Still Too Soon to Assess Impact on Residential ‘Doors Opening’

FOUR YEARS AGO, the first phase of Metro’s Silver Line opened for service and the second phase is now projected to be up and running by 2020. Since planning for the Silver Line began, the real estate community has seen an explosion of new commercial and residential developments in the Tysons- Dulles Corridor. However, there has been little overall impact on sales volume and pricing for ownership units in the ZIP codes that include Silver Line stations. There was a surge in inventory as some sellers sought to capitalize on enthusiasm for new transit service options.

This article examines January-to- July housing market trends from 2015 through 2018 in the Silver Line corridor. The Silver Line corridor includes six ZIP code areas: 20190 (Reston North), 20191 (Reston South), 22043 (Pimmit Hills), 22101 (McLean), 22102 (Tysons North/ Great Falls), and 22182 (Tysons West/ Wolf Trap).

THE SILVER LINE HOUSING MARKET

During the three years prior to the Silver Line’s opening, the corridor’s housing market did not dramatically outperform the overall NVAR Region, which includes Arlington and Fairfax counties and the cities of Alexandria, Fairfax and Falls Church. (See “The Silver Line’s Early Effects on the Housing Market”, published in the Nov/Dec 2014 issue of RE+VIEW magazine.) The corridor’s share of the regional market held steady during this time – representing about 11.5 percent of all sales in the Northern Virginia market. Price growth fell behind the region between 2012 and 2013 yet outpaced the region between 2013 and 2014. However, this was driven by significant single-family price growth and moderated by decreases in townhome and condo prices.

Not much has changed in the relative rate of home sales since the debut of the Silver Line. Between January 2015 and July 2018, there were 8,780 residential sales in the Silver Line corridor – representing 11.4 percent of all sales in the Northern Virginia market. The corridor’s share of the regional market held relatively steady during this time: it was 11.2 percent in 2015, 11.6 percent in 2016, 11.5 percent in 2017, and 11.4 percent in 2018.

"Not much has changed in the relative rate of home sales since the debut of the Silver Line."

The proportion of home sales has shifted to fewer single-family homes and more condos with similar numbers of townhouses. Since January 2015, about 46 percent of all sales in the corridor were single-family units, which was similar to the proportion in Northern Virginia overall. However, single-family sales dropped from a high of 46 percent in 2016 to a low of 44 percent in the first seven months of 2018. Townhome sales in the Silver Line area are less prevalent than the Northern Virginia market as a whole – townhouses represented 24 percent of sales in the corridor during this period compared to 27 percent in the region. Condos were 30 percent of corridor sales, which was slightly more than the region overall where condos represented 28 percent of sales.

