An Evolving Picture

Editor’s note: This article was written during the third week of April, 2020. Due to rapidly changing circumstances surrounding the COVID-19 pandemic, data trendlines included here may have shifted prior to the publication date.

Editor’s note: This article was written during the third week of April, 2020. Due to rapidly changing circumstances surrounding the COVID-19 pandemic, data trendlines included here may have shifted prior to the publication date.

PRIOR TO THE COVID-19 PANDEMIC, a typical Market Metrics article for RE+View included information based on the most recently available data, which usually described some measure of economic or real estate market performance one to three months prior to the time the article was written.

The data may have represented conditions that occurred four months before it is published. But that was in “normal” times. And even when the real estate market was overheated, or when the velocity of the market slowed to a crawl because of an economic downturn, we could anticipate the value of most data points by simply looking at recent data trends. Then came COVID-19.

Table 1

|

Date

|

Action (selected)

|

|

March 12

|

State of Emergency declared, ban travel for state

employees, ban large state government events,

localities urged to ban large government events

|

|

March 13

|

Public K-12 schools closed for two weeks

|

|

March 17

|

10-person limit for restaurants, theaters, fitness

centers, essential services exempted, prohibit new

eviction cases, ease rules and expand eligibility for

unemployment benefits, suggest self-quarantine for

vulnerable population

|

|

March 24

|

Public K-12 closed for remainder of academic year,

ban all gatherings of more than 10 persons except

for essential services, delivery and take-out only for

restaurants, non-essential retail closed for 30 days

|

|

March 30

|

Public colleges/universities online only, stay at home

order through June 10 except for medical, work, family

care, groceries, pharmacies and similar trips.

|

|

April 8

|

Primary elections moved from June 9 to June 23

|

*Announced or effective date. Source: Governor's office.

To illustrate the speed at which dramatic changes in the way we live and transact business have occurred, and to provide context for the market data presented here, Table 1 offers a brief synopsis of key executive decisions in Virginia related to COVID-19.

The American public largely remained unaffected by the emerging pandemic until mid-March. When state leaders and businesses began to limit travel and alter business operations in the leisure and hospitality, transportation, and retail sectors, the displacement of service industry jobs skyrocketed.

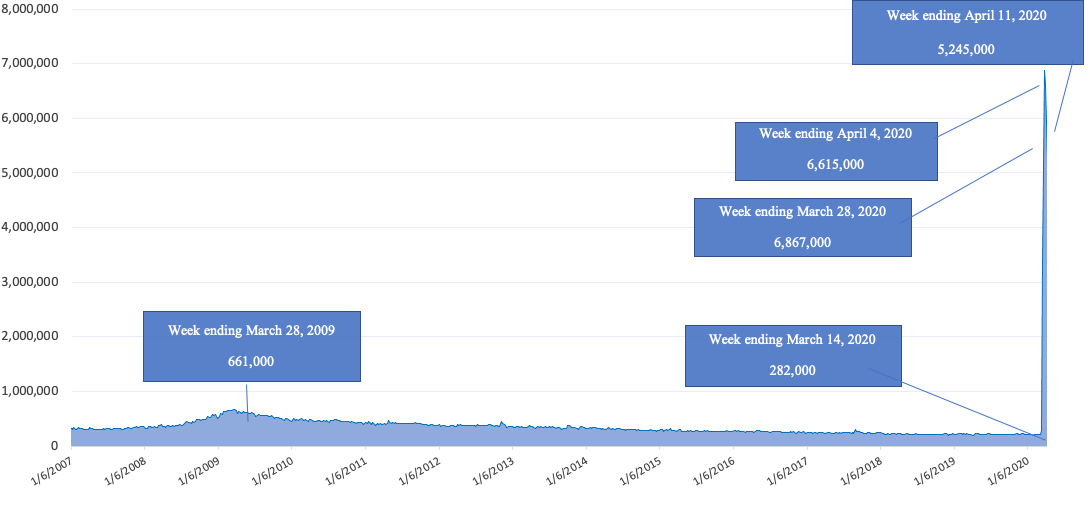

Figure 1: Weekly Initial Claims for Unemployment Benefits (seasonally adjusted)

