Not All Housing Types Are Created Equal

GOOD NEWS FOR HOME SELLERS, it seems, as Northern Virginia median home prices continue to rise, while median days on market continue to decline. Yet these two trendlines do not provide the whole picture; savvy Realtors® understand their regional housing market’s activity holistically and consider all available information before advising their clients.

In NVAR’s Sept+Oct 2019 issue of RE+VIEW magazine, Dr. Terry Clower, director of George Mason University’s Center for Regional Analysis, shared four “regional change elements” critical to understanding the local housing market’s evolution: the regional economy, the urban form, mortgage lending, and the emergence of non-traditional real estate brokerages. This issue examines recent multi-year data and trends correlated to these four indicators.

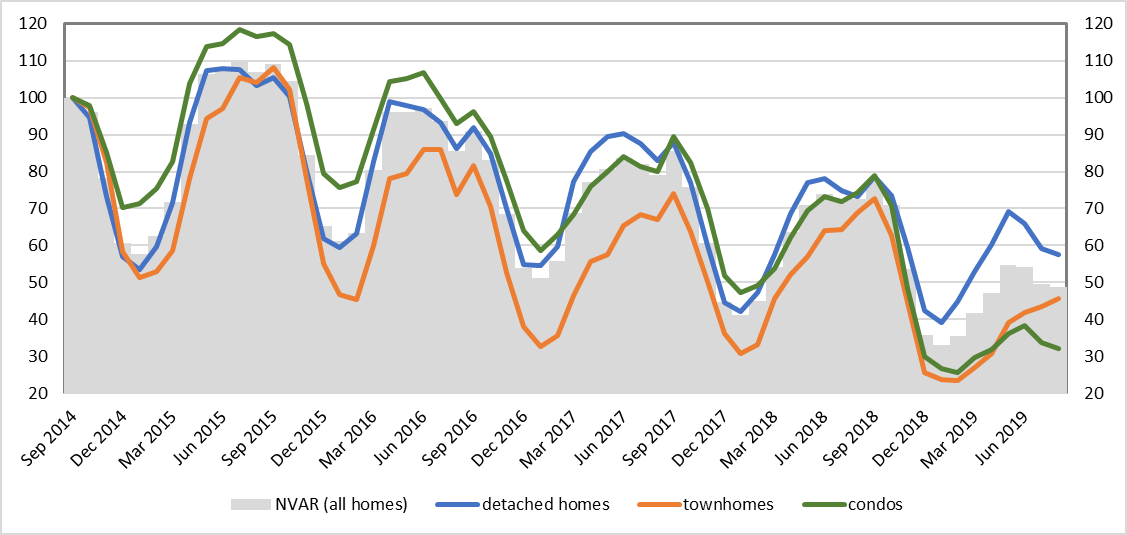

INTEREST IN INVENTORY

Everyone is talking about inventory! Buyers want options, sellers are concerned about competing listings, and Realtors® work hard to deliver exceptional results to their clients – but cannot wave a magic wand to loosen or tighten regional housing inventory. However, obtaining an overview of regional inventory trends – based on fact, not fairy dust – is helpful in educating clients and managing their expectations.

