Editor’s note: Conclusions in this article are based on data analyzed through the first week of June, 2020. Weekly market activity since that time has shown positive signs, but does not necessarily indicate a trend. For the latest data and analysis, visit the GMU-CRA COVID-19 resource hub developed in collaboration with NVAR at cra.gmu.edu/covid19/.

Editor’s note: Conclusions in this article are based on data analyzed through the first week of June, 2020. Weekly market activity since that time has shown positive signs, but does not necessarily indicate a trend. For the latest data and analysis, visit the GMU-CRA COVID-19 resource hub developed in collaboration with NVAR at cra.gmu.edu/covid19/.

ONE OF THE INTERESTING TRENDS that emerged in the early days of the COVID-19 pandemic was an actual increase in closed sales in the NVAR region during March 2020.

In the pre-pandemic final months of 2019, the joint George Mason University Center for Regional Analysis (GMU- CRA) and NVAR forecasting team had expected the 2020 NVAR area housing market to be generally characterized by a drop in the number of units sold compared to 2019, based on the probability that market inventories would continue to drop.

That forecast held through mid- March. But when a sizable number of sellers decided to pull their homes off the market and state and local governments imposed restrictions on business activities, closed sales numbers actually rallied.

In monitoring regional real estate market performance, the CRA team began to wonder how the transaction process would respond to office closures and social distancing while supporting individuals willing to proceed with selling or buying a home. Recognizing that there could be concerns that transactions might take longer to close, Realtor® associations, including NVAR, quickly adopted COVID Addendums to shield their members’ clients against unforeseeable delays.

Here we explore the time to close for transactions regionally and locally during the initial months of the pandemic. This analysis defines “time- to-close” as the time between purchase contract date and the closed date. Data are provided by our research partners, Bright MLS.

CLOSED SALES

This analysis offers data focusing on the NVAR service area but begins with a look at broader market trends for the Mid-Atlantic region for context. Bright MLS data for the Mid-Atlantic regions includes all or parts of Delaware, Pennsylvania, Maryland, the District of Columbia and Virginia.

MID-ATLANTIC REGION

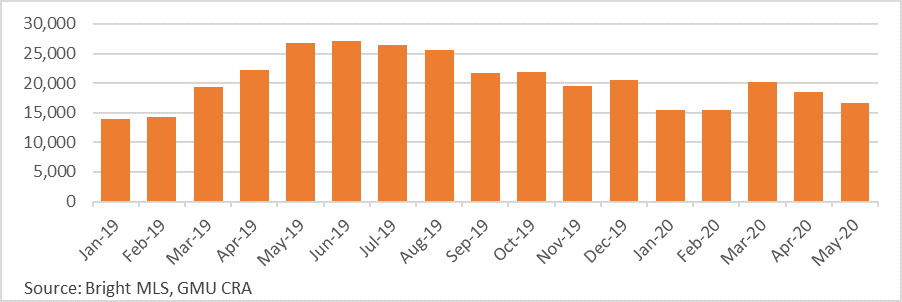

In the Mid-Atlantic region, closed sales were higher year-over-year for the first three months of 2020 before a substantial pandemic-induced decline (Figure 1). There were 10.5% more closed sales in January 2020 than in January 2019, 8.4% more closed sales in February 2020 than in February 2019, and 3.9% more closed sales in March 2020 than March 2019 – despite the start of social distancing guidelines. In April 2020, there were only 18,538 closed sales in the Mid- Atlantic, 16.3% fewer sales than recorded in April 2019. Most dramatically, there were almost 38% fewer closed sales in May 2020 than in May 2019. Comp-only sales (defined as those sales where the MLS list date is the same or after the closing date) and new construction sales are excluded from this analysis.

