SEVERELY LOW INVENTORY of available homes has plagued the NVAR region and much of the U.S. during the past year. In September there were 4,561 active listings in the region—a figure 6.1 percent less than the five-year September average.

Low inventory pushes housing prices up, and, therefore, makes new entry to homeownership increasingly difficult. Census Bureau figures from the 2016 American Community Survey released in September, 2017 show 340,000 owner households in the NVAR region, excluding Fairfax City and Falls Church, which were excluded from this survey.

Who is living in these households, and why are they staying put? Answering these questions and addressing the dynamics of homeownership could help us understand the region’s persistent inventory issue.

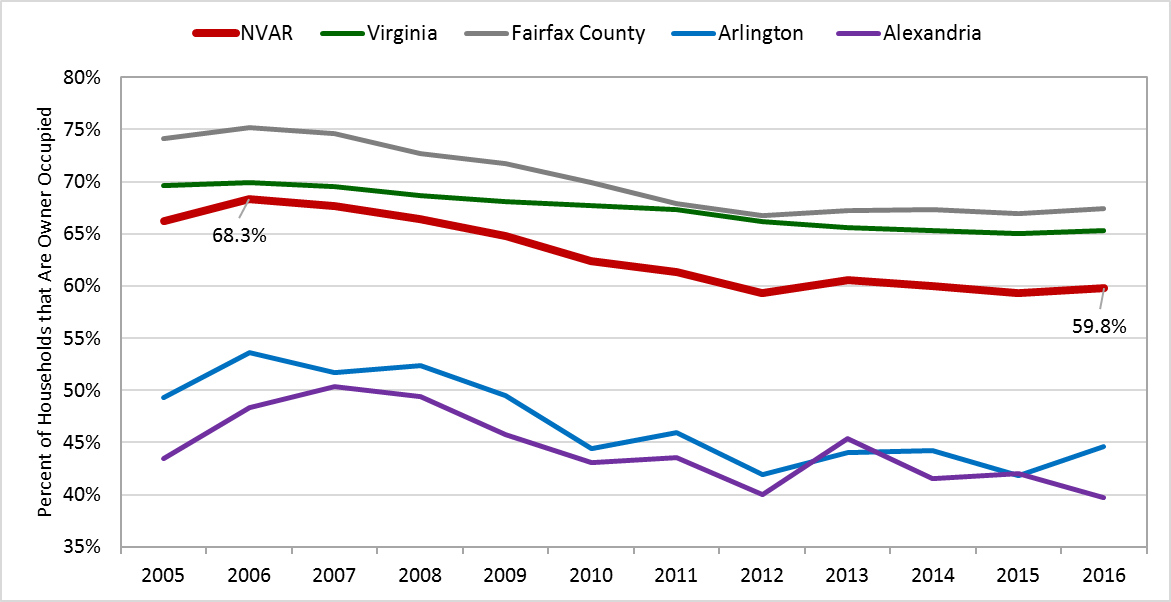

HOMEOWNERSHIP RATE IS DECREASING

The NVAR region homeownership rate has been on a downward general trend over the past decade. Owner-occupied households have declined almost 10 percentage points between 2006 and, and this trend is persistent both statewide and nationally. However, homeownership levels have remained relatively stable in the NVAR region—around 60 percent—since 2012.

By no coincidence, the region’s population growth has slowed significantly since 2012; from 18,870 new residents in 2012 to 4,859 added in 2013. This, combined with extremely low inventory, has led to a stuck housing market where younger renters generally continue renting and older owners continue to remain in their homes.

Homeownership Rate in the NVAR Region ( Excluding Fairfax City and Falls Church)

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

Demographic trends contribute to the overall decline in homeownership as younger households and minority households, who are less likely to own their own homes, replace older households, many of whom own their homes. The total number of owner-occupied households has remained relatively unchanged over the past decade—341,128 owner households in 2005 and 340,145 in 2016—yet the distribution among age groups has shifted.