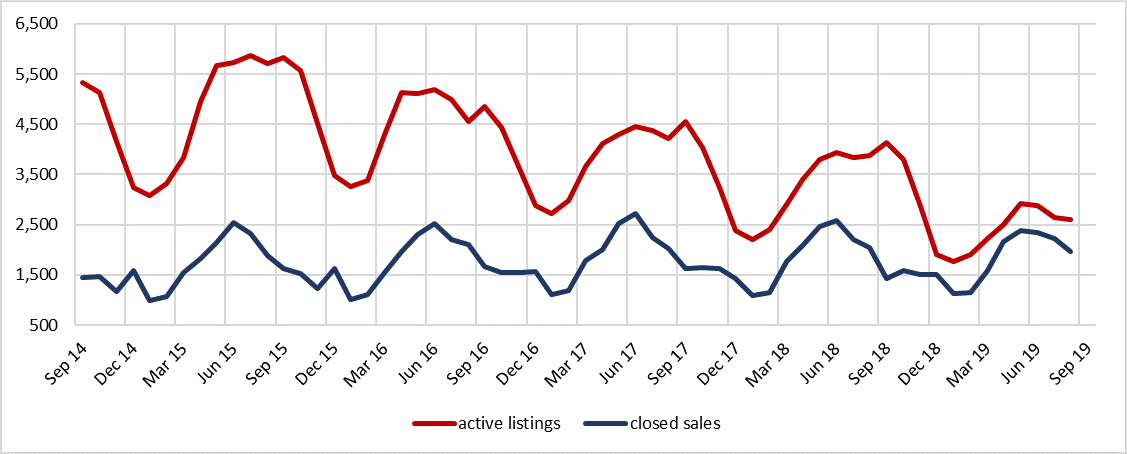

Figure 1 tells an interesting story of a tightening housing market in Northern Virginia. Graphing the trending five- year decline in end-of-month active listings compared against relatively stable monthly housing sales, it’s possible to visualize the compression.

Figure (1) Closed Sales and Active Listings - NVAR Region (All Home Types)

Source: Bright MLS. Statistics calculated 9/28/2019.

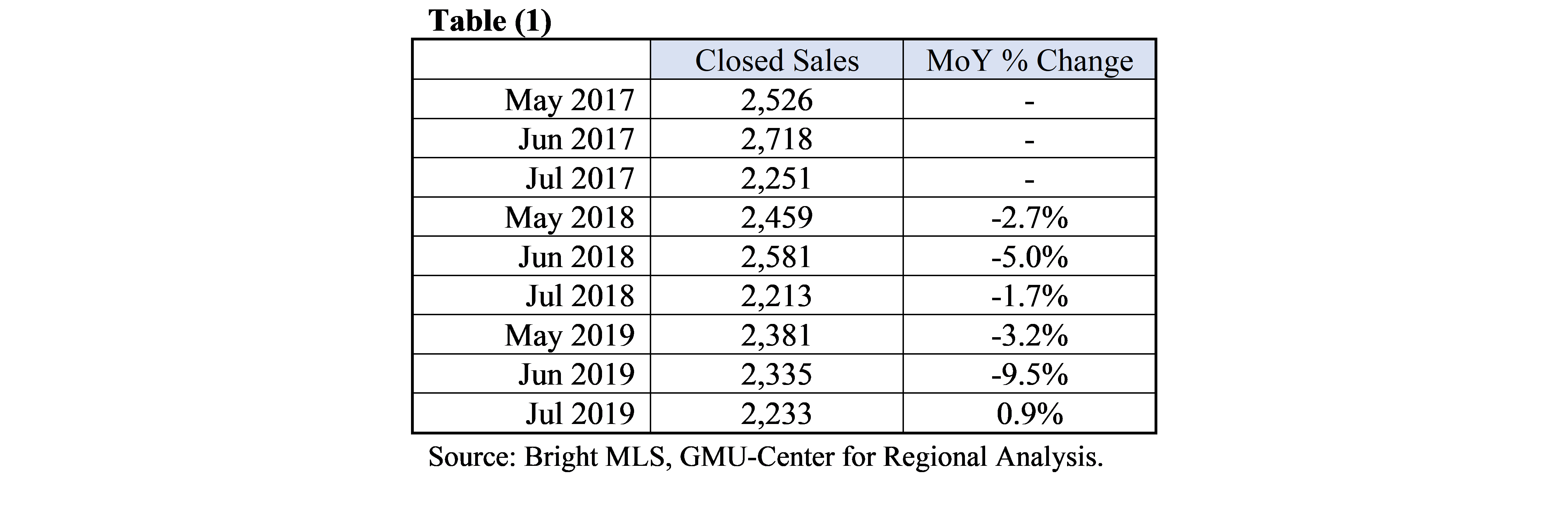

As for those “relatively stable” year-over-year housing sales, a close inspection of Figure 1 does show a modest three-season decline in peak summertime (May-August) closed sales, between 2017 and 2019. This recent (seasonal) month-over-year (MoY) decline is best illustrated in Table 1.

This slight downturn mid-2018 and mid-2019 notwithstanding, when the graph is “smoothed” of all active listings and closed sales by recalculating each series as a function of each month’s (past) 12-month average, as in Figure 2, the previous perception of a tightening market is reinforced – with a noticeable change in inventory but relative stability in closed sales across the 60-month period.