Source: Employment and Training Administration, US Department of Labor

Figure 1 shows the number of national weekly initial claims to state unemployment insurance programs. The data series goes back to the first week of 2007. The week ending March 14, 2020 saw total initial claims for unemployment drop to 282,000 – a small decrease from the previous week continuing a long-run strengthening of the job market since the Great Recession. Just one week later, total weekly claims exploded to 3.3 million, which was a record level that represented more than a 1,000% increase over the previous week. The next week, initial unemployment claims doubled again to 6.6 million, and while the pace of job loss abated slightly in the week ending April 11, to 5.2 million, this still meant that over a three-week period the U.S. shed almost 19 million jobs.

To put this in context, the worst week of the Great Recession for initial claims for unemployment benefits was the week ending March 28, 2009 with 661,000 claims – one-tenth of the level seen in the last week of March 2020. As the job impacts spread beyond the public-facing service industries into manufacturers and professional services that supply the sectors first impacted, the number of lost jobs will continue to accelerate. The duration and magnitude of the economic shock caused by the COVID-19 pandemic is unknowable at this point. There are simply too many variables to consider. Even with this limitation, it is important to at least keep track of available data related to the business of real estate.

There is little widely available real-time data on real estate markets that Realtors® can use to guide client decision-making and to plan business activities and outlooks. Moreover, the economic data on jobs, payrolls, and consumer confidence that underpin so much of the real estate business will not really show up for several weeks. However, there are some data that allow us to get a sense of what is market data as it becomes available. See the end of this article for more information.

