Elevated 32 feet in the air, The Plaza is a new urban-style open space on the north side of the Tysons Corner Center mall that connects via a pedestrian bridge to the Tysons Corner Silver Line Metro Station.

The long-awaited first phase of Metro’s Silver Line opened for service this past summer. The new line is envisioned as a means of improving the commercial appeal of the Tysons to Dulles Corridor, and the real estate community is hopeful that it will have positive effects on the surrounding area’s housing market. But how has the market actually been responding to the arrival of this prominent transportation link?

This article examines January-to-August housing market trends from 2012 through 2014 in the Silver Line corridor. The Silver Line corridor includes six ZIP code areas: 20190 (Reston North), 20191 (Reston South), 22043 (Pimmit Hills), 22101 (McLean), 22102 (Tysons North/Great Falls), and 22182 (Tysons West/Wolf Trap).

The Silver Line Housing Market

Between January 2012 and August 2014 there were 5,666 residential sales in the Silver Line corridor, representing 11.5 percent of all sales in the Northern Virginia market, which includes Arlington and Fairfax counties and the cities of Alexandria, Fairfax, and Falls Church. The corridor’s share of the regional market held steady during this time: it was 11.8 percent in 2012, and 11.2 percent in both 2013 and 2014.

About 50 percent of all sales in the corridor were of single-family units, compared with 48 percent of all Northern Virginia sales. Townhouses and condos each represented 25 percent of sales in the corridor during this period.

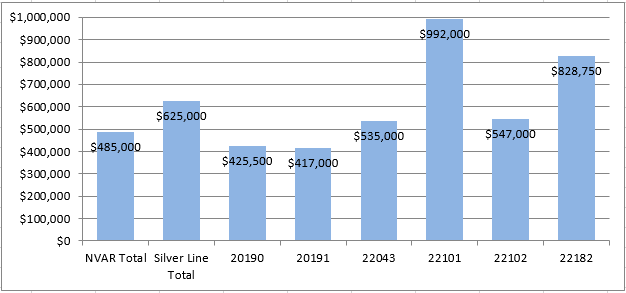

Even before the opening of the new Metro line, the Silver Line market was a higher-end housing market than the rest of the region. From January to August 2014, the overall median sale price of all units in the Silver Line corridor was $625,000, which was 29 percent greater than the Northern Virginia median price of $485,000. However, there is great price variation within the corridor: the median price in 2014, through August, in ZIP code 22101 was $992,000, which is more than double the median price in the two Reston ZIP codes, $425,500 in 20190 and $417,000 in 20191.

Median Home Sale Prices, January-August 2014

Source: Metropolitan Regional Information Systems, Inc.; GMU Center for Regional Analysis

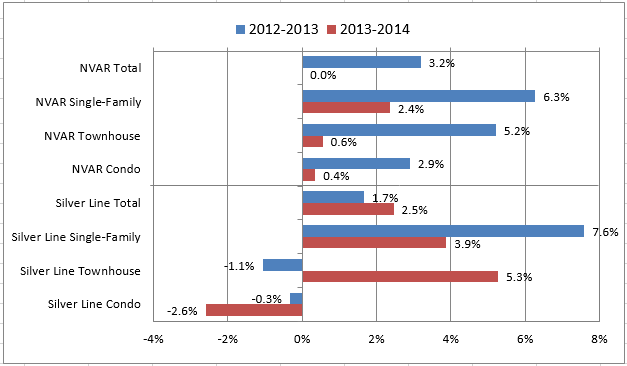

Regarding price changes, the Silver Line’s performance relative to the region has been uneven. The January-to-August median sale price in the Silver Line corridor increased by only 1.7 percent from 2012 to 2013, compared with a 3.2 percent increase for all of Northern Virginia. The corridor’s January-to-August performance improved from 2013 to 2014, though, with its median price increasing by 2.5 percent while the region’s median price was unchanged.

