GIVEN THE CONTINUING DECLINE in properties available for sale across Northern Virginia, it’s likely that Realtors® are increasingly having to advise clients on the availability and costs of renting a home while trying to enter the homeownership market.

The data examined in this article comes from Bright MLS and thus represents those homes sold or newly rented for a given time period. It does not reflect ongoing rentals covered by existing leases. It also only includes those properties that are listed through Bright MLS. Still, the snapshot of data offers insights into the regional housing market and provides data and information that can help prospective buyers make the best real estate investment decisions.

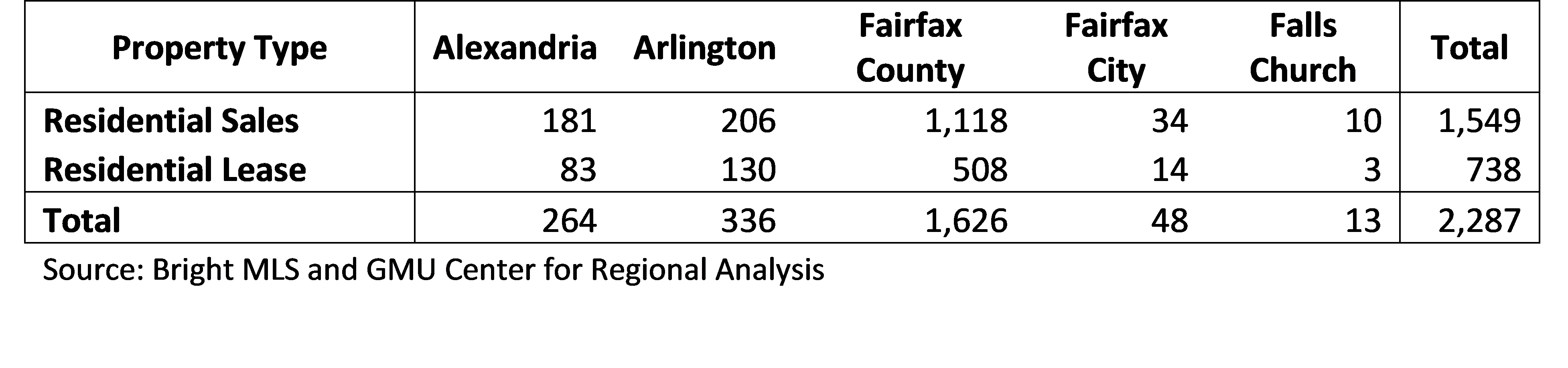

Table 1. Leased Residential Properties and Sold Residential Properties - Dec. 2019

To put the data on residential leases into perspective, there were 1,549 residential units sold in December 2019 in the NVAR region (Table 1). The number of new residential leases in the NVAR area totaled 738 units, or about 32% of the total residential transactions (Table 1 and 2) in December 2019. The relative proportion of transactions that were residential leases was similar across most area jurisdictions (around 30%) with Arlington being somewhat higher (38.7%) and Falls Church having relatively fewer (23.1%) leased properties transacted last December. Falls Church, which is one of the smaller jurisdictions in the NVAR footprint, had only 13 property transactions (sales and new leases) in December. Fairfax County had 508 residences leased in the last month of 2019, accounting for 68.8% of total NVAR area residential leases.

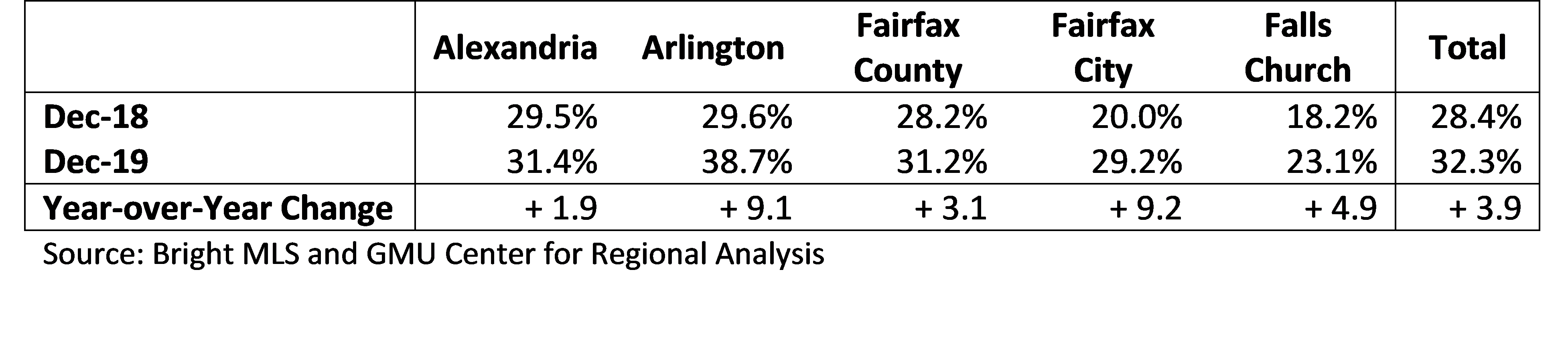

Table 2. Residential Leases as Share of All Closed Residential Properties - Dec. 2018 and Dec. 2019