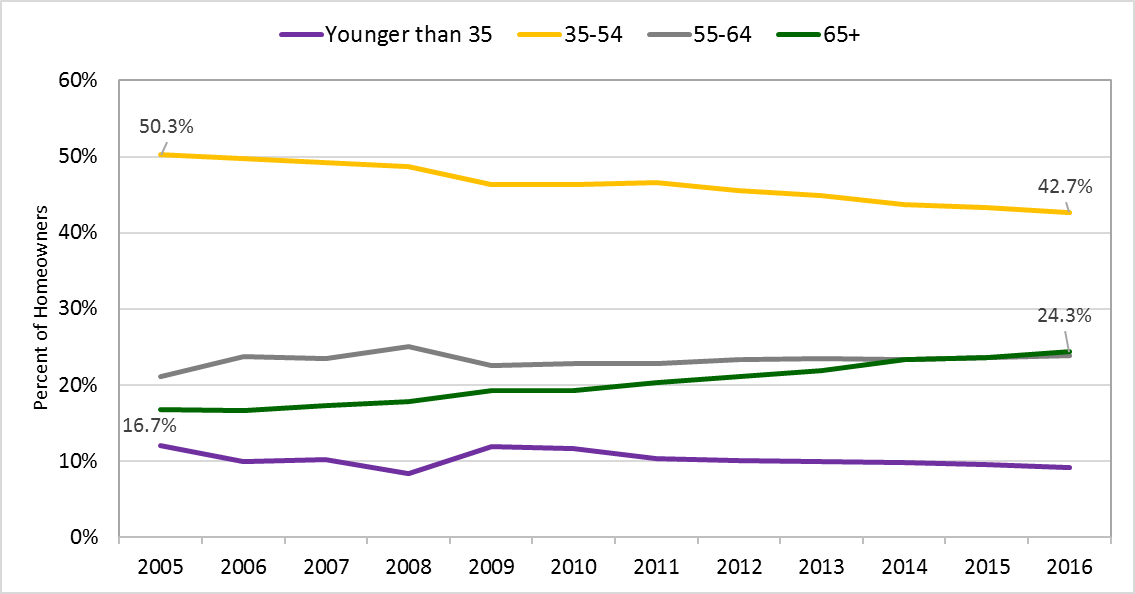

YOUNGER PEOPLE ARE INCREASINGLY LESS LIKELY TO OWN THEIR OWN HOMES

When broken down by age group, homeowners aged 35 to 54 made up half of all homeowners in 2005, and 43 percent in 2016. During this time, homeowners aged 55 and up increased from 38 percent of homeowners in 2005 to nearly half in 2016.

The millennial age group (younger than 35) has stayed relatively stable as a proportion of homeowners at about 9 percent, but in absolute numbers they have decreased nearly 25 percent since 2005. Since the total number of owner- occupied households has remained stable, we can conclude that homeowners are simply “aging up,” with little new entry into the homeownership market.

Percent of Homeowners by Age group, NVAR Region (Excluding Fairfax City and Falls Church)

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

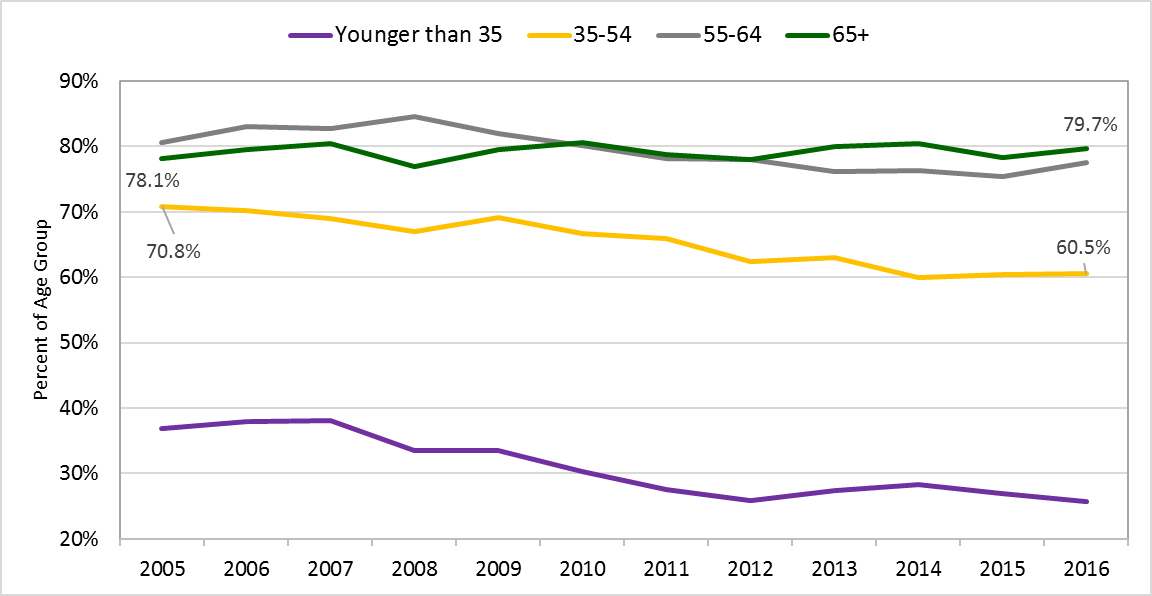

When age groups are broken down by homeownership, we see that younger households are increasingly less likely to own homes. Figure 3 shows the proportion of owners within each age group. In 2016, 25 percent of millennial households were homeowners, compared to 37 percent in 2005. For households aged 65 and older, 80 percent owned their own home in 2016—an increase of 2 percent during the past decade.

