THE OPTION TO RENT APPEALS TO THOSE WHO FIND HOME BUYING OUT OF REACH

Tens of thousands of people move into or within the Northern Virginia region every year. However, based on analysis of data from the American Community Survey, a relatively small share of these new households – about 30 percent – buy a home when they move. Younger households are particularly unlikely to become homeowners when they move in Northern Virginia.

The deficit in young, first-time homebuyers is having an impact on the overall housing market. An insufficient supply of appropriate and affordable housing may be limiting homeownership for new households. Student debt also impacts the creditworthiness of many prospective buyers.

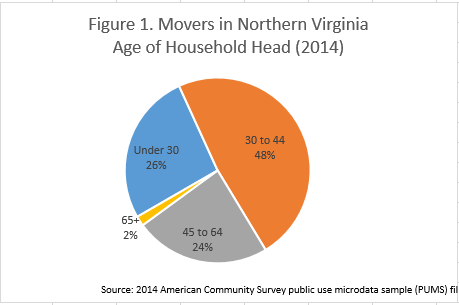

In 2014, more than 110,000 households moved within or to Northern Virginia. Nearly half of these movers were between the ages of 30 and 44, about one quarter were under 30, and another quarter were ages 45 to 64. Only about 2 percent of movers in the Northern Virginia region were 65 years or older.

Increasing job growth in Northern Virginia has helped to attract new residents in recent years. As the housing market improves, many new residents often choose to rent.

MOST OF NORTHERN VIRGINIA'S RECENT MOVERS ARE RENTERS

About 70 percent of recent movers in Northern Virginia are renters; 30 percent are homeowners. Among recent movers under age 30, only 16 percent became homeowners. That means, of the nearly 30,000 young adult households that moved into or within Northern Virginia, less than 4,800 purchased a home. The national homeownership rate among movers ages 30 to 44 is 32 percent, half of the local rate.

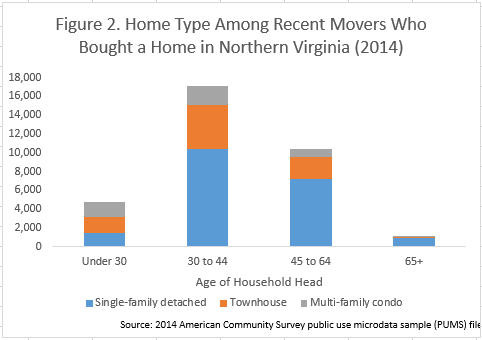

The age of the head of a household impacts the type of home purchased. Overall, 60 percent of recent homeowners in Northern Virginia live in a single-family detached home. Owners under age 30 most often buy a townhouse or condominium. Availability and affordability are likely factors.

INCOME IS NOT A MAJOR FACTOR AMONG YOUNGER HOUSEHOLDS

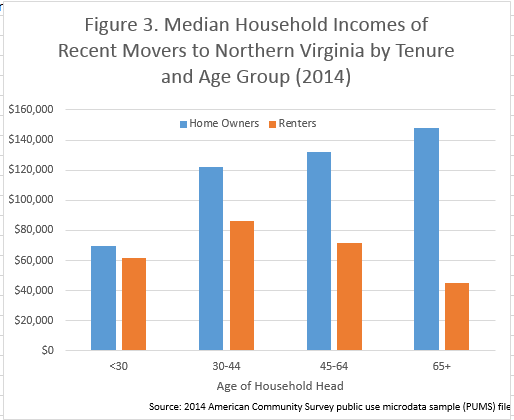

Recent movers under age 30 who are homeowners had a median household income of $70,000. When looking at under-30 movers who are renters, the median household income was $62,000 (Figure 3). For older households, the difference in the median household incomes of homeowners and renters is much larger.

The modest difference in the incomes between under-30 homeowners and renters might explain the difference in homeownership rates. That $8,000 income disparity suggests that there is probably more to the story about why younger households who moved to or within Northern Virginia rent. Homeownership rates among younger households continue to remain lower than they were before the housing market downturn. If not income, what else is keeping these movers in Northern Virginia out of homeownership?

HIGH HOUSING PRICES, LOW INVENTORY

Even if newcomers to the region have sufficient income and credit to buy a home, first-time homebuyers may not be able to find the right one. According to data from Real Estate Business Intelligence (RBI), in June 2016, the average price of a single-family detached home in the NVAR region was nearly $770,000. An average townhouse sold for about $490,000 and the average price of a condo was over $330,000. First-time home buyers can find the median priced home out of reach, particularly if they must save about 10 percent for a down payment – although there are no-money-down options available for first-time buyers.

"Even if newcomers to the region have sufficient income and credit to buy a home, first-time homebuyers may not be able to find the right one."

While there are lower-priced homes available in Northern Virginia, the inventory of affordable homes is lean. At the end of June 2016, just over one quarter of active listings in the NVAR region (27.4 percent) were priced below $400,000. The vast majority of those—78 percent—were condominiums. Recent analysis by the George Mason University Center for Regional Analysis found that there is about a two-month supply of housing for sale at these lower price points.

Inventory has risen recently, which should provide more options for new residents moving forward. But will it be enough to induce these new residents to buy a home when they move within or to the Northern Virginia region? It is possible that for some households, the threshold for homeownership remains too high.

If employment options are uncertain or plans include another move out of the region, young newcomers may continue to rent. The desire for a single-family home—rather than a townhome or condominium—might also be part of the reason some households are remaining renters. Since the housing market downturn, the supply of single-family homes for rent has increased, giving families more options.

While building equity is a great motivator to homeowners at every level, those just starting careers may prefer the mobility that renting provides. Owning a home also requires maintenance expenses. For some movers in this region, the benefit of putting down roots in the Northern Virginia community may be something that they choose to defer.

Dr. Lisa Sturtevant is the president of Lisa Sturtevant & Associates, providing public and private sector clients with comprehensive analysis of economic, demographic and housing market data to support better housing policy and development decisions.