Examining the composition of closed residential units over time reveals that leasing’s share of all closed residences increased year-over-year in the NVAR region (Table 2). The share of all closed residential units accounted for by leased residential units increased 3.9 percentage points from 28.4% in December 2018 to 32.3% in December 2019. Among the jurisdictions in the NVAR region, the two largest year-over-year market share increases occurred in Fairfax City and Arlington County – likely the result of low inventories of residential units for sale. In Fairfax City for December 2019, the share of closed residential units that were leased increased 9.2 percentage points over the previous December.

In Arlington County, the share of closed residential units that were leased increased from 29.6% in December 2018 to 38.7% in December 2019, an increase of 9.1 percentage points. The share of closed leased residential units in Alexandria increased by the smallest amount year-over-year, increasing only 1.9 percentage points, which is interesting given the level of investor interest in Alexandria homes since the Amazon HQ2 announcement in 2018.

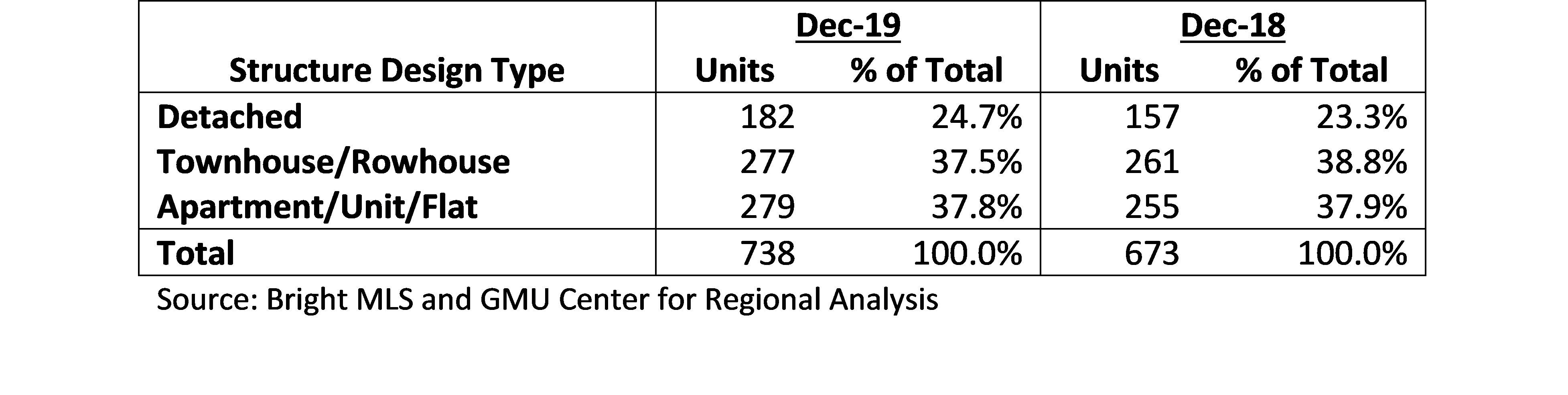

Table 3. Residential Leases by Property Type - Dec. 2018 and Dec. 2019

The remainder of this analysis focuses solely on leased residential units. Among property types, townhouses and apartments accounted for the majority of leased residential units (Table 3). In December 2019, there were 279 apartments leased in the NVAR region, accounting for 37.8% of leased residential units. There were 277 townhouses leased in the NVAR region in December 2019, accounting for an additional 37.5% of leased residential units. In contrast, there were only 182 detached homes leased in the NVAR region in December 2019, accounting for an additional 37.5% of leased residential units. In contrast, there were only 182 detached homes leased in the NVAR region, accounting for just 24.7% of leased residential units. The share of residential units leased by property type remained fairly consistent from December 2018 to December 2019; apartments and townhouses accounted for the majority of units, split roughly evenly between the two home types, with a notably smaller share of detached homes leased.