Figure 1. Mid-Atlantic Monthly Closed Sales

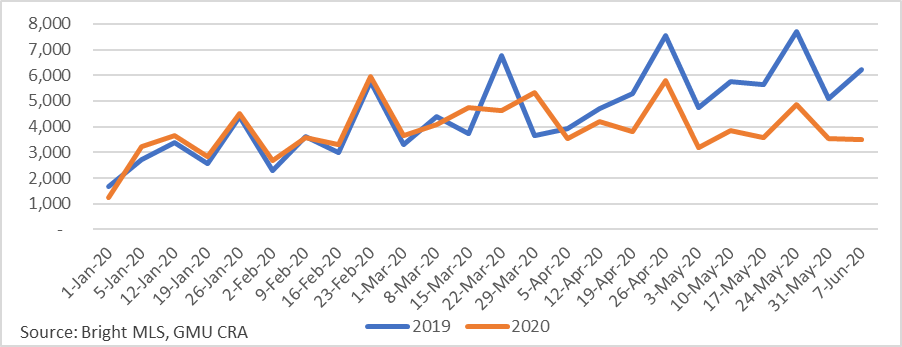

The year-over-year decline in the number of closed sales in the Mid-Atlantic is revealed more clearly by weekly data (Figure 2). Weekly sales volumes in 2019 and 2020 were broadly comparable until the week of March 22, 2020. Since that time, the trend lines in closed sales have diverged with a gap in the number of closed sales growing through the week starting on June 7, which is the most recent data available at the time of publication. In this most recent period, the number of closed sales were 44% lower than the same week the year prior.

Figure 2. Mid-Atlantic Weekly Closed Sales: 2019 and 2020

NVAR REGION

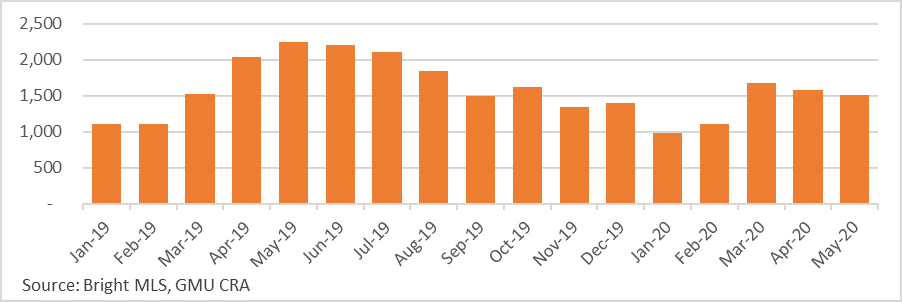

The number of closed sales in the NVAR region began the year notably different than the Mid-Atlantic. While closed sales in the Mid-Atlantic increased markedly year-over-year, there were 11.5% fewer closed sales in January 2020 than January 2019, but February 2020 tracked very closely with February 2019.

In contrast with the small year-over-year increase in closed sales in the Mid-Atlantic in March, the number of closed sales in the NVAR region increased 10.1% over the previous year. However, as business restrictions took hold, closed sales in the NVAR region decreased 22.4% year-over- year in April and 32.5% year-over-year in May (Figure 3).

Figure 3. NVAR Monthly Closed Sales

While monthly data revealed that market conditions were notably different in the NVAR region than the Mid-Atlantic, weekly data indicates that the NVAR region followed the same course as the Mid-Atlantic when the state began to restrict activity (Figure 4). There were 24.2% fewer closed sales the week of March 22, 2020 than the same week the year prior. As with the Mid-Atlantic region, the large decline was followed by a week of notably more closed sales than the year prior (+29.6%). Following these two extraordinary weeks, the number of closed sales in the NVAR regions was, on average, 26.4% lower year-over-year for the 10 weeks from April 5 through the end of the week that started on June 7.

Figure 4. NVAR Weekly Closed Sales: 2019 and 2020

TIME TO CLOSE

The unusual pattern of spikes and subsequent declines in closed sales is likely the result of delayed closings as Realtors® worked to operate in a new environment. These delayed closings would presumably result in a build-up of pending and contingent sales as financial intermediaries and lenders worked through the mechanics of closing sales under social distancing guidelines – thereby reducing the number of closed sales. To examine this possibility, this section considers the time-to-close more closely.

