Not One Size Fits All

YEAR OVER YEAR CHANGES

Remarking on industry changes that have occurred since the 2014 Finance Summit, event moderator Ken Harney, syndicated Nation’s Housing columnist identified last year’s hot issues:

• FHA insurance premium Increases

• Fannie and Freddie’s high fees

• Mortgage lenders’ perceptions of risk and threat of buyback.

In 2015, Harney said, credit has loosened in some areas. Lenders are more comfortable with the rules and are on the verge of flexibility. FHA has lowered mortgage insurance premiums, and the volume of FHA loans has increased by 12 percent in the first quarter of 2015. The biggest remaining challenge is mortgage interest rates, Harney said. He noted that a September rise in short-term interest rates is probable.

THE LENDERS' PERSPECTIVE

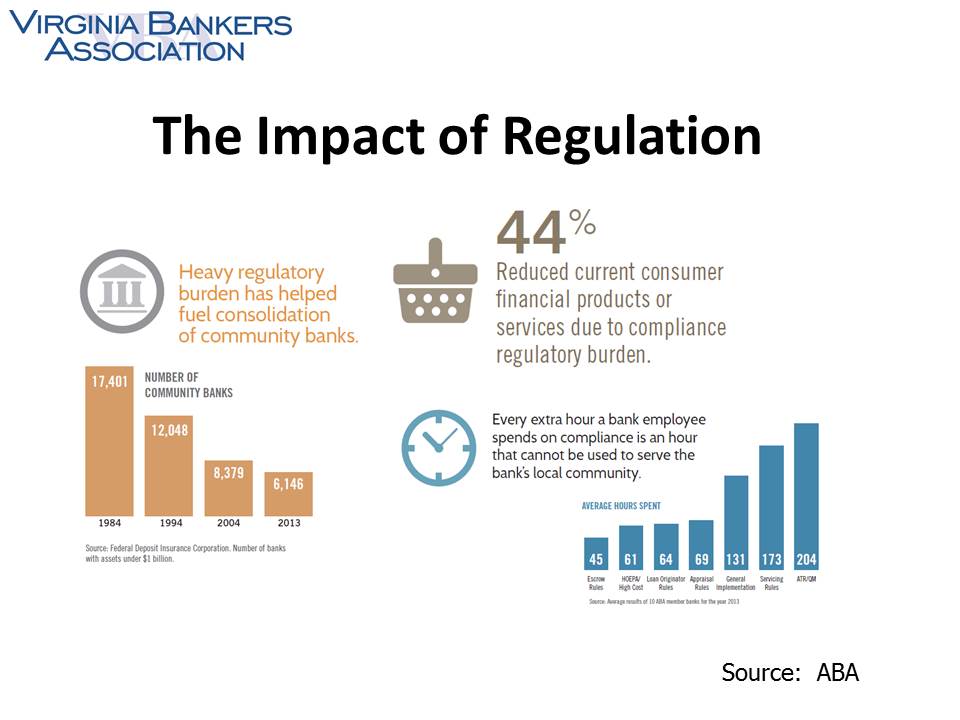

Steve Farbstein, vice president and head of mortgage banking at Park Sterling Bank, noted that the regulatory burden on banks has increased, and banks are consolidating to cope. As a result, the number of consumer banks has dwindled. More time spent ensuring compliance with regulations equals less time processing loans, he said.

THE TALE OF THE TRID

THE TALE OF THE TRID

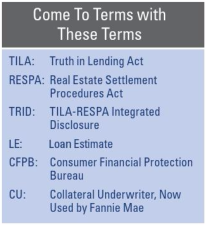

The new TILA / RESPA Integrated Disclosure Rule (TRID) takes effect October 3, 2015. Richard Owen, senior vice president and mortgage manager at Middleburg Bank, explained that it consists of 2,000 pages of rules and two new forms. The Loan Estimate form replaces the final Truth in Lending (TIL) and Good Faith Estimate (GFE), and must be provided within three business days of application and seven business days of consummation.

The Closing Disclosure form replaces the HUD form and must be received three days before consummation. The new rules for the timing of disclosures are unforgiving; expect closings to take longer, Owen warned. Read the latest TRID information at: http://www.consumerfinance.gov/regulatory-implementation/tila-respa/#additional; http://www.consumerfinance.gov/knowbeforeyouowe/;

http://www.realtor.org/topics/real-estate-settlement-procedures-act-respa.

TILA/RESPA and RESPA ENFORCEMENT

Compliance with the new rules will require intense collaboration among Realtors®, loan officers, processors, clients and customers, explained Ken Trepeta, director of real estate services at the National Association of Realtors®. “The rule does not sufficiently address the unexpected,” he said.

Avoiding last-minute delays is even more critical, he added. “The stranger the deal,” Trepeta observed, “the more potential for issues. A good rule of thumb is to add 15 days to your transaction timeline.”