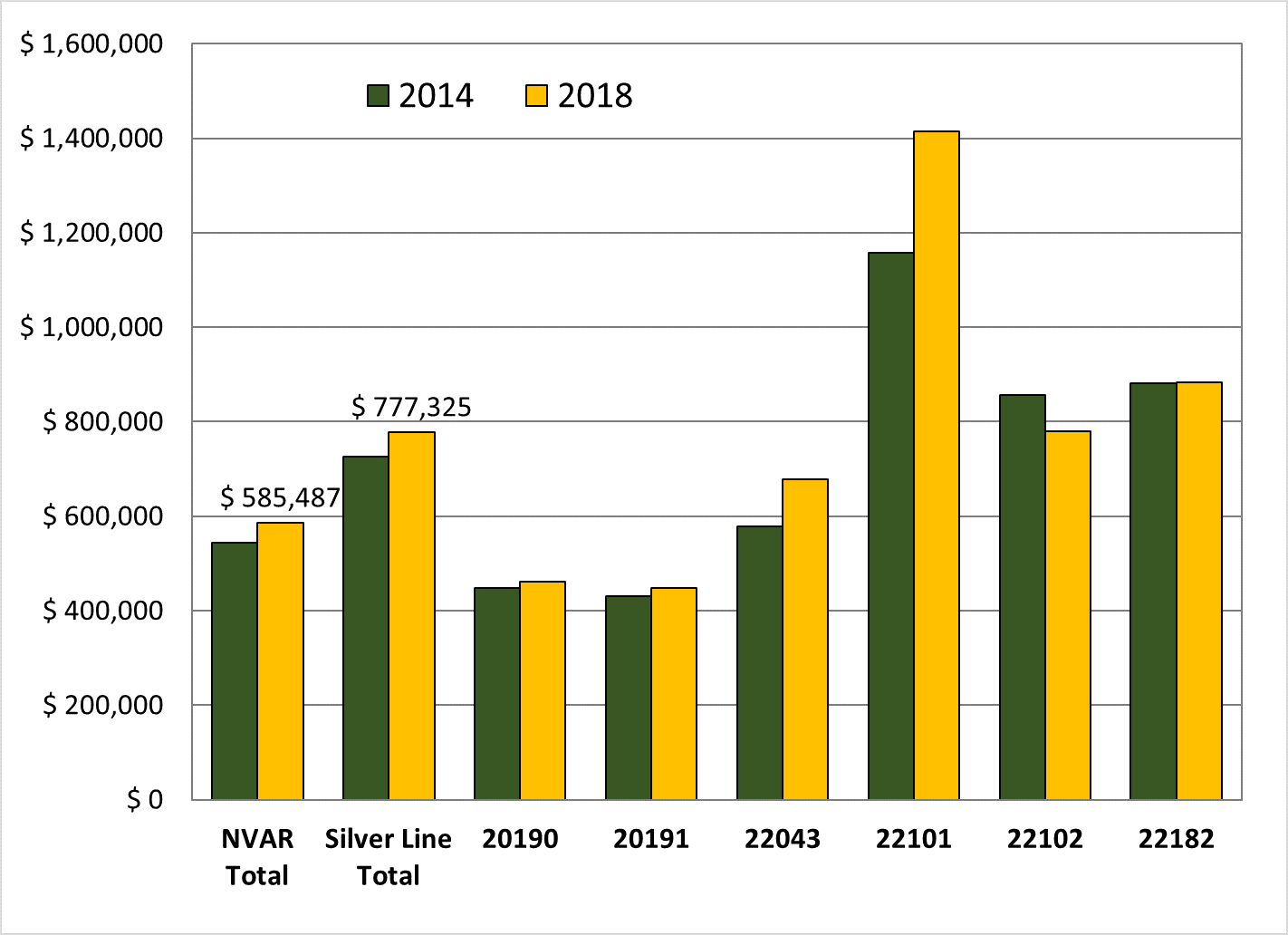

The Silver Line corridor market is a higher-end housing market than the rest of the region, both prior to and since the opening of the new Metro line (Figure 1). From January to July 2014, the overall average sale price of all units in the Silver Line corridor was about $725,000, which was 34 percent greater than the Northern Virginia median price of $543,000. Over the same period in 2018, the average sale price of Silver Line homes was $777,325 – 35 percent more than the average price in the Northern Virginia market.

Figure 1: Average Home Sale Prices, January-July 2014 and 2018

Source: Bright MLS; GMU Center for Regional Analysis

Still, there is variation in prices within the corridor. The median price from January to July 2018 in the 22101 McLean ZIP code was $1,414,000, which is nearly triple the median price in the two Reston Silver Line ZIP codes: $461,200 in 20190 and $447,500 in 20191. The housing type mix has contributed to the differential in price growth among ZIP codes within the Silver Line corridor. Price growth since 2014 has been greater in the 22043 Pimmit Hills and 22101 Great Falls ZIP codes – likely from a prevalence of single-family homes. There has been less price growth in the Tyson’s ZIP codes of 22102 and 22182, which have seen an influx of condos in recent years.

