A REFLECTION ON 2019 YEAR-END MARKET TRENDS FOR ALEXANDRIA, ARLINGTON AND FAIRFAX COUNTIES

THE START OF A NEW YEAR, for some, means embracing this transitional moment as an opportunity to reflect upon past accomplishments, anticipate challenges and set new goals. This column will do just that – by reviewing 2019 Northern Virginia real estate data from Alexandria City, Arlington County and Fairfax County to provide useful insights that can help grow your business in 2020.

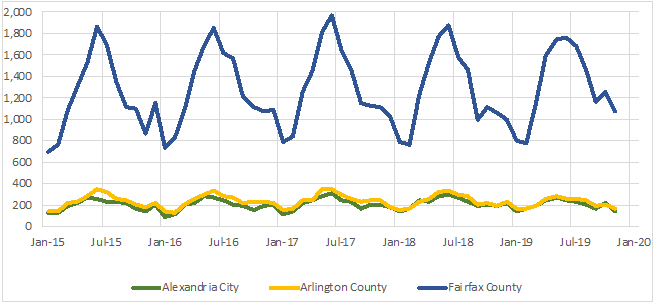

Figure (1) All Home Types Closed Sales (2015-2019)

FIVE-YEAR OVERVIEW

As a baseline, consider how the market has been cycling during the past five years. Figure (1) conveys the seasonal peaks and valleys. Figure (2), however, indexes the seemingly disparate data to facilitate comparison and illuminate trends. Figure (2) captures moving averages of past- months’ closed sales; therefore, the trendlines serve as lagging indicators. This chart demonstrates trending declines in closed sales for Alexandria and Arlington. Fairfax County, while having experienced two years of declining closed sales, broke with Alexandria and Arlington – posting increased closed sales since mid-2019.

Figure (2) All Home Types Indexed (12-month average) Closed Sales (2015-2019)

-closed-sales.png?sfvrsn=ca5fbb0d_0)

THE AMAZON EFFECT

What Figure (2) does not provide, however, is context. Discussion following Amazon’s decision to locate its new HQ2 in Arlington has included debate regarding Northern Virginia’s potential to grow as a technology cluster. This has likely influenced homeowners within a certain vicinity of the proposed HQ2 campus to hold their properties, both as residences and rentals. In the meantime, inventories fall, the market tightens and competition increases. Declining monthly median numbers of days on market (DOM) reflect this tightening; Figure (3) captures the calculated averages of median DOM from January to November of 2019.

Figure (3) Average Median Days on Market (Jan-Nov 2019)

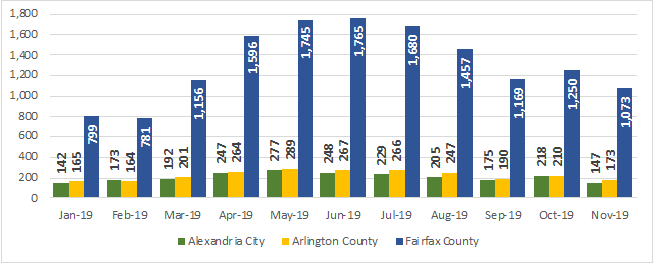

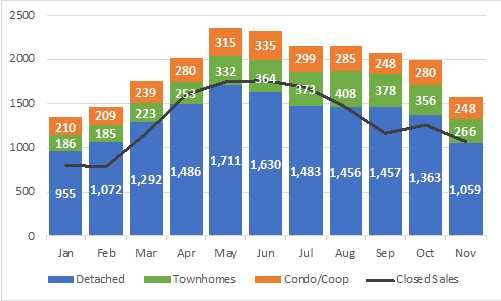

Similar to diminishing DOM, the combined monthly closed sales of detached homes, townhomes and condos across Alexandria, Arlington and Fairfax County in 2019, captured in Figure (4), contributes to our understanding of the Northern Virginia market, particularly when compared against similar months in 2015, 2016 and 2017.

Figure (4) All Home Types Closed Sales (Jan-Nov 2019)

KEY METRICS: END OF MONTH INVENTORIES AND CLOSED SALES, MEDIAN HOME PRICES, AND MEDIAN SALES PRICE TO ORIGINAL LIST PRICE RATIOS.

Understanding that most Northern Virginia homeowners find themselves under contract fairly quickly after listing their properties, what do the end-of-month inventory numbers look like in relation to those homes that actually conveyed in that same month? Figures (5-7) tell a story that likely resonates with NVAR Realtors®: closed sales in Alexandria equaled or exceeded end-of-month inventories for two-thirds of 2019; Arlington closed sales exceeded end-of-month inventories for slightly less than half of the year; and Fairfax County inventories exceeded closed sales for the entirety of the year.