Figure (2) Averaged 12-month Values of Closed Sales and Active Listings in the NVAR Region

Source: Bright MLS. Statistics calculated 9/28/2019.

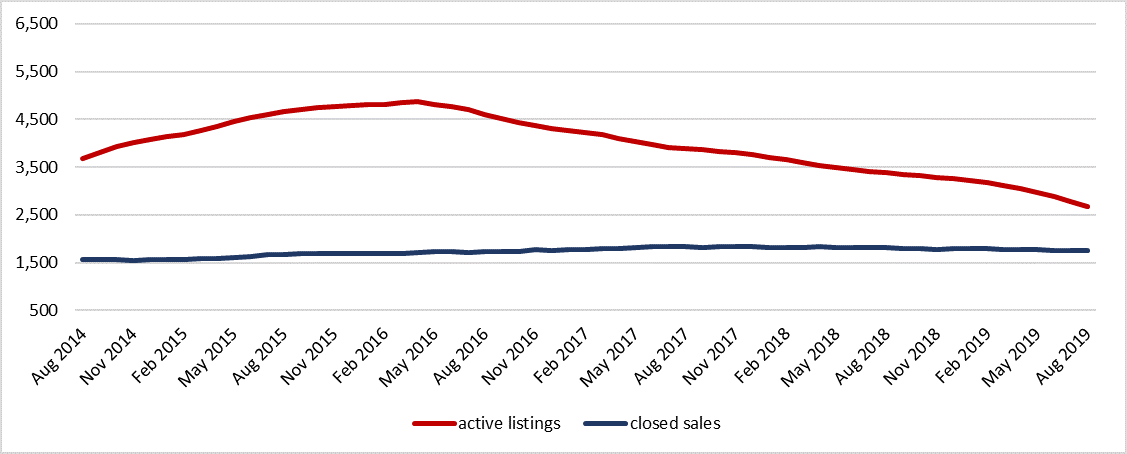

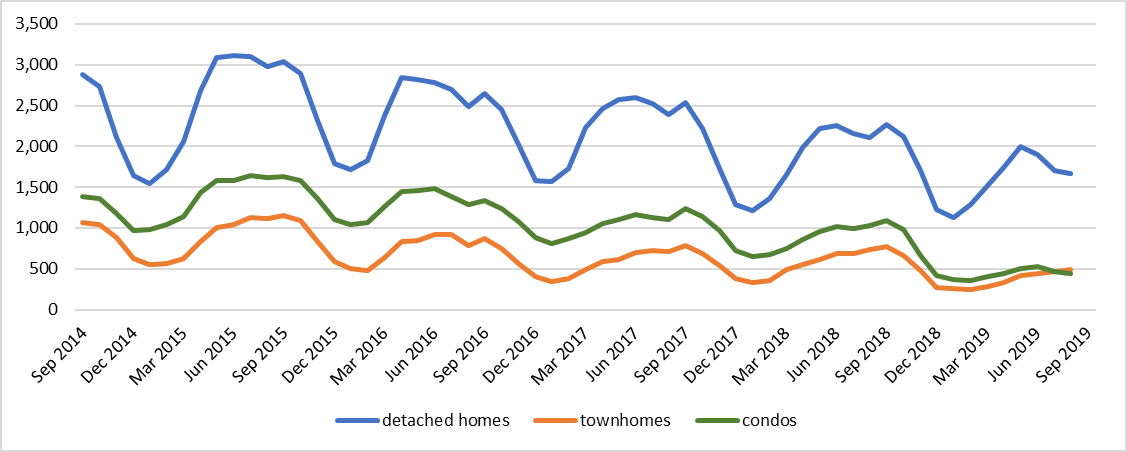

Having a macro understanding of declining inventory of all home types, taken together, in Northern Virginia is interesting, but understanding end-of-month active listings by housing type provides a clearer picture of what is happening in the market. Figure 3 demonstrates an interesting trend in condo inventories over this past year.

Figure (3) NVAR Region Detached Home, Townhome, and Condo Inventories, Original Values

Source: Bright MLS. Statistics calculated 9/28/2019

Specifically, in the October to December 2018 timeframe, condo inventories noticeably declined, and have since continued to fall away from the previous trend that roughly mirrors the availability of for-sale detached homes and townhomes.