Median Sale Price Changes: January-August 2012-2013 and 2013-2014

Source: Metropolitan Regional Information Systems, Inc.; GMU Center for Regional Analysis

The single-family market in the Silver Line corridor has significantly outperformed both other property types within both the corridor and the regional single-family market. From 2012 to 2014, the January-to-August median single-family price in the corridor increased from $790,000 to $883,000, a gain of 11.8 percent. During the same period the regional median increased by 8.8 percent, from $597,500 to $650,000.

The corridor’s townhouse market has performed unevenly over the past three years. The January-to-August median price declined by 1.1 percent between 2012 ($459,900) and 2013 ($455,000), but rebounded with a 5.3 percent increase from January to August 2014 ($479,000). The condo market in the corridor has been weak, as its January-to-August median decreased from $309,000 in 2012 to $300,000 in 2014, a 2.9 percent decline.

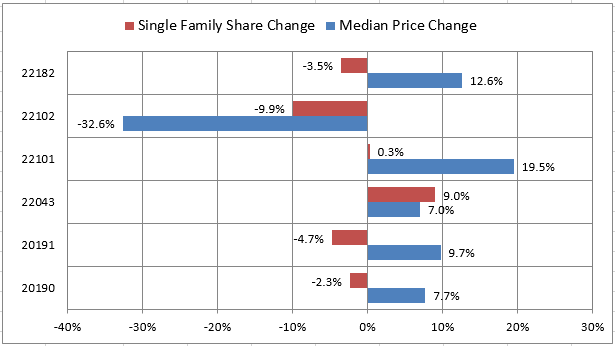

Another dynamic to the Silver Line market performance is the balance of unit types sold. There is great variation in the existing housing stock within the corridor. In the 22101 and 22182 ZIP codes, about 80 percent of recent sales have been of single-family homes. By contrast, single-family units represent less than 10 percent of sales in the 20190 ZIP code.

Changes to the balance of unit types sold have affected the Silver Line housing market as well. This was particularly evident in ZIP code 22102, which includes parts of Tysons Corner and the Great Falls area. From January to August 2012, 49 percent of sales in this ZIP code area were of single-family homes and the median price was $812,000. From January to August 2014, just 39 percent of its sales were of single-family homes, and its median price had declined to $547,000. For the other two ZIP codes in the corridor’s eastern half, 22043 and 22101, the single-family share increased, as did median prices. The three ZIP codes in the western half of the corridor each experienced declines in their single-family shares combined with median price increases.

Change in Median Sales Price and in Single-Family Share of Total Sales January-August 2012 to January-August 2014

Source: Metropolitan Regional Information Systems, Inc.; GMU Center for Regional Analysis.

Conclusions and Future Outlook

The opening of the Silver Line has dramatically changed the transportation network in the Dulles corridor, but its impacts on the housing market are less clear. The Silver Line’s housing market has not dramatically outperformed the overall Northern Virginia market during the past three years. Strong performance in the Silver Line’s single-family market has been blunted to some degree by an uneven townhouse market and a weak condominium market. There have also been many new rental properties developed in the corridor in recent years, which has created additional options for prospective residents.

Within the corridor there are clear variations in the residential market’s performance between the Tysons and Reston areas, which is logical given the different nature of the new Metro stations. The four Tysons stations are designed as catalysts for turning that area into an urban center. As such, these stations have no permanent parking and are intended to serve the occupants of future office and residential buildings, most of which have yet to be built. By contrast, the Wiehle-Reston East station has a large parking garage and serves as a hub for bus service around the Reston area. Given these differences, it makes sense that the Reston resale housing market would react more positively to the Silver Line than would the current Tysons market.

Looking ahead, now that the Silver Line’s first phase is open, the local housing market is likely to gain strength. Still, it will take years for new developments designed around the line to be completed and to change the established commuter habits. Furthermore, the line’s full impacts will not be realized until after the completion of Phase Two, which will add three more stations in the Reston/Herndon area and links to Dulles Airport and Loudoun County. With these considerations, it is premature to judge the Silver Line’s long-term impacts on the housing market.

That said, the prognosis is favorable. After all, consider the favorable real estate impact that the Orange Line has had since its opening in 1988. Perhaps the Silver Line’s influence is on the same track.

David Versel is a Senior Research Associate with the George Mason University Center for Regional Analysis.