Industry representatives asked the Consumer Financial Protection Bureau to postpone putting TRID into full effect on August 1, and make August 1 to December 31 a trial implementation period, Trepeta explained. Fines for non-compliance are $5,000/day for a mistake or $1M/day for an intentional transgression. At press time, the CFPB announced that while the August 1 effective date will not change, there will be an implementation grace period for those lenders that can demonstrate a good faith attempt to comply with the new regulations.

TRID Implementation Concerns:

• Substantial technology changes

• Employee training in new forms and procedures

• High cost of implementation

• Transformation of the mortgage and settlement process.

Realtor® Best Practices

• Meet with your lender & title business partners in your market soon

• Discuss timing & deadlines with your buyers & sellers

• Consider TRID as you write / finalize contracts

• Prepare consumers / establish realistic expectations

• Avoid closing dates <30 days from contract

• Provide all seller invoices ASAP to ensure timely completion of CD

• Communicate ancillary fees ASAP

• Plan to bring NOTHING to closing that would impact the numbers on the CD

• Back-up offers more important than before

• Consider back-to-back closings

"Compliance with the new rules will require intense collaboration among Realtors®, loan officers, processors, clients and customers."

PRIVATE MORTGAGE INSURANCE

Home buyers may question their Realtor® about the need for PMI. Private mortgage insurance protects the lender in the event that a home buyer defaults on a loan, explained Carolyn Delaney, senior account executive at United Guaranty.

However, she noted, PMI also could benefit home buyers by:

1) Lowering down payments

2) Making it possible to buy a home sooner, and

3) Saving cash.

Today, FHA mortgage insurance can cost three times as much as a conventional mortgage insurance loan.

FHA insurance cannot be cancelled. With PMI, the mortgage servicer has the option to cancel it if the borrower meets all of the servicer’s cancellation criteria.

Delaney explained that there are two types of PMI cancellation:

• Automatic cancellation occurs when the principal mortgage balance reaches 78 percent loan-to-value of the original property value.

• Borrowers can request cancellation when their principal mortgage balance reaches 80 percent of the loan-to-value. Most investors require two years of “seasoning” before they cancel PMI.

APPRAISALS

Addressing Realtor® frustration with the appraisal process, Pat Turner, Appraiser at P.E. Turner & Co., explained that Appraisal Management Companies don’t have a mechanism for ensuring appraisal quality. Many suspended appraisers, he said, have even started their own AMCs.

Turner addressed Collateral Underwriter, now used by Fannie Mae. This is an appraisal risk assessment application developed to support proactive management of appraisal quality. CU is used by Fannie Mae as a risk management tool for lenders. Typically, it has four levels of correction, he explained:

1. Private warning letter to the appraiser stating that improved accuracy is needed

2. Letter to appraiser and the lender

3. Formal notification to lender that 100 percent quality control over this appraiser’s work is required. This usually necessitates a second appraisal by another appraiser. The lender must pay for both appraisals.

4. Fannie will refuse to accept appraisals from this appraiser.

Turner says that there is no federal requirement to use AMCs. Another myth, says Turner, is that the use of AMCs shields lenders from liability for the appraisal process. Turner explains that he AMC is considered an agent of the lender; therefore, the lender can be liable for a shoddy appraisal.

Lenders do best to hire appraisers whose work they know, he added. Turner recommends that lenders ask other lenders about specific appraisers, and also question potential appraisers who come from outside the area about their geographic competence. Suggested questions include:

• “Are you a member of our local MLS?”

• “Have you ever done an appraisal in our area?”

Turner advises lenders: “Ask yourself, ’If they are worth anything in Richmond, why are they coming to Newport News to do an appraisal for $290?’ Beware of AMCs that do nothing but seek out the lowest common denominator — that puts your deal at risk every single time.”

Harney commented that appraisals are vital to consumers. With the rise of AMCs, he said, big lenders get a cut of the appraisal fees. Big lenders play AMCs off against each other to get the lowest rates, he said. To stay competitive, AMCs reduce appraiser compensation and raise fees to home buyers.

Owen put the rise of AMCs into historical perspective. In the early 2000s, he said, there was fear that lenders might coerce appraisers to squeeze more value out of appraisals. AMCs were supposed to create a “wall” between the lender and the appraiser to ensure impartiality. In practice, appraisers became dependent on the lender’s good graces, and increased fees got passed on to the consumer.

Turner predicts that, “we’re going to see the CFPB sound off on the ’customary and reasonable fee’ question.”

IT'S ABOUT RELATIONSHIPS

Realtors® are pros when it comes to forging strong client relationships. Finance Summit speakers stressed the importance of creating a similar connection with lenders, settlement agents and appraisers.

Farbstein and Owen said that when lenders and Realtors® partner with one another, it brings opportunity and value to transactions. That’s why real estate professionals are on Owen’s company’s advisory board. “If either of us falls down, the client suffers. We’re service providers just like you.”

Editor’s Note: View 2015 presentation slides at

go.nvar.com/financePPT15.

Farbstein: Realtors® help the seller by:

• Ensuring information is validated

• Asking service providers to alert you to any red flags

• Dealing with local people whom they can reach immediately

• Staying on top of the lender

• Ensuring the lender coordinates with the seller’s side