by

Josh Veverka

| 02/06/2023

In the advocacy world we love to tout the power of the Realtor® Party when it comes to passing legislation that will improve real estate transactions, protect property rights and help Realtors® and their business.

But it is the morbid reality of politics that more legislation ends up defeated than survives to become law. These bills do not die by accident. Each year we block numerous policy proposals that would harm the industry. Most of these bills are not ill-intentioned or targeted at harming Realtors®, but they do present a threat to the industry through over-reaching regulations or unintended consequences.

Before killing a bill, our Realtor® advocacy team works with bill patrons to amend language, pull the legislation from the docket to allow for further study, or exempt Realtors® from the law. In most cases we are able to come to agreement and have “peace in the valley” before allowing the bill to become law, but not every proposal can be fixed.

These bills represent legislation the Realtors® opposed and helped to defeat in Richmond:

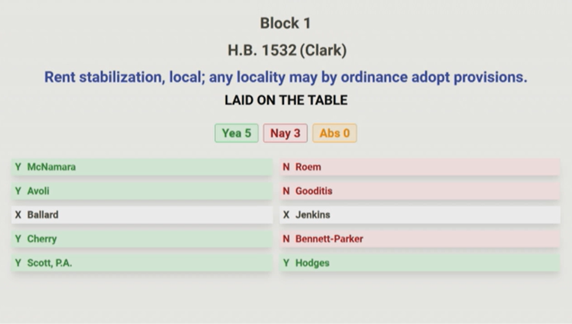

Rent Control – Defeated in House Subcommittee on a 6-3 vote, and in Senate Committee on 9-5 vote. (Senate will ask issue to be studied in the interim)

Would have allowed any locality in the Commonwealth to adopt “rent stabilization” ordinances limiting rental increases to no more than the rate of increase in the Consumer Price Index for the region in which the locality sits. Violators of the law would face a civil penalty of $2,500 per separate violation.

Mandatory Disclosure of Publicly Available Information – Defeated in House Subcommittee on a 5-3 vote

Requires the owner of residential property who has actual knowledge that the property contains a resource protection area (RPA) established under the Chesapeake Bay Preservation Act to disclose such fact to the purchaser of such property.

Alerting Social Services to Evictions – Defeated in House Subcommittee on a 8-0 vote

This bill would require landlords to notify the Department of Social Services when legally evicting tenants with children or dependent mentally or physically incapacitated elderly persons.

Presuming Landlords are Guilty – Defeated in House Subcommittee on a 5-3 vote

Created a rebuttable presumption against a landlord under the Virginia Residential Landlord and Tenant Act, if a leased premises was condemned due to the landlord's failure to remedy a condition. The bill requires a court, when such rebuttable presumption is established, to award the tenant the amount of three months' rent, any prepaid rent, and any security deposit paid by the tenant.

Toxic Communities – Defeated in House Subcommittee on a 5-4 vote

Would have allowed cities and counties to identify and call out neighborhoods with major sources of pollution or hazardous waste (effectively stigmatizing entire neighborhoods) before identifying objectives and policies to reduce health risks in the neighborhoods and to prioritize improvements and programs that address the needs.

Short Term Rental Permits Do Not Convey – Defeated in House Subcommittee on a 6-3 vote

Allows a locality to automatically expire any short-term rental permit upon a change of ownership, possession or control of a property or business.