PRICE GROWTH HELD BACK BY CONDOS AND TOWNHOUSES

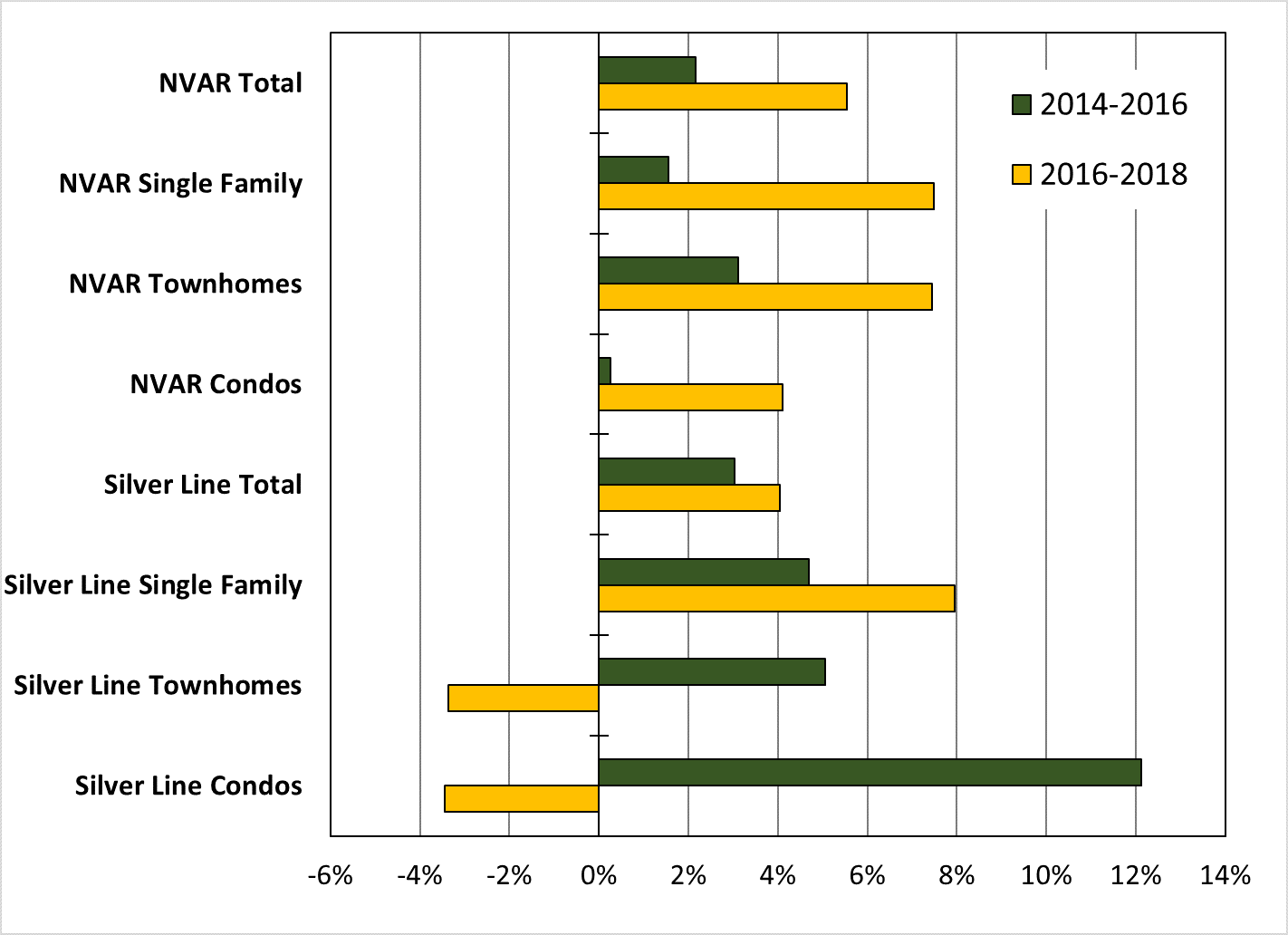

The Silver Line corridor’s price growth outperformed the region as a whole during the first two years of operation but has since lagged (Figure 2). The January to July average sale price in the Silver Line corridor increased by 3 percent from 2014 to 2016, compared with a 2.2 percent increase for all of Northern Virginia. However, the corridor’s January to July performance fell behind the region’s from 2016 to 2018; the corridor’s average price increased by 4 percent, which was 1.5 percent less than the region’s average price increase of 5.5 percent. Overall sales price growth is impacted by the market shift to condo sales.

Figure 2: Average Sale Price Changes: January-July 2014-2016 and 2016-2018

Source: Bright MLS; GMU Center for Regional Analysis

Price performance has varied among housing types since 2014. While there has been increasing growth in all NVAR region segments, pricing has fallen significantly behind within the Silver Line attached housing markets. The single-family market in the Silver Line corridor has outperformed the regional single-family market since 2014 while becoming the sole source of price growth within the corridor in recent years. From 2014 to 2018, the January-to-July average single-family price in the corridor increased from $950,000 to $1,074,000 – a gain of 13 percent. During the same period, the regional average increased by 9.2 percent from $723,250 to $790,000.

Townhouse and condo price growth were exceptional in the two years post Silver Line opening. January-to-July average townhouse price increased by 5.1 percent between 2014 and 2016, from $610,375 to $641,300, while average condo price grew from $328,600 in 2014 to $370,000 in 2016 – a 12.1 percent increase. Yet, in the past two years, the average sale price of townhouses and condos has actually depreciated – each segment declining approximately 3.5 percent in January-to-July average price between 2016 and 2018.