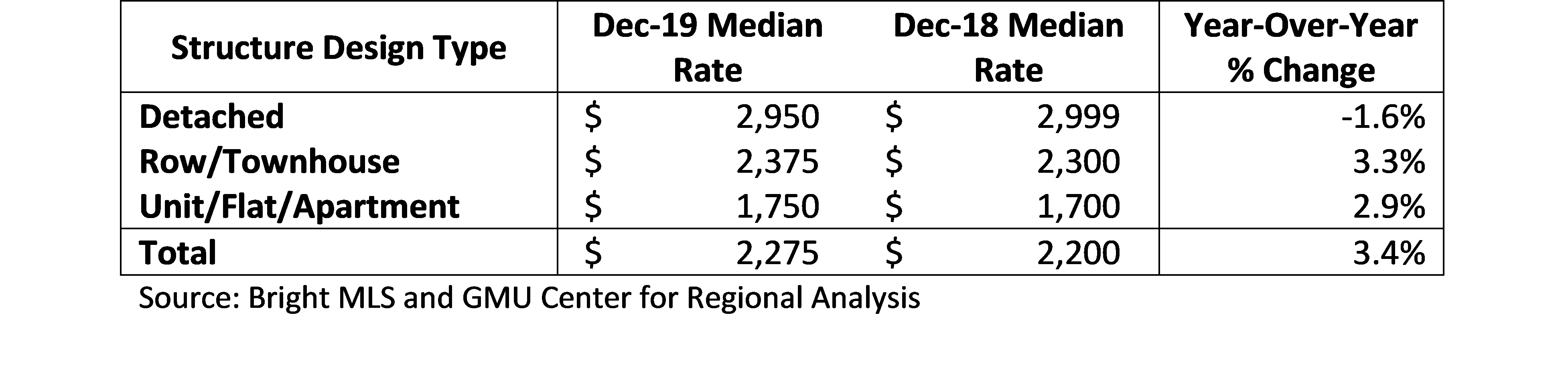

Table 4. Median Rate by Condo/House/Townhouse - Dec. 2018 and Dec. 2019

While the overall median rate of residences leased in the NVAR region increased from December 2018 to December 2019, the median rate of detached homes leased declined over the period (Table 4). However, just as when analyzing market data on units sold, a given decline or large increase in lease rates can be affected by the characteristics (size/age/location/condition) of the particular units that transacted that month. The median rate of residences leased increased 3.4% from $2,200 in December 2018 to $2,275 in December 2019. Among home types, the median rate of townhouses leased increased the most, gaining 3.3% from $2,300 in December 2018 to $2,375 in December 2019. The increase in the median rate of apartments leased was not far behind, increasing 2.9% from $1,700 in December 2018 to $1,750 in December 2019. In contrast, the median rate of detached homes leased declined 1.6% from $2,999 in December 2018 to $2,950 in December 2019.