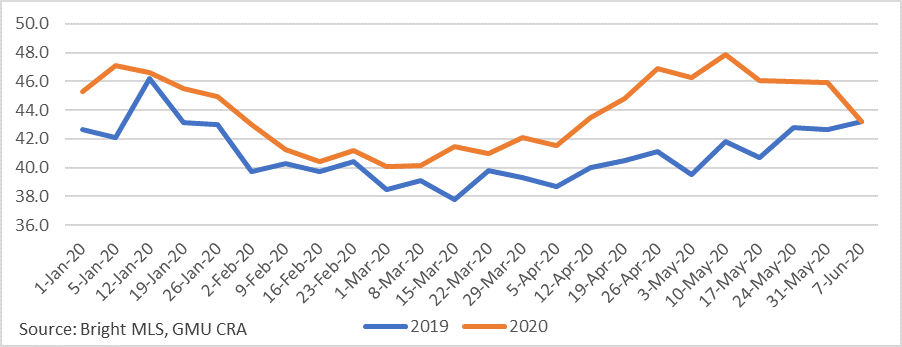

MID-ATLANTIC REGION

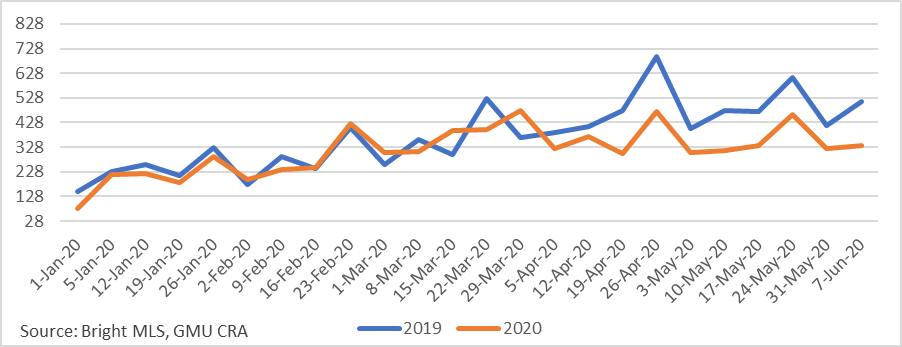

The average time-to-close has been increasing since roughly when states began to restrict activity (Figure 5). Up to the week of March 29, the average weekly time-to-close in the Mid-Atlantic was approximately 5% higher (two days) in 2020 than in 2019. From the week of March 29 through the week of June 7, the average weekly time-to-close time was 9.8% higher than the same week the year prior. The year-over-year increase in time-to-close peaked at 17.1% longer (6.7 Days) the week of May 3.

Figure 5. Mid-Atlantic Weekly Time to Close: 2019 and 2020

According to Fred Westerlund, CEO of MBH Settlements and a member of the GMU-CRA/NVAR Forecasting Group, among the biggest challenges was the variance in lender acceptance of e-notarizations and e-signatures. Lenders had to adapt their internal rules quickly, and some were shown to be more nimble than others.

However, by late May and early June it appears that real estate professionals have risen to the challenge and are back to more normal closing schedules.