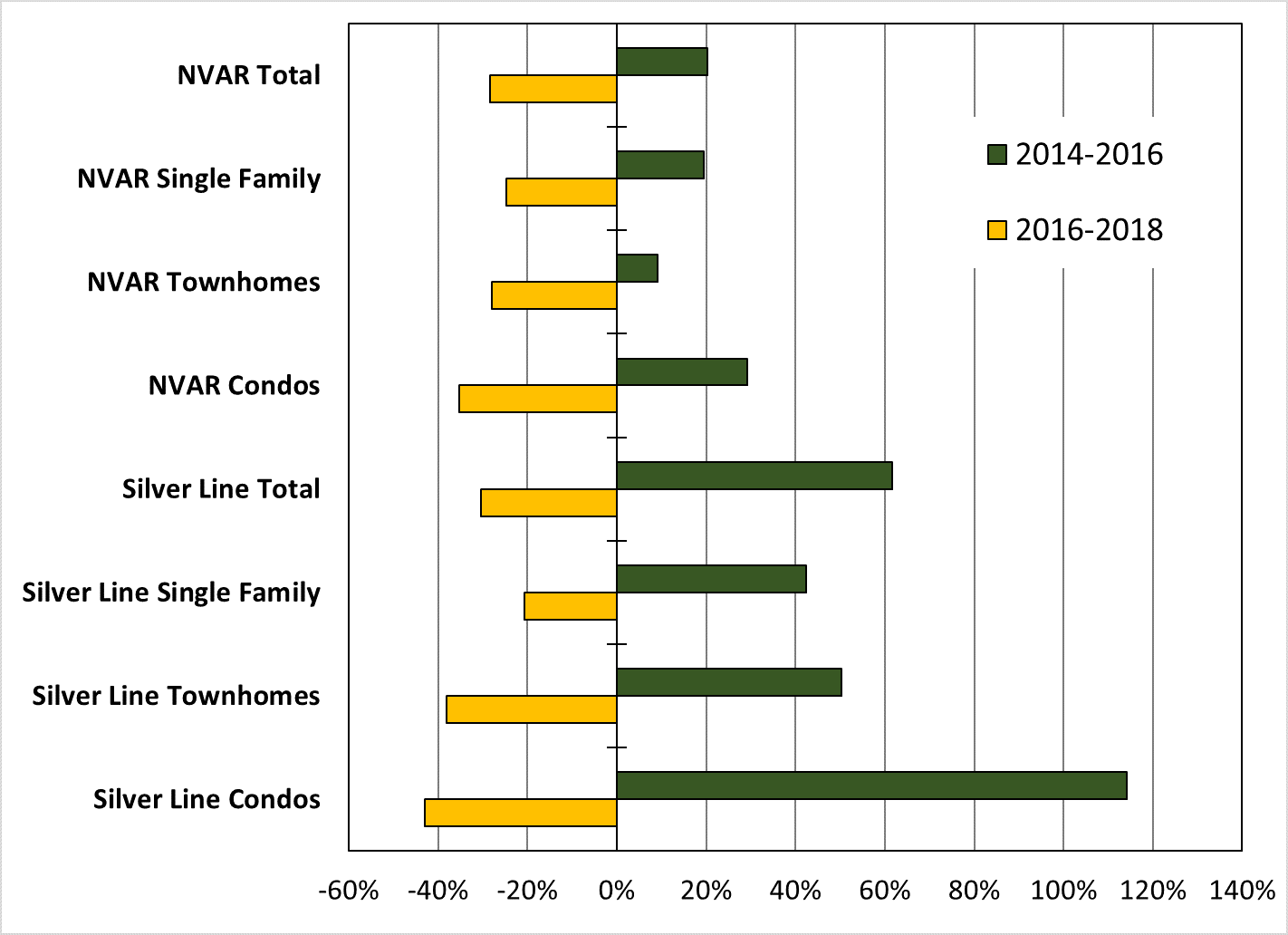

Increasing inventory is a possible factor weakening the price growth in the condo and townhome market. January-to-July condo active listings increased 114 percent just after the Silver Line debut between 2014 and 2016, compared to 20 percent in the Northern Virginia region (Figure 3). However, inventory decreased across all home segments in both the NVAR region and Silver Line corridor between 2016 and 2018, while Silver Line condos had the largest decline at -43 percent. A decreasing supply does not explain the recent decrease in sales price; low inventory should drive up prices.