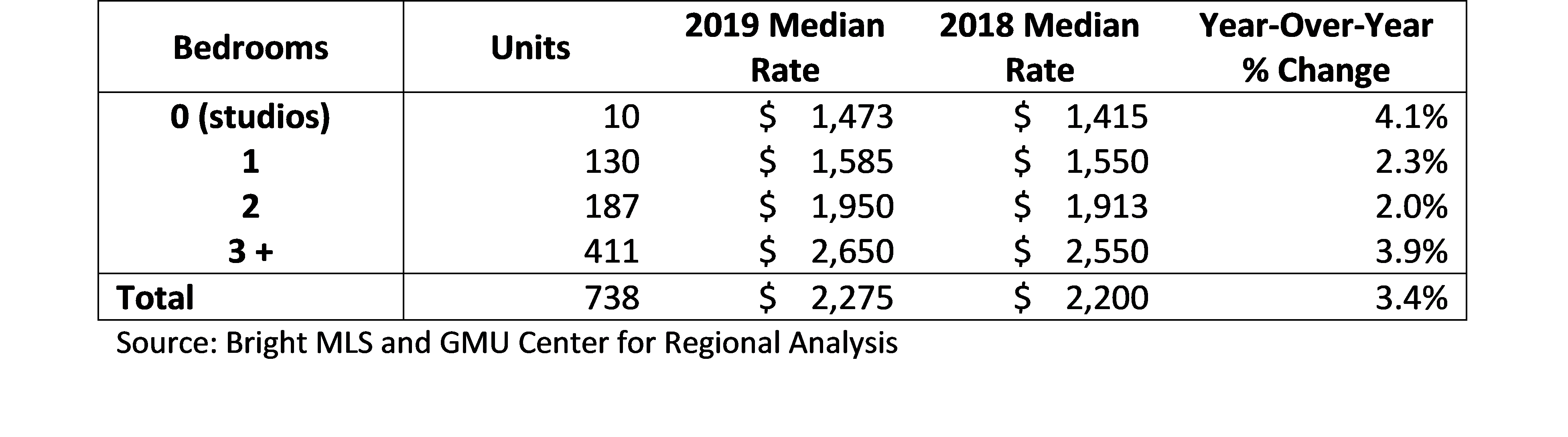

Table 5. Median Rate by Number of Bedrooms (0,1,2,3+) - Dec. 2018 and Dec. 2019

As would be expected, the median rate for residential units leased in the NVAR region in December 2019 increased with the number of bedrooms (Table 5). There were only 10 studios leased in the NVAR region in December 2019 with a median rate of $1,473. Residential units with one and two bedrooms leased for a median rate of $1,585 and $1,950, respectively. The median rate of leased residential units with three or more bedrooms was $2,650 in December 2019. The largest year-over-year increases in the median rate of residential units occurred at either end of the size spectrum with the smallest (studios) and largest units (three plus bedrooms) recording the largest median rate increases at 4.1% and 3.9%, respectively, for the 12 months ending in December 2019. The median rate of leased residential units with one and two bedrooms increased year-over-year by 2.3% and 2%, respectively.

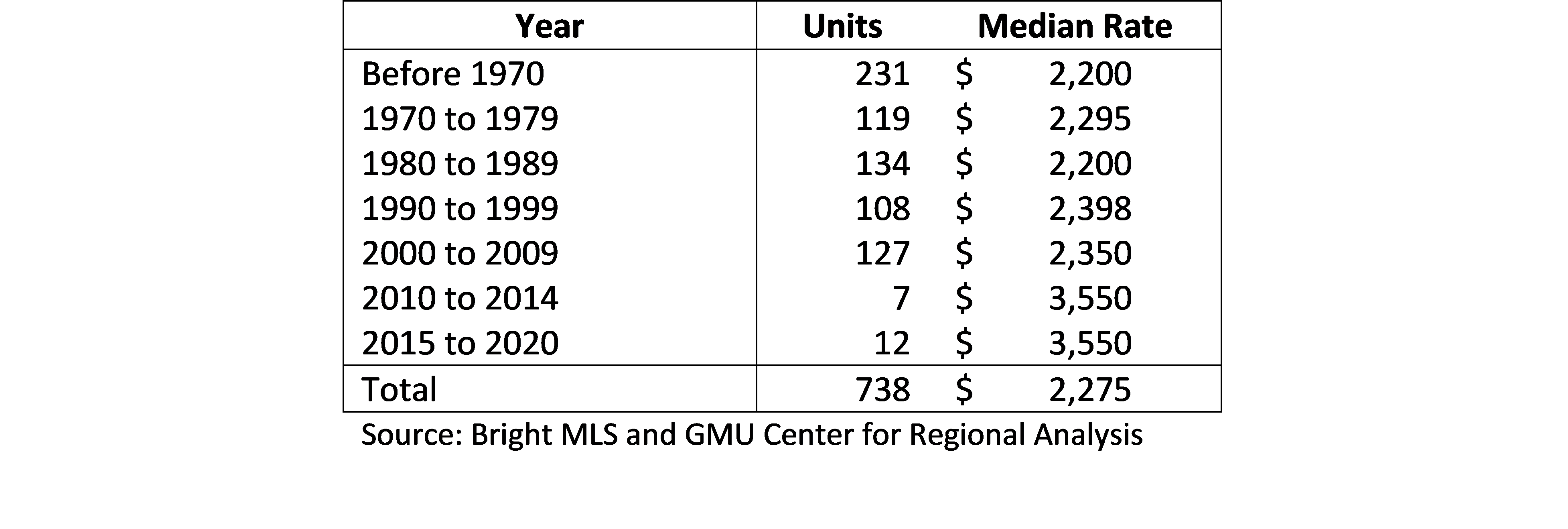

Table 6. Median Rate by Year Built - Dec. 2019

Finally, newer properties tend to command a higher median rate in the NVAR region (Table 6). Residential properties built before 1990 had a median rate of between $2,200 and $2,295. It is interesting to note that the oldest properties leased in December 2019 in the NVAR region were built over two centuries ago – in 1790. The rate premium for newer residences begins with those built in the 1990s; residences built in the 1990s leased for a median rate of $2,398 in December 2019. While properties built in the 2000s did not command a notable rate premium, very new residences, those built since 2010 including pre-completion leases of brand- new units (2020), commanded a median rate of $3,550.

Overall, the NVAR region’s rental housing market is relatively expensive with few choices in the most desirable communities. For individuals and couples, renting a smaller unit may be a reasonable financial choice. There simply is not enough for-sale inventory among smaller units (studios and one- bedroom condos) available for this to be a viable option for most prospective buyers. Once a family needs two or more bedrooms, current rental market rates suggest that buying a home is the best financial option – assuming reasonably solid personal finances.

As Northern Virginia Realtors® navigate the search for limited inventory solutions, arming clients with information about the rental market can provide context for them to make the best decision in their home rental or purchase.

Dr. Terry Clower is the director of the George Mason University Center for Regional Analysis.

Dr. Keith Waters is a research associate for the George Mason University Center for Regional Analysis.