Yet the best way to compare the relative inventory changes between dissimilar quantities (in this case, detached home, townhome, and condo end-of-month active listings) is to index each series to a common starting point. Figure 4 indexes a shadow of the combined inventory volume of all home types across the NVAR region (also indexed to September 2014, for parity). In so doing, the recent down- turn in condo availability comes into sharp contrast against the availability of detached homes, noticeably crossing townhome availability in May 2019, then increasing its separation from relative detached home and townhome sales.

Figure (4) Indexed Inventories of Detached Homes, Townhomes and Condos

Source: Bright MLS. Statistics calculated 9/28/2019.

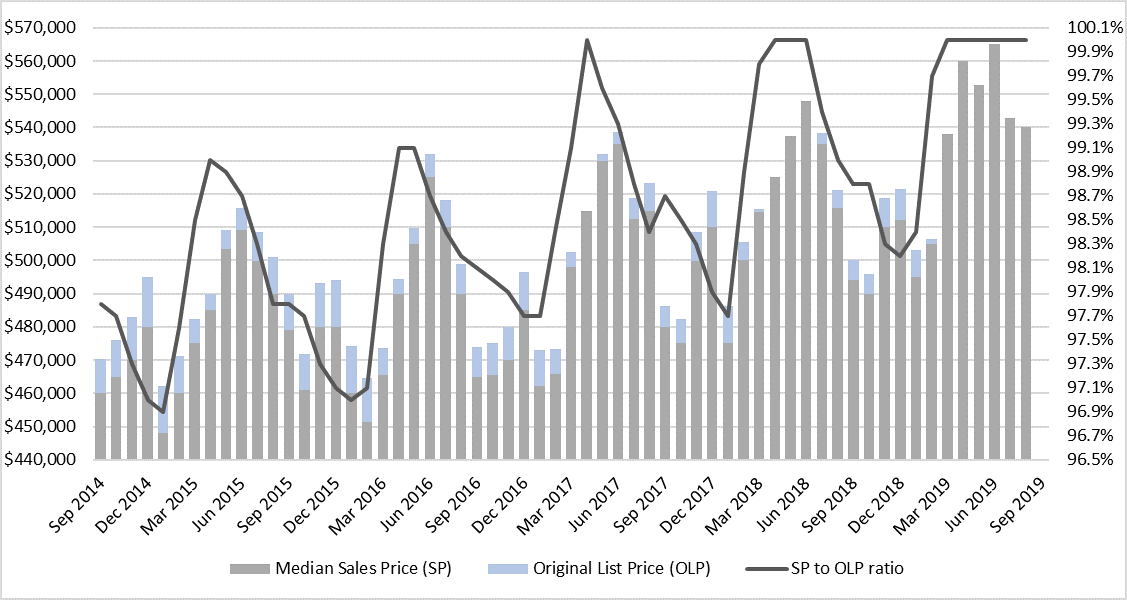

SHOWING SELLERS THEIR MONEY – AND QUICKLY

If there is an upside to the downturn in housing availability, then it’s this: NVAR Realtors® are generally delivering higher median home sales prices that are very close to, if not matching, their seller’s original list prices. And these sales are happening in record time, as the total number of days that properties are on the market continues to decline appreciably.

Evaluating both median sales prices and Sales Price (SP) to Original List Price (OLP) ratios across the NVAR region, it becomes readily apparent that home sales prices, overall, are increasing. What jumps off the chart in Figure 5 is that sellers are increasingly receiving their ask, or close to it.

Figure (5) NVAR Region Median Sales Prices and SP to OLP Ratios - All Home Types

Source: Bright MLS. Statistics calculated 9/28/2019.

Notice that the median SP to OLP ratio hit 100% only once in 2017. Yet in 2018, the median SP to OLP ratio reached 100% three times (April to June). By theclose of August 2019, fully three-quarters of 2019 sales months (six out of eight months) witnessed median SP to OLP ratios at 100% (March to August).