MARKET INERTIA

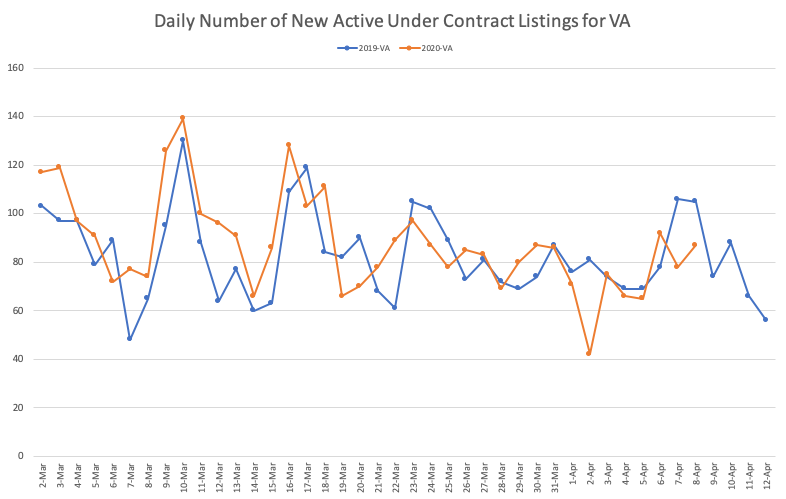

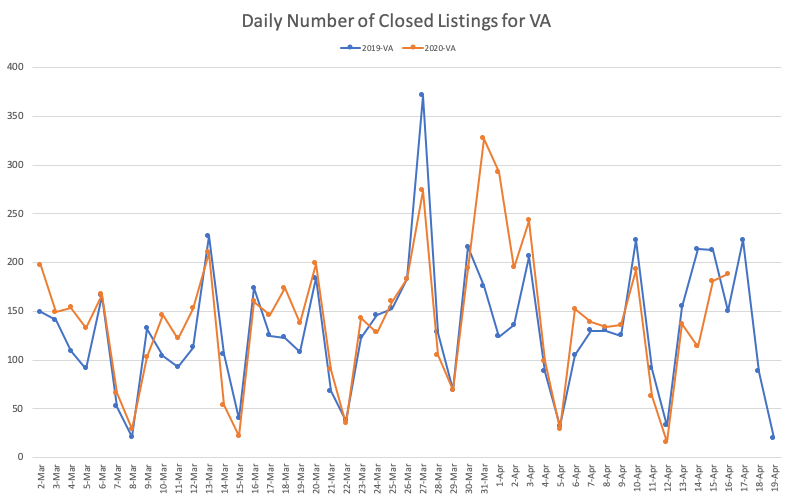

There are certain elements of the real estate business that exhibit substantial inertia. As shown in Figure 2 and Figure 3, the number of properties going under contract and the number of closed properties have essentially tracked with usual seasonal patterns. The lack of an impact of the increasing restrictions on business and personal activities in the last half of March 2020 is likely due to these data points reflecting market processes that began in January and February, when the pandemic was seemingly limited to other countries. However, there is a critically important conclusion that can be drawn from these data.

Figure 2

Source: Bright MLS

Figure 3

Source: Bright MLS

The business transaction side of real estate – meaning agents and brokers processing offers and getting contracts executed, as well as title companies and lenders closing deals – has shown tremendous resiliency in keeping the market moving. This has been the result of several factors: adopting existing and emerging technologies; common sense strategies and actions; and a refusal to be cowed by evolving challenges. Undoubtedly, the number of contracts and transaction closings will decline, perhaps dramatically, in the coming weeks. However, industry professionals may use this calamity as the impetus for improving the transactional component of real estate.

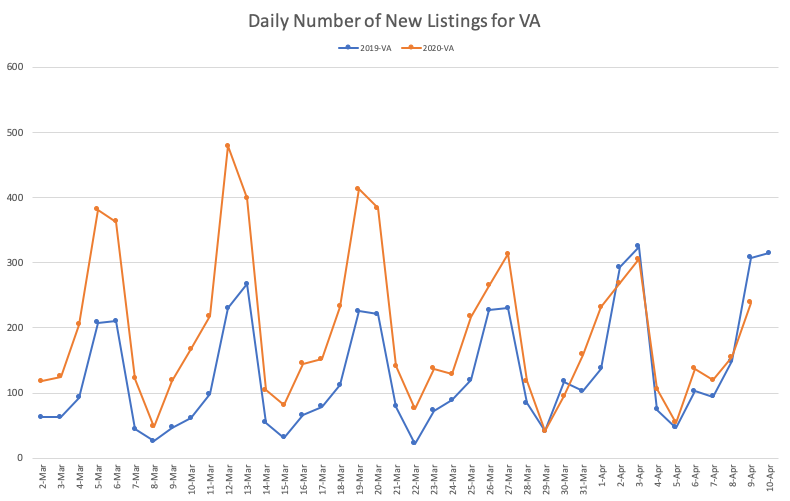

Figure 4

Source: Bright MLS

LISTINGS

The number of listings of for-sale properties in the early part of 2020 had seen improvement over 2019 – a welcome phenomenon. The Center for Regional Analysis even analyzed the data to examine whether the increase in listings was related to policy changes regarding off-market listings. (Visit cra.gmu.edu for a white paper on this topic.)

