Proactive Protection for You, Your Clients and Everyone's Data

The world can be a scary place. While most Realtors® are naturally outgoing and optimistic, they must also be realistic: agents, their clients and real estate transactions can be a target for criminals.

“One of the most important things we teach Realtors® is to call 911 first if you’re in a scary situation. Don’t call your friend. Don’t call your manager. If you think you’re in danger, call 911."

One-third of real estate professionals report they have encountered a safety threat while working, according to the National Association of Realtors® Member Safety Report. The U.S. Treasury Department’s Financial Crimes Enforcement Network reported losses of more than $300 million per month in 2018 due to wire transfer fraud and business email compromise schemes, with real estate the third most targeted sector for these schemes. In 2018, more than 20 percent of fraudulent transaction amounts were tied to real estate, and the industry had the highest average fraudulent transaction amount at $179,001.

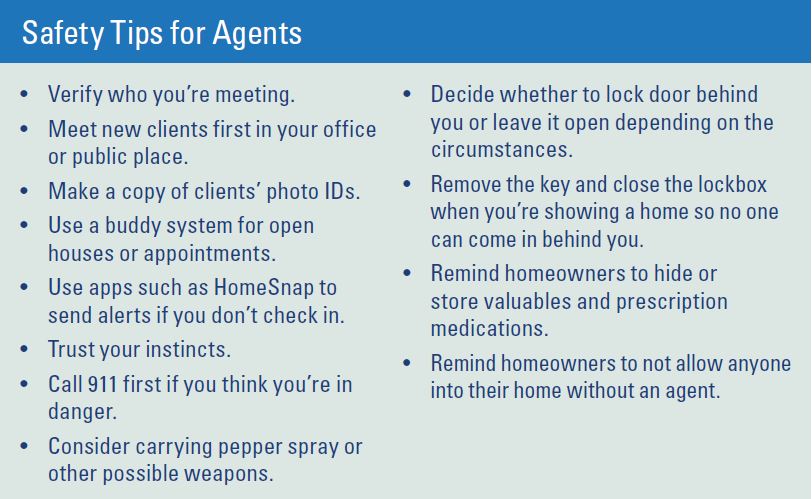

While keeping your money and your clients’ money secure is important, the physical safety of you and your clients and their families matters most. Real estate professionals who have had frightening experiences agree that some simple steps can reduce the chances of someone getting hurt.

“When I was holding an open house at a split-level property in Arlington, I noticed a man come into the house, but I didn’t see him leave even though others had come and gone,” says Michelle Sagatov, a Realtor® with Washington Fine Properties in Arlington. “I walked outside and found another agent with her client and explained the situation. We walked through the house as a group and never found him, but we noticed the back door was open, so we think he slipped out that way. The agent stayed with me while we closed up the open house and locked up, so I would be safe.”

Sagatov, a former police officer, says it’s important to follow your instincts and take precautions when anything seems even slightly suspicious.

“You would never put yourself in a situation like this, being in a house with strangers, unless you’re a real estate agent,” she says. “You have to be ready and willing to stick up for yourself and apologize later if your instincts were wrong.”

After several instances when items were stolen from an open house or she felt threatened by people, Teri Ann LaBuwi, an associate broker with the Eric Stewart Group of Long & Foster Real Estate in McLean, developed a protocol for open houses.

“I request and save a photo ID from each person who wants to come through the door,” says LaBuwi. “My street signs say ‘Safe Open House’ so people know what to expect. When anyone arrives, I welcome them, hand them my card and ask for their ID. I also ask them to record their phone number or email address on my voice recorder.”

LaBuwi says everyone cooperates with the request and that capturing contact information gives her more control over her roster and makes it easier to follow-up with potential buyers.

Another agent told Sagatov about a man who came to three or four of her open houses, always near the end and acting nervous. When she recognized him at another of her open houses, she went outside and called someone to come meet her. Together, they looked for the man and eventually found him trying to hide in the basement. He left quickly after that and the agent began having a second agent work with her at open houses.

“One of the most important things we teach Realtors® is to call 911 first if you’re in a scary situation,” says Sagatov. “Don’t call your friend. Don’t call your manager. If you think you’re in danger, call 911. It’s especially important not to start a phone tree of people calling to check on you or several people calling the police. When you call 911, you reach the right jurisdiction for your location, which may not be the same jurisdiction as your home or office.”

SHOWING PROPERTY SAFELY

Open houses leave agents vulnerable because, by definition, the agents want to welcome anyone into the property. Realtors® face potential hazards when showing property to individual buyers, too.

“Back in 2009, when everyone was pretty desperate for sales, a man called me and asked to see a property but refused to get prequalified for a loan because he said he’s bought a home before and didn’t need one,” says Marcia Burgos-Stone, a Realtor® with Redfin brokerage in Falls Church. “I didn’t have a good feeling about him, so I took my boyfriend with me to meet him. When we went into the house, the guy just stood there and didn’t really talk about the house or look at it. As we were leaving, he asked me to come back later that night to see it again, but when I said we’d have to schedule for another time he didn’t respond.”