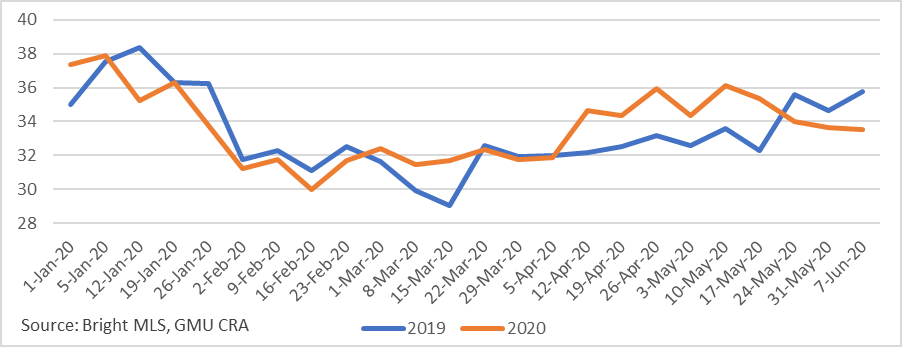

NVAR REGION

Fortunately, time-to-close in the NVAR region has not increased as dramatically as in the Mid-Atlantic (Figure 6). The weekly average of time-to-close in the NVAR region was roughly comparable year-over- year leading up to the pandemic. While the time-to-close has increased in the NVAR region, it began several weeks later than the broader Mid-Atlantic, increasing notably the week of April 12, 2020. The average time-to-close in the NVAR region increased the most during the week of May 17, when it peaked at 9.4% longer (3 days) year-over-year. Following the brief and less severe increase in the time-to- close, the average weekly time-to-close in the NVAR region was lower than the same week the year prior for the weeks from May 24 through the week that started on June 7. The evidence illustrates that the practices of Realtors® in our region are adaptable and resilient to the most trying of circumstances.

Figure 6. NVAR Time-to-Close - 2019, 2020 Comparison

HOUSING TYPE

While the time-to-close in the NVAR region has performed well relative to the Mid-Atlantic, the time-to-close varied substantially by housing type in the NVAR region (Table 1).

Table 1. Time to Close - 2019, 2020 Comparison by Housing Type in NVAR Region

|

|

DETACHED

|

TOWNHOUSE/TWIN

|

CONDO

|

|

Closed Week (2020)

|

2019

|

2020

|

2019-2020% Change

|

2019

|

2020

|

2019-2020% Change

|

2019

|

2020

|

2019-2020% Change

|

|

5-Apr-20

|

33.8

|

32.7

|

-3.3%

|

28.1

|

31.0

|

10.4%

|

33.8

|

31.5

|

-6.7%

|

|

12-Apr-20

|

34.0

|

34.2

|

0.5%

|

31.9

|

36.3

|

13.7%

|

29.2

|

33.3

|

13.8%

|

|

19-Apr-20

|

34.0

|

36.2

|

6.4%

|

31.3

|

31.4

|

0.3%

|

31.1

|

36.2

|

16.4%

|

|

26-Apr-20

|

35.3

|

37.0

|

4.9%

|

32.1

|

34.8

|

8.4%

|

30.8

|

35.6

|

15.7%

|

|

3-May-20

|

34.5

|

38.7

|

12.4%

|

31.2

|

29.8

|

-4.4%

|

31.1

|

31.2

|

0.3%

|

|

10-May-20

|

36.6

|

39.0

|

6.5%

|

31.2

|

33.3

|

6.7%

|

30.2

|

33.5

|

10.8%

|

|

17-May-20

|

33.6

|

35.7

|

6.2%

|

31.1

|

35.1

|

13.0%

|

31.6

|

35.0

|

10.5%

|

|

24-May-20

|

37.6

|

35.6

|

-5.3%

|

36.5

|

33.2

|

-9.0%

|

29.5

|

30.8

|

4.6%

|

|

31-May-20

|

36.2

|

36.1

|

-0.2%

|

34.2

|

31.2

|

-8.8%

|

32.0

|

32.3

|

0.7%

|

|

7-Jun-20

|

39.3

|

35.8

|

-8.9%

|

32.1

|

31.4

|

-2.2%

|

32.0

|

32.1

|

0.4%

|

Source: Bright MLS, GMU CRA

The largest increase in time-to-close was recorded for closed sales of condos. The time-to-close for condos increased year-over-year by more than 10% for five out of the six weeks from April 12 through May 17. The time-to-close for townhouses/twins also increased, though the increase was less than for condos and more volatile, indicating that some increases were the result of a few sales increasing substantially. The time-to-close for detached homes was notably higher for just one week (May 3), and in recent weeks has dropped substantially compared to last year. This can be attributed to both operational changes, which is good news, as well as fewer transactions than typical at this time of year.

To analyze subregions of the NVAR footprint, Alexandria and Arlington are compared against Fairfax County, Fairfax City, and Falls Church (Greater Fairfax). Among the two subregions, the time-to-close has increased more dramatically in Arlington and Alexandria than in the Greater Fairfax subregion (Table 2). The average weekly time-to-close in the Alexandria and Arlington sub-region was more than 10% longer in 2020 for five out of six weeks beginning in mid April, peaking at 26.7% longer the week of April 12.