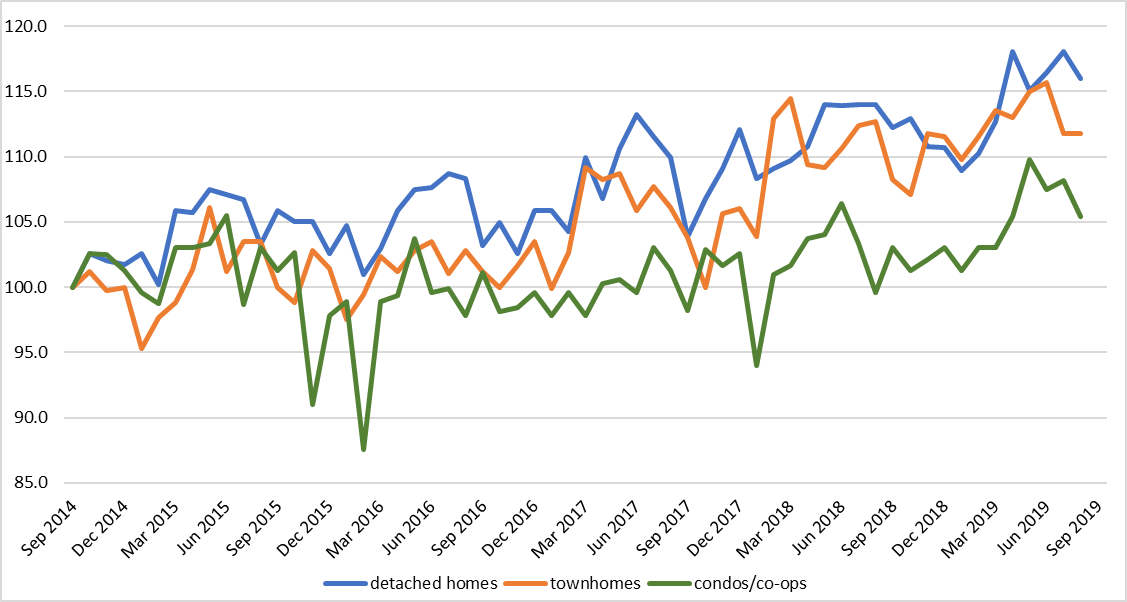

This begs the question: what are the market trends in home sales prices when evaluated in terms of detached home, townhome and condo sales? Figures 6.A and 6.B provide indexed trends in actual sales price values and running six-month averages (once more, to “smooth” the data), respectively.

Figure (6.A) Indexed Median Sales Prices of Detached Homes, Townhomes and Condos

Source: Bright MLS. Statistics calculated 9/28/2019.

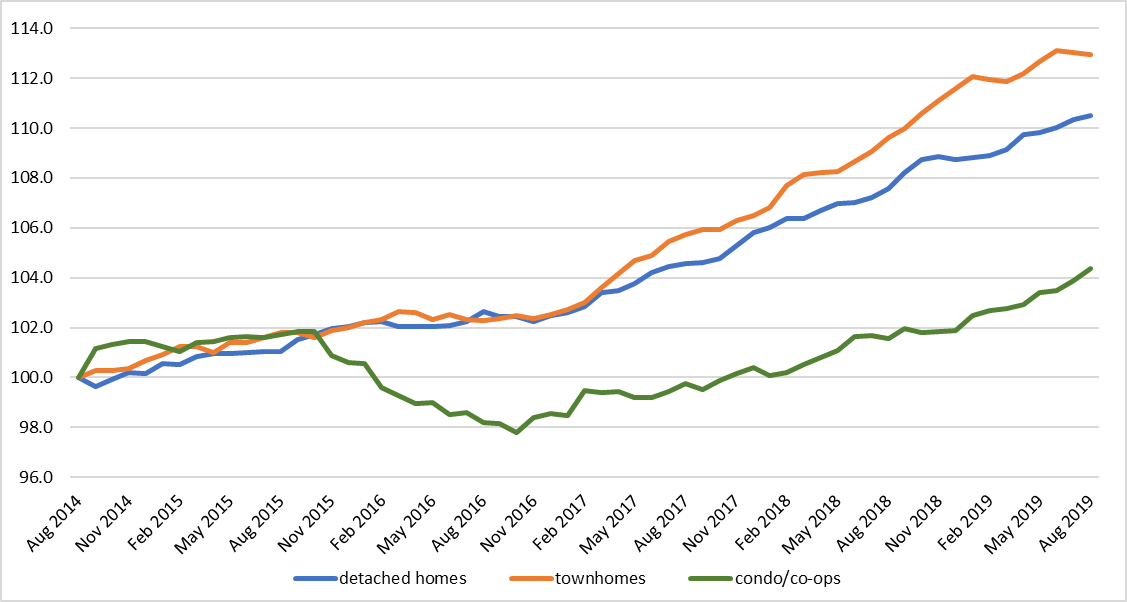

Figure (6.B) Indexed Averaged 12-month Values of Median Sales Price

Source: Bright MLS. Statistics calculated 9/28/2019.