Figure 3-Average Monthly Active Listing Changes: January-July 2014 and 2016-2018

Source: Bright MLS; GMU Center for Regional Analysis

Readers should be careful when interpreting these data. Despite the price declines, the demand is still high near Silver Line stations, and close proximity to Metro stations does have an impact on prices. The conflicting evidence presented is a challenge produced by the geographical scale of analysis and the nuance that occurs in housing submarkets. Housing data is presented at the ZIP code level in this case, which may mask intense housing interest immediately surrounding the stations by averaging in pricing trends in neighborhoods outside of walking distance to Metro stations. Ultimately, the data is useful by providing a picture of the market at a macro scale while enabling speculation and insight.

There is steady turnover in both the condo and townhouse markets as sales and new supply remain high. The share of January-to-July 2014 to 2018 home sales remained around 13 percent for condos and 10 percent for townhomes in the corridor, while the corridor’s share of new listings has increased over this period for these housing types. Home sales in the Silver Line corridor are possibly leaning toward smaller, less expensive units. Additionally, many new rental properties have been developed in recent years, which has created additional options for prospective residents. Just because listings are down from year to year does not necessarily indicate low supply in this case; more people could be deciding to rent or purchase single-family homes farther out, bringing down the new “normal” amount of condo inventory.

"Corridor price growth outperformed the Northern Virginia region across all housing types early after opening, yet the townhouse and condo market has seen a dip in prices in recent years."

SALES AND PRICE GROWTH VARY WIDELY ACROSS THE CORRIDOR

Single-family sales are occurring in separate areas from the high-density condo and townhome market within the Silver Line corridor. Smaller units and renters are less likely in those neighborhoods. In the 22101 and 22182 ZIP codes, about 80 percent of recent sales have been of single-family homes. By contrast, single-family units represent less than 10 percent of sales in the 20190 ZIP code.

