There’s a New Disclosure in Town: Are You Prepared?

For loans originated on or after August 1, 2015, creditors must provide consumers with a closing disclosure three days prior to consummation. Do you know what that means, and are you prepared? Realtors® who hear lenders talking about a “TRID” can rest assured that those lenders are familiar with the new rules, and should be ready to issue a “TILA-RESPA Integrated Mortgage Disclosure” for their upcoming transactions.

In response to the 2008 financial crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) was enacted in 2010. Dodd-Frank created the Consumer Financial Protection Bureau (CFPB), whose mission “is to make markets for consumer financial products and services work for Americans.” The CFPB issued its TILA-RESPA Rule in November 2013, which becomes effective on August 1. The Integrated Mortgage Disclosures under the Real Estate Settlement Procedures Act (Regulation X) and the Truth in Lending Act (Regulation Z) become a reality this summer.

Lenders, settlement agents, and their software providers have been working on new forms to comply with these regulations. Lenders will provide the “Loan Estimate,” which combines the Good Faith Estimate (GFE) and the initial Truth in Lending (TIL) disclosure. The three-page HUD-1 Settlement Statement that has been used since January 1, 2010 will be replaced with a five-page “Closing Disclosure” (CD). This document is a combination of the HUD-1, including GFE comparisons and the final TIL. It will include the agent’s name, license number, email address, and phone number, as well as the name and address for both the listing and selling brokers.

"For loans originated on or after August 1, 2015, creditors must provide consumers with a closing disclosure three days prior to consummation."

Lenders are responsible for the accuracy of the CD. Many have announced their intent to prepare it, and not have it done by the settlement agent. Fines for failing to follow the regulations range from $5,000 per day up to $1,000,000 per day for intentional violations. Settlement agents will still be responsible for having all documents executed, and for preparation of the two-page Seller Closing Disclosure.

THE THREE-DAY RULE

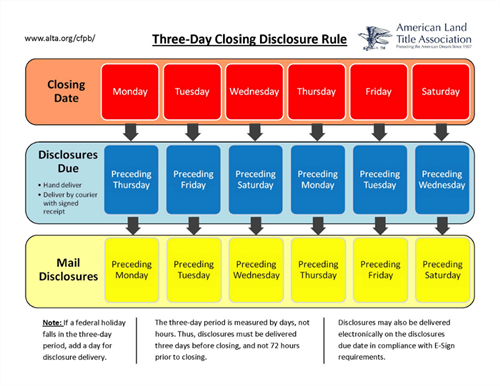

A three-day advance disclosure requirement will apply to both the Loan Estimate and the CD. Consumers must receive the CD three business days before closing, and Saturday may be counted as a business day, even if the lender is not open on Saturdays. There are no prior-to-closing delivery requirements for Sellers.

There are only three changes that will trigger a new three-business day-disclosure:

1. The APR becomes inaccurate,

2. The loan product changes, or

3. A prepayment penalty is added.

However, in order to avoid the possibility of incurring hefty fines, some lenders have indicated that they may overlay stricter requirements.

The three-day waiting period cannot be waived by the consumer except for a “bona fide personal financial emergency.” A natural disaster or imminent foreclosure sale are two examples.

EXEMPT TRANSACTIONS

Some transactions will not be subject to the TILA-RESPA Rule. While it applies to “most closed-end consumer mortgages,” it will not apply to HELOCs, reverse mortgages, loans on mobile homes or on a dwelling that is not attached to real property. However, certain loans that are currently subject to TILA but not to RESPA will be subject to the new TILA-RESPA disclosure requirements. Construction-only loans, loans secured by vacant land or by 25 or more acres could be subject to the new regulations.

While the new regulations will challenge industry professionals, top-notch lenders and settlement agents will be prepared to make the closing process as smooth as possible for agents and their clients.

HOW DOES THIS AFFECT YOUR PRACTICE?

1. Expect 45 to 60 days from contract ratification to settlement

2. No more last minute changes to the settlement statement/closing disclosure, so:

a. Get inspections completed early

b. Get repairs completed early

c. Do the initial walkthrough seven days before closing

3. Prepare sellers and purchasers for the likelihood of lender settlement delays:

a. Understand the post-settlement and pre-settlement occupancy agreements; you may need them

b. Back-to-back and coinciding settlements may be problematic

NEW TERMINOLOGY TO LEARN

OLD NEW

Lender Creditor

Buyer/Borrower Consumer

Settlement/Closing Consummation

Sample Documents:

http://www.consumerfinance.gov/f/201403_cfpb_loan-estimate_fixed-rate-loan-sample-H24B.pdf

http://www.consumerfinance.gov/f/201403_cfpb_closing-disclosure_cover-H25B.pdf

http://www.consumerfinance.gov/f/201403_cfpb_closing-disclosure_cover-H25HI.pdf

Lisa Lettau is the Alexandria branch manager for The Settlement Group.