Burgos-Stone believes she escaped being a crime victim simply because of the presence of her boyfriend, a police officer who wasn’t in uniform at the time. Since then, she always has potential weapons to protect herself, such as a crowbar and screwdriver in her car.

“Even an ink pen can be used as a weapon if necessary,” she says.

Burgos-Stone follows the recommended protocol of interviewing and meeting potential clients in the office, but she says that’s not always enough protection. Sagatov recommends asking numerous questions of potential clients to make sure they’re serious buyers. She also Googles them to find out more information.

“Set up a safety alert app like HomeSnap and practice with it,” says Sagatov. “You set a timer and if you haven’t turned off the timer before it goes off, the app automatically alerts your safety contacts such as another agent, a friend or your spouse.”

Two years ago, Sara Melander, director of sales with the Goodhart Group of Compass real estate brokerage in Alexandria, was showing a house in the Del Ray neighborhood when she and her buyers heard gunshots.

“I had left the door open in case someone else showed up, and when we heard the shots we were terrified that someone would come inside,” says Melander. “It turned out to be a domestic violence situation and three people were shot directly outside the house. My client’s car was damaged, and we were stuck at the house for three hours while the police had the street locked down.”

Since that incident, Melander locks the door when she’s showing property to a trusted client.

“My husband and I use the ‘Find My Friend’ app, and he checks up on me when I’m showing property,” she says. “I’m also careful to let people in my office know my schedule.”

Melander says it’s important to always be aware of your surroundings, trust your instincts and follow protocol to check out buyers before meeting them.

“I’ve often had phone calls from someone who wants to see a property right away and of course I’m excited, but as soon as I say we have to meet first at the office or someplace, they disappear,” says Kathy Kratovil, a Realtor® with Coldwell Banker Residential Brokerage in Alexandria. “As agents, our faces and information are out there in the public and it’s necessary for people to get to know us. But that can be dangerous, too.”

WIRE FRAUD AND OTHER WOES

While many brokerages today have established a wire fraud alert protocol for all buyer and seller presentations, the problem of wire fraud and other email scams continues to be an issue.

Several years ago, a friend of Sagatov’s in Utah lost $350,000 to a wire fraud scheme when criminals tapped into a settlement company’s email system.

“The most important thing is to warn buyers and sellers about the problem,” says Sagatov. “If something happens, they have to act fast because typically the money only stays in the U.S. for 48 hours.”

At one of LaBuwi’s closings, $130,000 was stolen from buyers through wire fraud, which delayed the closing by two weeks while the FBI investigated. The buyers eventually had their money returned by the bank.

“Oddly enough, this same couple told me that years ago, when they bought their first house, they took a cashier’s check with them when they traveled to the closing and that check was stolen from the hotel safe,” says LaBuwi.

Today, most settlement companies use a secure portal and won’t email instructions to wire funds, says Sagatov.

When Tom Cronkright, president of Sun Title in Grand Rapids, Mich., and his business partner were bilked out of $180,000 through wire fraud, they started a company to address this issue. Cronkright and his business partner personally covered the loss for the real estate investor in the transaction and eventually recovered $140,000 after working with the FBI and testifying before the Department of Justice.

“We saw that wire fraud is a symptom of a bigger problem in the industry: the inability to confirm someone’s identity,” says Cronkright, now CEO and co-founder of CertifID, an identity theft and fraud prevention system.

Buyers are typically targeted within the first week after they sign a purchase agreement, says Cronkright.

“Everyone is being targeted, but in particular, criminals are looking for cash sales or offers with a large earnest money deposit, so they can get their hands on cash faster,” he says.

To reduce issues with fraud, Cronkright recommends that Realtors® use multi- factor authentication for email accounts, which means that in addition to a password, you would need a one-time code to access your account. He also suggests using a password manager system such as OnePass or LastPass.

“Realtors® need to talk to their buyers and sellers about wire fraud from the minute they meet them,” says Cronkright. “They should also have a conversation with their vendors and partners about what they are doing to protect their clients. If the weakest link gets compromised, that can hurt everyone.”

Kratovil says she tells buyers and sellers not to provide any sensitive information such as a Social Security number or other personal information via email. She recommends that anytime they get an email asking for financial information they should call and verify that the request is legitimate. She is vigilant about changing her passwords at least once per quarter, in part because of personal experience with an email scam.

“One day I received almost 300 emails from agents across Northern Virginia, each one thanking me for my client’s interest in their property and looking forward to receiving the offer,” says Kratovil. “I responded to everyone and told them it was a scam, so as far as I know there weren’t any financial consequences from that instance.”

Self-preservation and preservation of your client’s information and property require extra effort on the part of Realtors®, but the consequences of skipping steps can be detrimental to your business and to you.

Michele Lerner, a freelance writer based in the Washington, D.C. area, has been writing about real estate and personal finance for more than 20 years.