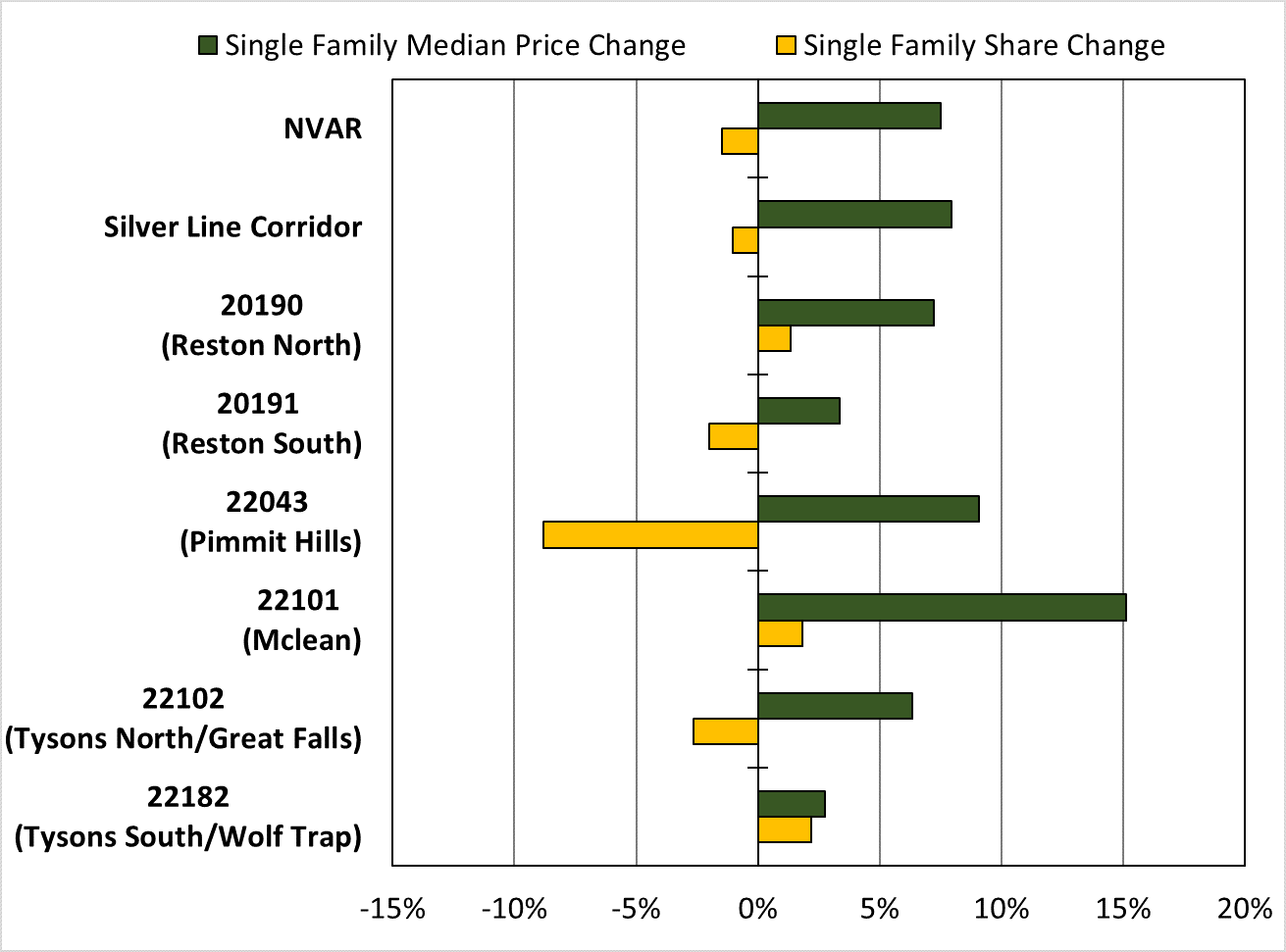

Changes to this balance of unit types sold have affected the Silver Line housing market as well. This is exhibited in Figure 4, which represents the balance of unit types sold in the Silver Line market by showing the change in price and share of single-family homes by ZIP code between 2016 and 2018. Price growth among single-family homes has been positive and strong across all regions within the corridor, with the greatest change in average price occurring in McLean’s 22101 – up by 15.1 percent, to $1,560,000, from January-July 2018.

Figure 4: Change in Single-Family Share of Total Sales and Average Sales Price: January-July 2016 to January-July 2018

Source: Bright MLS; GMU Center for Regional Analysis

The change in single-family share of total sales remained relatively stable over this period with 22043 in Pimmit Hills being one noticeable outlier – declining 8.8 percent to about 50 percent single-family sales in the ZIP code. Pimmit Hills is located between Tysons Corner and Falls Church and has been the recipient of new residential developments catered around Tyson’s to the west and Merrifield to the south. The two ZIP codes with the largest increase in share of single-family homes were those that already have the largest concentration of such developments. Tysons South and McLean both had about a 2 percent increase in share of single-family home sales to 76 and 81 percent, respectively, in the first seven months of 2018.

PHASE 2 AND FUTURE OUTLOOK

The first phase of the Silver Line has shown both positive and negative outcomes. New developments designed around the line are being completed at a blistering pace, yet its five new stations are struggling to attract riders, according to a July 29, 2017 Washington Post article. Even four years later, the arrival of this prominent transportation link has shown unclear impacts in the housing market. Corridor price growth outperformed the Northern Virginia Region across all housing types early after opening, yet the townhouse and condo market has seen a dip in prices in recent years. Single-family prices have soared in the past four years – keeping track with the region as a whole.

The six new Metro Stations that will open with Phase 2 of the Silver Line are – despite construction complications – expected to be completed in 2020. Three of them will be in Fairfax County (the Reston Town Center, Herndon and Innovation Center stations) and the remaining three (the Dulles Airport, Loudoun Gateway and Ashburn stations) will be in Loudoun County. The new stations are stimulating another surge of development and office leasing activity, while developments along Phase One are still coming to fruition. Metro-adjacent plans for Reston alone account for more than 38,000 residences, a network of parks, a performing arts center, schools and other amenities over the next several decades. The Boro development in Tysons, expected to be completed later this year, is slated for 1.8 million square feet of office, 1,500 residential units, 316,000 square feet of retail, and 250,000 square feet of hotel space. Multiple Loudoun County developments are continuing to progress with many coming online within the next few years (One Loudoun, Loudoun Station, The Preserve at Westfield’s, etc.).

The line’s full impacts will not be realized until after the completion of Phase Two and the buildout of development surrounding the Dulles Metrorail Corridor. The Silver Line is also an enticement for Amazon, whose potential arrival would likely further bolster the areas around transit. With dedicated Metro funding, expanded regional connectivity, and an influx of investment, it is hard to see a future where the local housing market does not gain strength. Still, it will take years for new developments designed around the line to be completed and to change established commuter habits. Will the new rail bring long-term, dense, transit-oriented settlement, or will it enable further sprawl to the outer edges of Loudoun County and beyond? With these considerations, it is still premature to judge the Silver Line’s long-term impacts.