Figure (5) All Home Type End-of-Month Inventories (& Closed Sales) 2019 – Alexandria City

Figure (6) All Home Type End-of-Month Inventories (& Closed Sales) 2019 – Arlington County

Figure (7) All Home Type End-of-Month Inventories (& Closed Sales) 2019 – Fairfax County

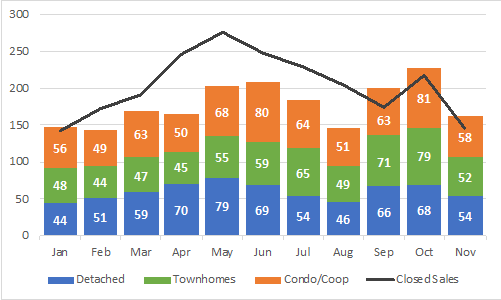

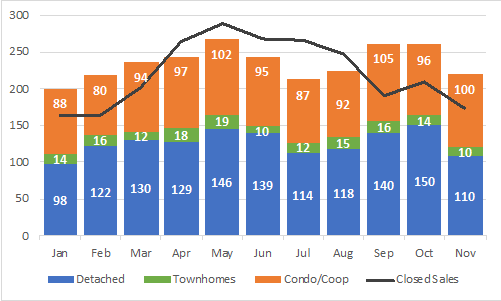

Not shown are each month’s new listings, which make up the balance of the total inventory of homes. November 2019 inventory declines typically reflect sellers removing their listings from the market for the holiday season or waiting until the spring to list their properties. Of note are the differences between each county’s 2019 offerings in terms of home type. Alexandria City showed end-of-month inventory home types in a proportional mix; Arlington largely offered detached homes and condos; detached homes comprised the bulk of Fairfax County’s end-of-month inventories.

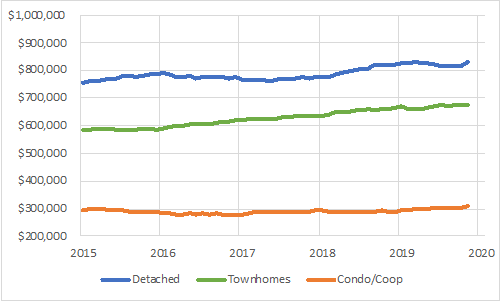

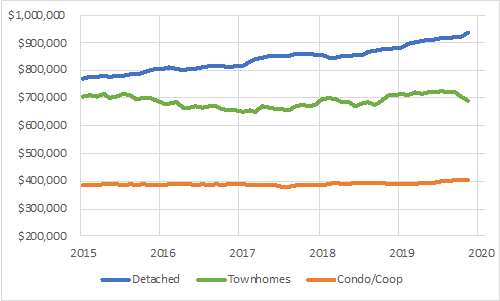

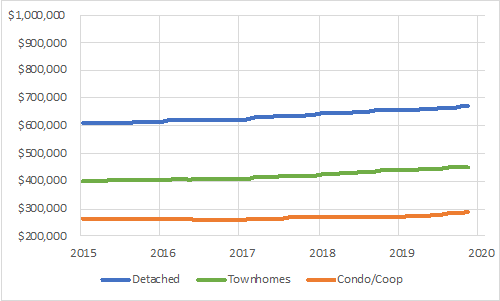

Median home prices have, on average, continued to increase across all three counties for all three home types (Figures 8-10). The only two exceptions to these trends are: (1) Alexandria condominiums/co-ops, posting a -0.6% November 2019 decline in their 12-month (averaged) median home price ($306,111) over the same calculation in January 2015 ($308,000); and (2) Arlington townhomes, showing a -2.1% November 2019 decline in their 12-month (averaged) median home price ($692,465) over January 2015 ($707,283).

Figure (6), on page 29, reinforces that there are relatively few townhomes typically available in Arlington. Alexandria and Fairfax County detached home property owners enjoyed average property value growth rates of 9.6% and 10.5% over the five-year period, while detached home property owners in Arlington experienced, by comparison, more than double the growth rate (22%). Finally, since 2015, (averaged) median home prices increased for townhomes in Alexandria (15.8%) and Fairfax County (13.0%), as well as for condos in Arlington (5.1%) and Fairfax County (10.6%).

Figure (8) Median Home Prices (continuous 12-month averages) Alexandria City (2015-2019)

Figure (9) Median Home Prices (continuous 12-month averages) Arlington County (2015-2019)

Figure (10) Median Home Prices (continuous 12-month averages) Fairfax County (2015-2019)

Home sellers enjoyed more than simply limited days on market for their properties in 2019. Overall, the tightening market delivered, on average, sales price to original list price ratios of 100%, or very close to it. Moreover, 12-month (averaged) SP to OLP ratios continued their multi-year trends upwards, well exceeding 2018 end-year ratios at the close of November 2019 across all counties and home types.

Ultimately, appreciating key market trends across the NVAR region, including those concerning various home types, should facilitate the development of smart sales strategies for 2020.

Source: All Bright MLS data employed herein for charts and graphs, plus calculations, were extracted from MarketStats by ShowingTime on 12/11/2019.

Camilla Bosanquet is a research associate with the George Mason University Center for Regional Analysis.