Once again, the data demonstrate an upwards trend in home price values across all housing types. Even so, growth in condo sales prices appears to lag behind that of both detached homes and townhomes.

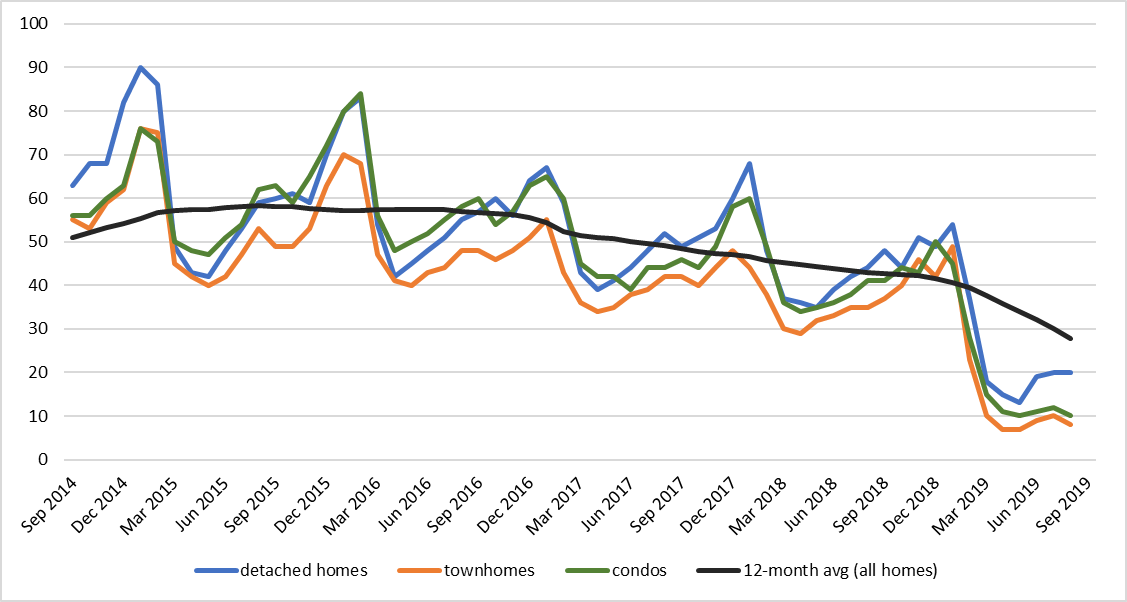

It is no secret that median days on market (DOM) have been in decline for a number of years. Analyses of recent data show a precipitous decline for all home types, from the start of this year until May when the median DOM slipped under the two-week timeframe (Figure 7). Median turnaround from listing to contract in May proved astonishingly quick for detached homes (13 days), condos (10 days) and townhomes (7 days). While longer waits are both typical and anticipated during the winter months, ever- tightening market inventory is unlikely to return recent DOM timeframes to something more palatable for already-stressed buyers.

Figure (7) NVAR Region Days on Market

Source: Bright MLS. Statistics calculated 9/28/2019.

THE BIG PICTURE

Admittedly, these market trends have been apparent for some time now. Perhaps the most surprising detail in this analysis, though, is that while condo inventories have tightened to a greater degree than their detached home and townhome counterparts, condo sellers are not necessarily enjoying higher returns relative to increases enjoyed by detached home and townhome sellers. However, most sellers do appear to be getting under contract with their buyers extraordinarily quickly. Moreover, sellers are generally walking away with more money in their pockets thanks to buyers making offers much closer to, if not above, original list prices.

Whether consumers are new homebuyers or existing home owners on the hunt for their next residence within Northern Virginia, they will have to work closely with their Realtor® to negotiate the tight housing market – where moving quickly and smartly when making offers on hot homes is essential to success.