Percent of each Age Group that are Homeowners, NVAR Region (Excluding Fairfax City and Falls Church)

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

THE TIGHT MARKET IS MULTIFACETED

The NVAR region’s stalled housing market is two sided. Current homeowners who are typically older are not moving out, while new homeowners who are typically younger are not entering the housing market. Although it is often framed in such a manner, the narrative should not focus on a clash between boomers and millennials, as both have logical motivations for their actions.

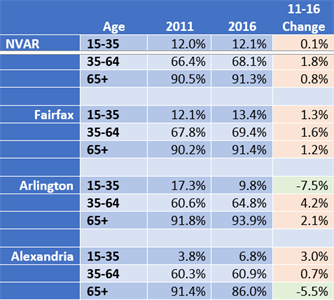

HOMEOWNERS ARE STAYING IN THEIR HOMES LONGER

As homeownership rates have declined over the past decade, owners are mostly staying in the same home. In 2005, 89.1 percent of those living in owner-occupied households were in the same house one year ago, compared to 92.2 percent in 2016. It is logical that older owners would be more likely to live in the same house for longer, and vice-versa for younger homeowners.

Overall in the NVAR region, 91 percent of owners who are 65 years or older have lived in the same home for more than five years. However, we see that across all ages the proportion of homeowners who have been in the same home for more than five years has increased between 2011 and 2016. In other words, a positive change number highlighted in red in Figure 4 indicates that a greater proportion of people in that age group are staying in their homes longer. In the NVAR region as a whole, regardless of age, more homeowners are holding onto their homes for longer.

Percent of Owner Households that Have Lived in the Same Home for More than Five Years by Age Group, NVAR Region (Excluding Fairfax City and Falls Church)

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

Why are homeowners not moving out and freeing up inventory? Often it is because there are no open homes to buy. In order to put their house on the market, they need another house that matches their needs. Such homes often are not available due to tight inventory.

Many are also locked into unaffordable mortgages, or older homeowners are drawing from their mortgaged assets to fund their retirement years. As older generations in the U.S. continue to live longer than in the past, homes are increasingly occupied with aging homeowners who do not plan on moving.

PROSPECTIVE HOMEBUYERS CANNOT FIND OR AFFORD A HOME

The limited number of available entry-level homes makes choices low for potential new homebuyers, and also drives up prices.

The September median sold home price in the NVAR region was $479,950—the highest September sales price on record and the 10th straight month of year-over-year median price increase. Someone buying a $515,000 home with a traditional FHA 3.5 percent down-payment loan should expect to come up with $32,500 for the closing minimum—nearly twice as much as the national figure.

A 2015-2016 Bureau of Labor Statistics Consumer Expenditure Survey reports that the average resident of the Washington, D.C. metropolitan area spends $26,743 on housing related expenses each year—with $10,715 each year for mortgage, taxes and maintenance for owned residences. This makes homeownership even more difficult for those who do find a suitable home to buy in the region.

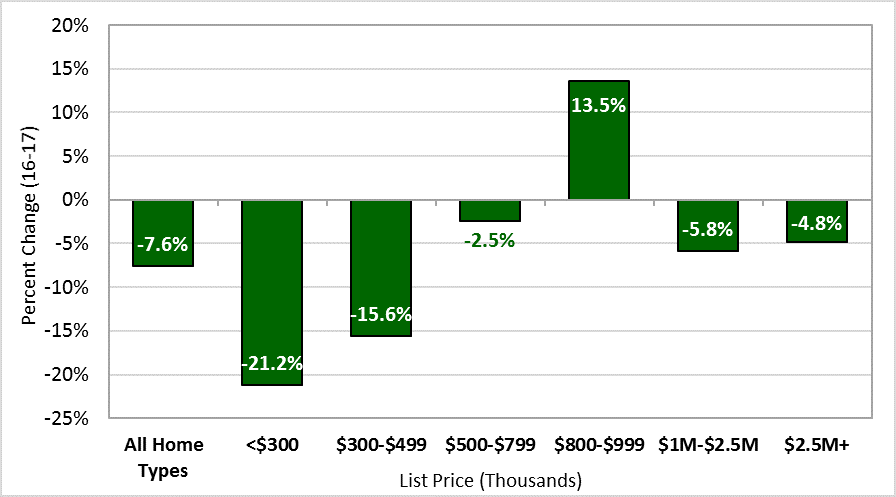

Inventory is not tight at all price points—lower list price homes make up the lowest proportion of active listings but are decreasing the fastest. NVAR region properties listed for less than $300,000 make up 13.9 percent of active listings in September, down 15.2 percent from September 2016. At the same time, property listings on the higher end of the market— often not accessible to first-time homebuyers—are decreasing at much lower rates and even increasing, as is the case of the 528 available homes in the $800,000 to $1 million range.

