Workers Staying For Nine Years May Gain Homeownership Dividends

When employment growth is strong, the housing market does well, right? So when there is fast job growth in the Washington, D.C. and Northern Virginia regions, strong sales activity, more multiple contracts, and escalating prices should follow. And when job growth slows, expect rising inventories, longer days on market and slower price growth.

Perhaps not surprisingly, the relationship between job growth in the region and the housing market is a little more complicated than that.

According to the S&P/Case-Shiller Index, between 2014 and 2015 the median home value in the Washington, D.C. metro area increased at the slowest pace since 2011, when home prices actually dropped. In fact, the Washington area had the slowest home price appreciation of any of the 15 largest metropolitan areas in the United States in 2015.

The region also experienced relatively weak job growth in 2015, with the number of jobs increasing by just 1.6 percent over 2014, according to data from the U.S. Bureau of Labor Statistics. It seems obvious that the strength of the housing market—as measured by home sales and home price appreciation—is tied to a region’s job growth. That link makes sense.

As a metro area adds jobs, it attracts workers and their families who need a place to live. The extra demand for housing accelerates the pace of sales activity and puts upward pressure on prices. The reverse happens when job growth slows down.

It turns out it’s not always that simple.

For example, according to the S&P/Case-Shiller data, in 2010-2011, the Washington, D.C. region had the second fastest home value appreciation among the nation’s 15 largest metropolitan areas. The largest metropolitan areas are defined by the number of jobs in each region. The Case-Shiller only has data for 13 out of 15 of those metropolitan areas—Philadelphia and Houston are therefore excluded from the analysis of home price data.

The Washington, D.C. region ranked #1 in job growth the year before. It makes sense that there would be a lag between new jobs being added and new households searching for and buying homes. The Washington, D.C. region also had the second fastest home price appreciation in 2003-2004, but in 2002-2003, the region ranked only ninth in terms of job growth.

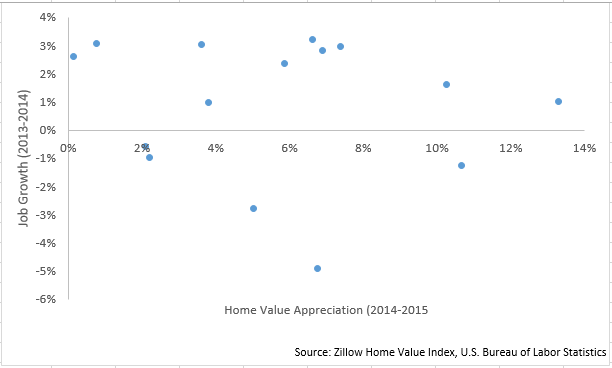

In the most recent year, 2014-2015, the San Francisco-Oakland metropolitan area experienced the fastest growth in home values but its pace of job growth put the region in the middle of the pack. Figure 1 shows the relationship between home value appreciation in 2014-2015 and job growth in 2013-2014 for the nation’s largest metropolitan areas.

If home prices usually went up when job growth was higher, one would expect dots to be clustered in the top right portion of the chart. Conversely, lower job growth associated with slow home price appreciation would cluster dots in the bottom left hand corner of the chart. But there is no discernible pattern for the 13 metropolitan areas shown in the figure. Over the last 15 years, in fact, there is practically no statistical correlation between job growth and home value appreciation for the nation’s largest metro areas.

So if it’s not jobs, what factors are important for understanding where the Washington, D.C. region’s housing market is headed?

“Over the last 15 years, in fact, there is practically no statistical correlation between job growth and home value appreciation for [the nation’s largest] metro areas."

1. The characteristics of new residents is important. A region that grows by attracting young workers, right out of high school or college, will have a different housing market dynamic than a region that attracts older workers or grows its population from within. The Washington, D.C. metropolitan area has always been a strong magnet for young people.

Since the recession ended in 2009, thousands of young people have moved to the region, fueling population growth in the District of Columbia, as well as Arlington, Alexandria and other inside-the-beltway areas in Northern Virginia. But because these newcomers tend to be young, they are more likely to be renters, so they won’t have a dramatic impact on the for-sale market—at least in the short-run. If they decide to stay in the region—and can afford to do so—they could have a major impact on the Northern Virginia housing market.

2. Affordability matters in both faster and slower-growing regions. Even if a region is adding a lot of new jobs, many of those new workers might choose—or be forced—to remain renters if home prices are too high or, more precisely, if the cost of owning a home exceeds the cost of renting. According to a rent-versus-buy calculator developed by realtor.com -realtor.com/mortgage/tools/rent-or-buy-calculator-, in many places in Northern Virginia, it is most cost effective to rent, particularly for people who are planning to stay in their home for less than 9 or 10 years.

For example, in the Fairfax County Zip code 22030, assuming the median home price and rent, home buying becomes cheaper only after nine years at the residence. So even when the region is adding jobs, examining the relative cost of renting versus buying is important for understanding the impact on the for-sale market.

3. Maybe it is jobs—but not just any jobs. It is important not just to look at the data on job growth, but also to look at the types of jobs—and the wages of those jobs—that are coming to the Washington, D.C. and Northern Virginia region. Historically, the metro area has attracted thousands of workers in the Professional and Business Services sector, jobs that tend to have relatively high wages and workers who are likely to be homeowners.

Over the last few years, the region has also been adding jobs rapidly in typically lower-paying professions, including thousands of jobs in the Leisure and Hospitality, Construction and Retail sectors. But according to recent data from the George Mason University Center for Regional Analysis, nearly 40 percent of the Washington, D.C. area’s job growth over the past year was in the Professional ad Business Services Sector. A greater share of jobs in higher-wage sectors could mean stronger housing market activity, even if overall job growth is slower.

So what should real estate professionals do if they are trying to monitor regional economic conditions in order to stay on top of where the housing market might be headed? Knowing whether jobs are coming to the region—and if a major employer is moving or expanding to a particular area—is important.

Keep an eye on GMU CRA data and other sources for the characteristics of new workers—especially the ages and levels of education—as well as the industries that are fueling job growth. These are the

Lisa Sturtevant is the president of Lisa Sturtevant & Associates.