019, which has propped up housing demand among middle and upper-middle income households. In contrast, the administrative and support and waste management sub-sector, which proportionately would represent more renters, has lost about 10,000 jobs year-over-year as of November 2020.

Figure 3. Professional and Business Services, NVAR Region

(in thousands)

Source: U.S. Bureau of Labor Statistics

Independent of pandemic-related developments, the Northern Virginia economy has been reliant on professional, scientific and technical services for more than two decades. The recent growth in this sub-sector has undoubtedly helped to support the local housing market, as these are the workers that can afford the houses in Northern Virginia.

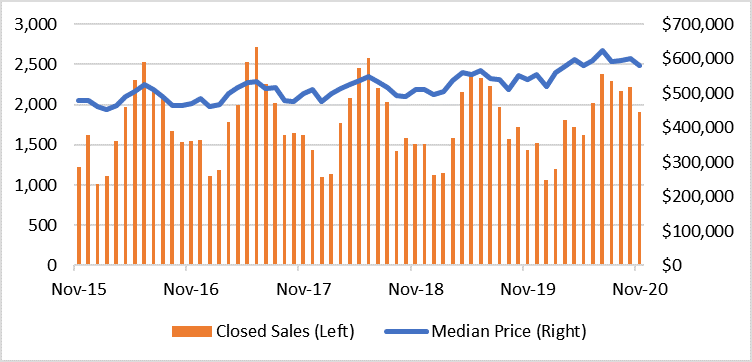

Indeed, the housing market remained strong in Northern Virginia throughout 2020, even with tighter inventories. The number of closed sales has not deviated markedly from the past five years, other than usual seasonal fluctuations. The number of closed sales runs from about 1,000 homes per month during the winter to around 2,500 homes during peak market (Figure 4).

Given demand increases caused by a combination of continuing strength in key sectors of the regional economy, historically low mortgage rates, and pandemic-induced shifts in preference for single-family properties, the median home prices of sold homes in the NVAR region has continued to climb – reaching a record high of $625,000 in July 2020.

Figure 4. Closed Sales and Median Sales Price, NVAR Region

Source: Bright MLS. Statistics calculated 12/15/2020

The price gains may finally have enticed would-be sellers to put their houses on the market, thereby increasing inventory. Alternatively, some inventory gains could be attributed to some homeowners leaving core jurisdictions as their work-from-home status becomes more permanent.

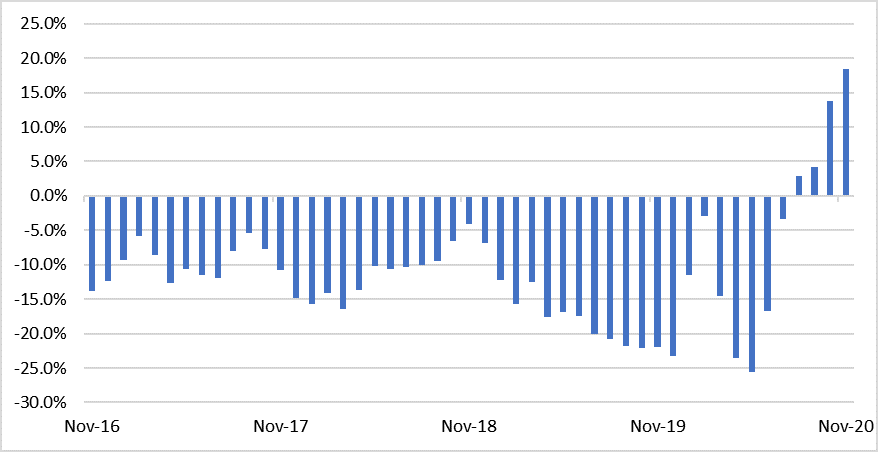

The increase in inventory could also represent a shift in timing whereby the pandemic caused some to put off housing market activities in spring and early summer, and now are selling homes that would have been sold earlier in the year in a normal market. Whatever the cause, fall inventory trends have helped Realtors® see market activity extended well past the usual seasonal slow-down (Figure 5).

Figure 5. Year-Over-Year Percent Change in Inventory

(All Pending Sales and Active Listings), NVAR Region

Source: Bright MLS. Statistics calculated 12/15/2020

2021 Outlook

The past year has been among the most difficult in memory. The pandemic brought devastating job losses to the national and regional economy. Despite the job losses, there are signs of resilient strength in Northern Virginia. Job growth continues in the higher paying professional and technical services sub-sector. As heard anecdotally from local Realtors®, there are plenty of consumers in the market who can afford to enter the ranks of homeownership in the NVAR region.

The data discussed in this report are all pointing to a bright year ahead. Job growth in high-paying sectors appears to be robust, and we can expect the new federal administration to expand efforts to stimulate the national economy as we continue to be challenged by the pandemic.

Have we finally seen a bottoming out of regional inventory levels? The work-from-home phenomenon may ultimately benefit local home buyers. An increase in the inventory of for-sale properties will allow local Realtors® to assist the many eager buyers who plan to continue to work AND live in Northern Virginia.

The residential real estate industry was an economic sector leader in adapting to the challenges of COVID-19. This adaptability has allowed many regional residents to realize their dreams of homeownership. Still, lingering economic and market factor unknowns make predicting real estate market performance in 2021 a real challenge.

The GMU Center for Regional Analysis will continue working with the NVAR Forecast Advisory Team to track the pulse of regional market trends; stay tuned in the coming weeks for the annual GMU/NVAR market forecast.

Dr. Terry Clower is the director of the George Mason University Center for Regional Analysis.

Dr. Keith Waters is a research associate for the George Mason University Center for Regional Analysis.