Change in Inventory by List Price, September 2016-2017, NVAR Region

Source: Bright MLS. Statistics calculated 9/6/2017

YOUNGER HOMEBUYERS ARE HELD BACK, BUT THINGS ARE LOOKING UP

High home prices combined with increasing student debt have created a financial equation that has hindered many young potential homebuyers. Nationwide, there was $1.44 trillion in outstanding student loans at the end of the first quarter of 2017, according to the Federal Reserve, and 20 percent of all households had student loan debt in 2015, up from 12 percent in 2001. Survey estimates from the National Association of Realtors® say that student loan debt delays homeownership by seven years.

"As older generations in the U.S. continue to live longer than in the past, homes are increasingly occupied with again homeowners who do not plan on moving."

Not only has increased debt itself prevented home buying, but across the country it typically has also delayed other milestones that prompt entering the housing market. Life events such as getting married or having children are typical triggers to buying a home.

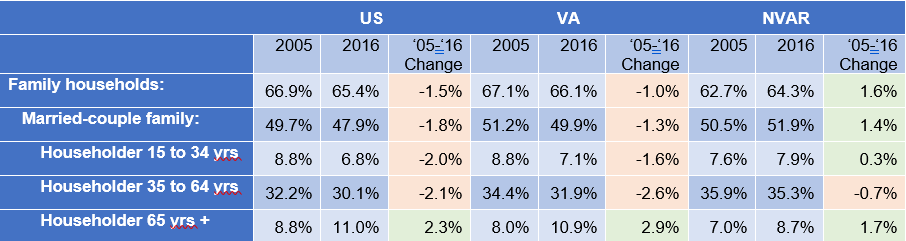

Compared to previous generations, millennials are less likely to be married, have children, and own a house. But the NVAR region is opposing this trend— between 2005 and 2016 the percent of family households has increased 1.6 percentage points, and this figure has increased 1.4 percentage points for married couples. This is compared to decreases in the proportion of family and married-couple households in both the US and Virginia. People in the NVAR region are increasingly forming families, but not buying homes.

Family and Married Couple Households by Age as a Percent of Total Households

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

Source: 2016 American Community Survey 1-year estimates, US Census Bureau

Things are looking up in the Washington region, as recent census data showed that in 2016, millennials’ incomes jumped 7 percent, far more than most other groups. Employment data also shows that the percentage of 25-to-34-year-olds in the labor force is the largest it has been since the recession.

In a stronger financial position, more millennials are starting families and the US Census Bureau projects that national household formation will average about 1.5 million per year through 2020, up from the 900,000 annual average in the past five years. If demand is expected to increase for new homebuyers, but affordable starter homes are not available, then people will be more likely to leave the region or avoid the area entirely.

It is intuitive to think that an increase in young people entering the housing market would boost demand and further tighten inventory, but the future of the region’s housing market depends on steady new household formation. Homeownership has long been considered an important factor in wealth formation for middle-class households. Continued low entry into homeownership will impact the region negatively moving forward.

The longer households wait to buy, the less wealth they will accumulate throughout their lifetime. This could exacerbate income inequality and limit future regional sale volume.

AN INVENTORY JUMPSTART IS NEEDED

The overall cause behind the consistently low number of active listings is simple: demand is steadily outpacing supply. A large portion of housing supply relates to homes already on the ground, and the financial availability to enter into homeownership drives demand. The current stalemate between the two has led to low and stagnant inventory levels, especially for lower-price-point homes. The needed turnover between current and future homeowners is not occurring due to roadblocks on both sides.

Unfortunately, homebuilding to open up inventory has slowed, and the homes that are for sale are attached to bigger price tags than ever before. The slower homebuilding is caused by a combination of high building costs and builder hesitancy lingering since the previous housing crisis in the late 2000s. As more millennials age into household formation, the pace of housing starts will need to not only meet— but also exceed—the growth in new households. Absent an influx of new homes, the inventory shortage will continue to burden the region’s housing market.