Don't miss Politics and Pancakes Breakfast on October 11. On November 8, you get to vote on whether or not the Board of Supervisors of Fairfax County can levy a tax on prepared food and beverages, otherwise known as a meals tax; read the pros and cons. The NVAR Board of Directors voting closes on October 7; the new Directors will be announced at the Annual Convention and Tradeshow on October 11.

Don't Miss the 2016 Politics and Pancakes Breakfast

October 11, 7:30 a.m.

Get a front row seat to one of NVAR's most popular events, and hear the latest political analysis at the convention-day Politics and Pancakes Breakfast.

Please REGISTER by October 7, 2016. Cost is $35 per attendee; FREE to 2015 NV/RPAC Investors of $250 or more. To claim your free registration as a $250+ RPAC Investor (2015 Investors), please contact Josh Veverka at jveverka@nvar.com.

Sponsored by:

Elections

2016 Fairfax County Meals Tax Referendum: Its Your Decision

The Board of Supervisors voted on June 7, 2016 to place a meals tax referendum on the November 8 election ballot. State law authorizes counties, cities, and towns to levy a tax on prepared food and beverages, commonly called a "meals tax," subject to certain restrictions. Most counties, including Fairfax County, may levy a meals tax only if the voters approve the tax by referendum. The question below appears on the November 8 election ballot:

For the purpose of reducing dependence on real estate taxes, shall the Board of Supervisors of Fairfax County, Virginia, be authorized to levy a tax on prepared food and beverages, otherwise known as a meals tax, as allowed by Virginia Code § 58.1-3833, at a rate not to exceed four percent (4%) of the amount charged for prepared food and beverages (which, based upon state law, is applicable only to sales outside of the town of Clifton, and towns of Herndon and Vienna that have already implemented a meals tax)? The revenues generated shall be dedicated to the following purposes:

- 70 percent of the net revenues to Fairfax County Public Schools.

- 30 percent of the net revenues to County services, capital improvements and property tax relief.

What Supporters are Saying (vote "YES" on the ballot)

- A meals tax is the only meaningful method for Fairfax County to raise additional revenue. Businesses want to see diversification of taxes. Homeowners want to avoid future property tax increases. Parents want their students to learn in appropriate school facilities, taught by the best and brightest teachers. And all residents depend on excellent public safety.

- If approved by voters, the meals tax is estimated to generate approximately $99 million in the first year - with 28 percent of that amount coming from non-county residents.

- No documented evidence of harm to employees, tourism or business has been found in Virginia localities that have meals taxes.

- All of these surrounding jurisdictions also have a meals tax: Arlington, Alexandria, DC, Fairfax City, Falls Church, Herndon, Manassas, Manassas City, and Vienna. (A County meals tax would not override or apply in addition to the towns of Herndon and Vienna which already have a meals tax.)

Source of information: Invest In Fairfax (www.yesmealstax.org)

What Opponents are Saying (vote "NO" on the ballot)

- This tax raises the overall tax on restaurant meals and prepared food to ten percent (10%)

- This is the second $100 million tax increase in Fairfax County in the past year and despite what supporters say, this tax won't result in property tax relief.

- Family budgets are being stretched thin with everything from higher tolls to higher premiums. The tax disproportionately impacts middle- and lower-income families who rely on prepared meals in order to balance hectic work and family schedules.

- The tax unfairly targets on single industry - the food industry.

- Everyone is subject to a meals tax, meaning there is a very real threat of Fairfax County's tourist industry being negatively impacted, including the many large groups and organizations who choose to host their breakfasts, galas, conventions and conferences here.

Source of information: Fairfax Families Against the Food Tax (www.stopthefoodtax.com)

In-Person Absentee Voting Open Now for 2016 General Election. Deadline for Voter Registration Approaching.

The much discussed 2016 general election is nearly upon us, Election Day is November 8.

Many voters in Northern Virginia will choose to vote absentee either in-person or by mail for various reasons. In-person absentee voting is now open and continues until November 5.

Please see other important dates and deadlines and links to local election information below:

October 17: Voter Registration Deadline

November 1: Deadline to Apply for an Absentee Ballot by Mail

November 5: Final Day, In-Person Absentee Voting

November 8: Absentee Ballot Return Deadline

For in-person absentee voting times and locations in your area, sample ballots and other election information, visit your local elections site:

THE GENERAL ELECTION IS NOT THE ONLY ONE TO WATCH.

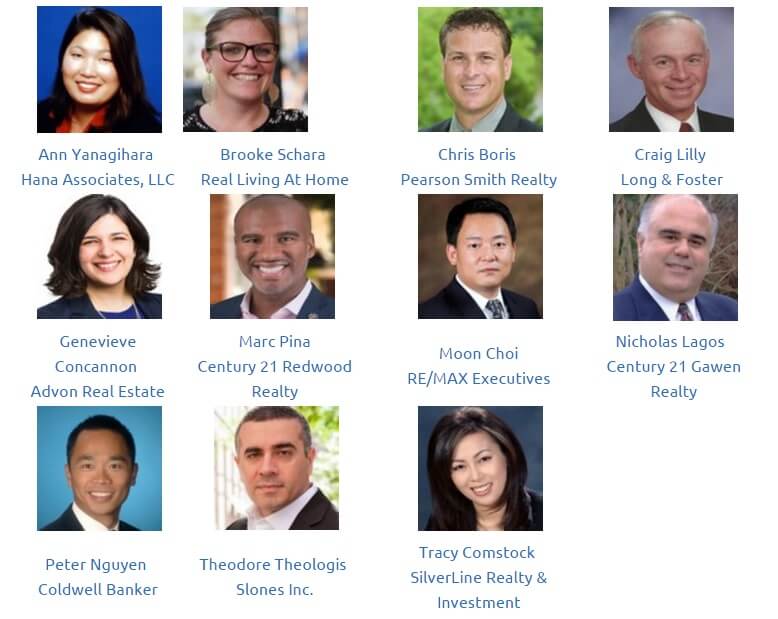

2017 BOARD OF DIRECTORS VOTING NOW OPEN!

VOTE NOW; ONLY TAKES SECONDS

Eleven (11) member candidates are running for the four openings on the 2017 Board of Directors. Voting closes at noon Friday, October 7. The 2017 Board of Directors will be announced Tuesday, October 11 at the Annual Convention and Trade Show. Click here to login, view candidate videos, and cast your four votes to fill the four openings.

Learn More About Becoming an Election Officer

Local jurisdictions around the region are in need of election officers for the upcoming elections. Election officers must be registered voters in Virginia and complete required training and forms.

Election officers may receive a stipend for a full day, or you may volunteer your time.

View the "Being an Election Officer" Video on YouTube.

For more information, visit the Alexandria Office of Elections website, the Arlington Office of Elections website or the Fairfax Office of Elections website.