Table 2. Time to Close - 2019, 2020 Comparison by NVAR Sub-Region

|

|

ALEXANDRIA & ARLINGTON

|

FAIRFAX + FAIRFAX CITY

+ FALLS CHURCH

|

|

Closed Week (2020)

|

2019

|

2020

|

2019-2020 % Change

|

2019

|

2020

|

2019-2020% Change

|

|

5-Apr-20

|

30.6

|

31.7

|

3.7%

|

32.4

|

31.9

|

-1.4%

|

|

12-Apr-20

|

29.6

|

37.5

|

26.7%

|

32.9

|

33.8

|

2.9%

|

|

19-Apr-20

|

30.1

|

35.4

|

17.8%

|

33.2

|

34.0

|

2.4%

|

|

26-Apr-20

|

31.4

|

34.7

|

10.3%

|

33.7

|

36.3

|

7.8%

|

|

3-May-20

|

30.5

|

33.3

|

9.4%

|

33.2

|

34.6

|

4.1%

|

|

10-May-20

|

31.3

|

34.8

|

11.1%

|

34.3

|

36.6

|

6.7%

|

|

17-May-20

|

33.7

|

39.2

|

16.5%

|

31.8

|

34.3

|

7.8%

|

|

24-May-20

|

34.2

|

29.7

|

-13.1%

|

35.9

|

35.1

|

-2.3%

|

|

31-May-20

|

31.3

|

32.8

|

4.8%

|

35.7

|

33.8

|

-5.1%

|

|

7-Jun-20

|

33.8

|

31.4

|

-7.1%

|

36.3

|

34.2

|

-5.9%

|

Source: Bright MLS, GMU CRA

In contrast, the Greater Fairfax sub-region did not record a single week with time-to-close more than 10% longer than the same week in 2019. Given the lack of sub-regional variation in active lenders in the NVAR region, the CRA suspects that much of the difference is due to higher shares of condos and townhomes in the Alexandria and Arlington as compared with the Greater Fairfax sub-region.

CONCLUSION

The data suggest that real estate professionals in Northern Virginia, from agents and brokers to financial intermediaries and lenders, have found ways to respond to client needs in response to the COVID-19 health crisis, especially when compared to the overall Mid-Atlantic regional market.

There may be a new wave of uncertainty emerging as the economic effects of the pandemic spread beyond the hard-hit hospitality and travel industries. There is a growing chorus of technology companies, professional business service providers, universities and others who are implementing or discussing temporary reductions in worker pay to adjust for revenue losses.

Some lenders are building partial loss of income risks into their interest rate models, but it does not appear that pre-qualified buyers are subsequently losing qualification after contracting because of income loss. The CRA will be monitoring the data for signs of market disruption associated with the potential threat to worker income.

At the time of this writing, Northern Virginia has entered the early phases of eased business and public gathering restrictions, but the region is not fully open. Moreover, epidemiologists are suggesting the possibility of multi- waves of COVID-19 cases for an extended period, though it is hoped these new caseload spikes will be smaller. Therefore, the region may experience a pattern of easing and re- imposing restrictions through the rest of this year and beyond.

The CRA expects that the regional housing market will respond to the pattern of restrictions on activities. But we now know that the transaction side of the housing market can adapt to a contact-free environment.

“The use of remote closings is here to stay. Those lenders who have been reluctant to accept e-supported transactions will see market pressure to adapt to our new abilities to conduct secure, fully electronic transactions,” Westerlund said. “This movement to e-commerce will enhance efficiency and lower the operational costs of transactions, which we will be happy to pass along to our clients. The pandemic has, in many ways, just accelerated the pace of technology adoption.”

Dr. Terry Clower is the director of the George Mason University Center for Regional Analysis.

Dr. Keith Waters is a research associate for the George Mason University Center for Regional Analysis.