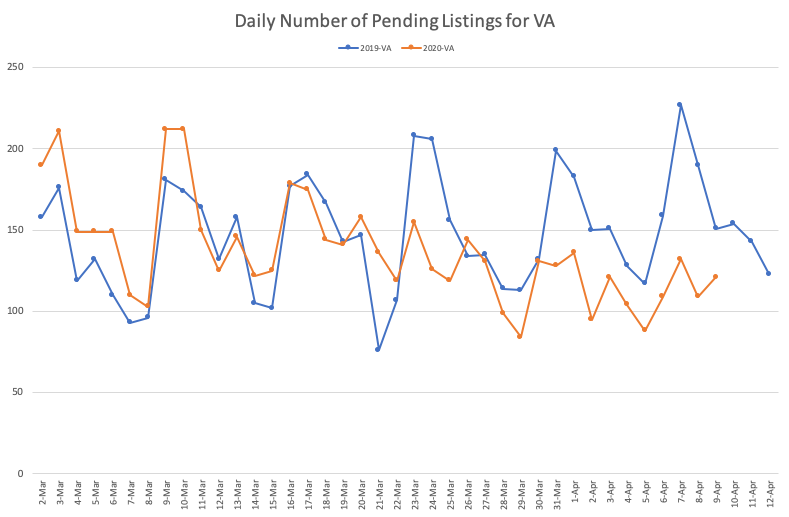

As shown in Figure 4, though the absolute level dropped, homeowners were still choosing to list their properties above last year’s level throughout the month of March and were at the same levels as early April 2019. The same homeowner attitude for “proceeding as planned” is also evident in the data on pending new listings, with 2020 patterns generally aligning with 2019 in the early part of March. However, in the last two weeks of March and early April, year-over-year figures began to diverge and were most notable for the absence of usual spikes in the number of new pending listings (see Figure 5). This is likely a foreshadowing of what is to come, despite a slight stabilization in April.

Figure 5

Source: Bright MLS

SHOWINGS

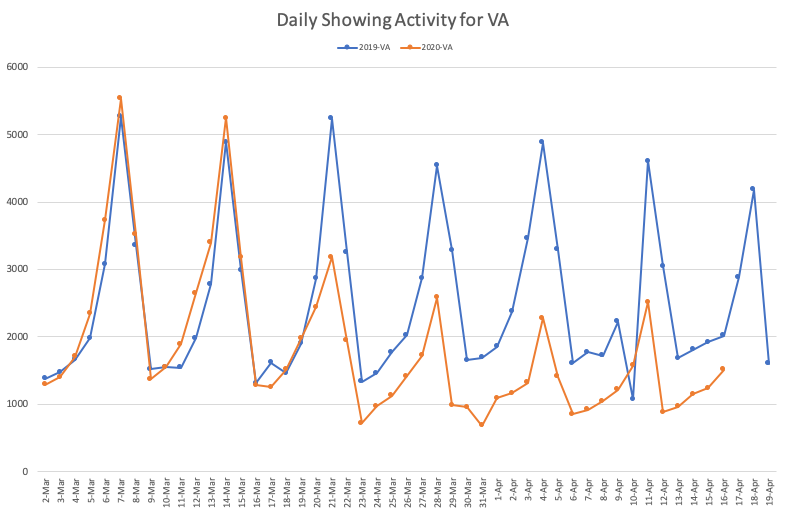

Without question, the movement towards “shelter in place” strategies to try to break the thread of contagion is most readily seen in data on property showings for Virginia, which is also indicative of the NVAR region

(Figure 6). Under the cautionary orders in mid-March, an increasing number of potential homebuyers chose to limit their physical home search activity. The available data do not reveal the type of showing activity. While a Realtor® could, under the Governor’s orders at press time, visit a marketed property, clients were limited in their ability to do so as of March 30. Many Realtors® are either recording or live-streaming home tours for their clients. The extent to which buyers are willing to make the single largest investment of their lives based on a virtual experience is not known. A reasonable projection would suggest that real estate showing activity may halt – a temporary effect, but one that could reverberate across the industry.

Figure 6

Source: Bright MLS

FINAL THOUGHTS

There is not enough data available at press time to make projections about the duration and magnitude of the effect of the COVID-19 pandemic on the real estate market in Northern Virginia, or anywhere else. The Center for Regional Analysis will continue to monitor data as it becomes available and will provide these data on our dedicated webpage accessible at

cra.gmu.edu/covid19/.

The dedication and ingenuity of Realtors® and supporting businesses is admirable. That willingness to adapt processes and procedures will mitigate some of the economic impact attending this pandemic. But in spite of the natural tendency to do anything possible to help clients, Realtors® must remember to protect their own health and that of their families and colleagues throughout this crisis. The business acumen and talent of Realtors® will be of great importance to the overall economic recovery. Take appropriate steps to ensure that you are here to continue to make that contribution as we navigate this current challenge.

The CRA faculty and staff wish NVAR members and their families good health!

Dr. Terry Clower is the director of the George Mason University Center for Regional Analysis.

Dr. Keith Waters is a research associate for the George Mason University Center for Regional Analysis.

Cansu Freeman is a research assistant for the George Mason University Center for Regional Analysis.