Focus on High-End Creates Void for Majority of Buyers: Pressure Mounts on Resale Market

In spite of lagging economic growth over the past two years, the for-sale housing market in Northern Virginia has remained strong. The slow pace of new home construction in the region has played an important role, as it has limited the available inventory. What does the new home market look like and what do its characteristics say about the overall market?

HOW MUCH (OR LITTLE) NEW CONSTRUCTION HAS THERE BEEN?

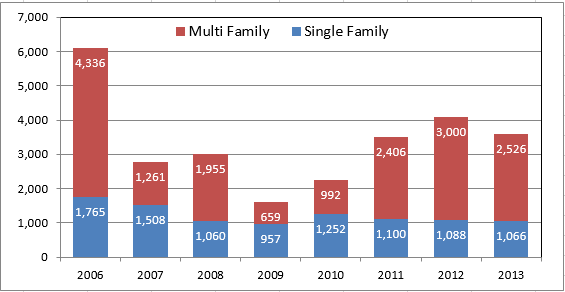

During the peak of last decade’s housing boom in 2006, there were more than 6,000 permits issued for new homes in the NVAR region, which includes Alexandria, Arlington, Fairfax County, Fairfax City and Falls Church. Of those permits, 70 percent were multifamily and 30 percent were single family.

The subsequent crash demonstrated that this construction pace was unsustainable: by 2009, there were only 1,616 permits issued in the region. New multi-family construction has returned since 2009, as the number of multi-family permits increased from 659 in 2009 to 3,000 in 2012. There was a slight decline in 2013.

Single-family permitting activity has not recovered. After increasing from its low point of 957 permits in 2009 to 1,252 in 2010, the number of single-family permits in the region has declined slightly each year since 2010. During 2013 there were just 1,066 single-family permits issued in the region; this figure is 40 percent below the 2006 peak level.

HOW HAVE NEW HOMES PERFORMED IN THE MARKET?

According to data from Metropolitan Regional Information Systems, Inc. (MRIS), there were 714 new homes sold in the NVAR region between January 1, 2013 and March 31, 2014. This includes homes built in 2012 or later, but only those that were sold via the MLS, so many new homes are likely excluded. Still, this represents the best source of data on new home sales and provides some interesting perspective.

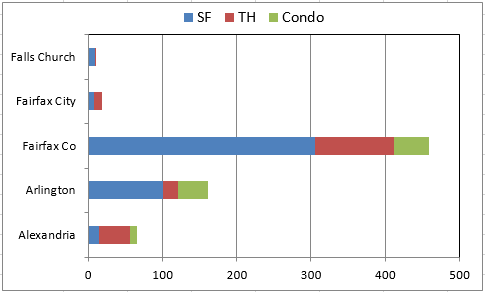

Among the 714 home sales reported, 61 percent were single-family homes, 25 percent were townhomes and 14 percent were condominium units. Most of the single-family activity was in Fairfax County (305 sales), though there were 101 sales of new single-family homes in Arlington. Most of the townhouse activity was also in Fairfax County, but Alexandria posted a significant number of townhouse sales.

Among the 714 home sales reported, 61 percent were single-family homes, 25 percent were townhomes and 14 percent were condominium units. Most of the single-family activity was in Fairfax County (305 sales), though there were 101 sales of new single-family homes in Arlington. Most of the townhouse activity was also in Fairfax County, but Alexandria posted a significant number of townhouse sales.

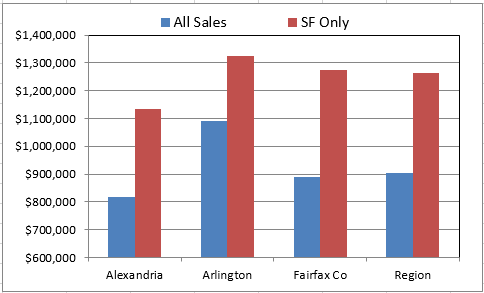

Sale prices for newly built homes in the region were extremely high. The median price for all new homes sold from January 2013 through March 2014 was $905,000, and the median price for all newly built single-family homes was $1,265,000. The median sale price for a new townhouse in the region was $700,000 and the median new condo price was $405,000.

Among the 437 new single-family homes sold, just nine sold for less than $500,000, while 301 sold for prices in excess of $1 million. Among the three major jurisdictions, Arlington had the highest median prices, with a median for all of its new home sales of $1.09 million, compared with $890,000 in Fairfax and $817,000 in Alexandria. The median sale price for new single-family homes was in excess of $1.1 million in all three jurisdictions.

A major reason for these high prices is that most of the new homes built were quite large. The median size of the new homes sold was 3,700 square feet, and the median size of the single-family units was 4,976 SF. Nearly all (95 percent) of the new single-family homes sold were at least 3,000 SF in size and 81 percent were at least 4,000 SF. While the new townhouse (median 2,282 SF) and condo (median 1,155 SF) units that sold were considerably smaller, they sold at higher prices on a per-square foot basis. The median new single-family unit sold for $262/SF, compared with $289/SF for townhouses and $367/SF for condo units.

A major reason for these high prices is that most of the new homes built were quite large. The median size of the new homes sold was 3,700 square feet, and the median size of the single-family units was 4,976 SF. Nearly all (95 percent) of the new single-family homes sold were at least 3,000 SF in size and 81 percent were at least 4,000 SF. While the new townhouse (median 2,282 SF) and condo (median 1,155 SF) units that sold were considerably smaller, they sold at higher prices on a per-square foot basis. The median new single-family unit sold for $262/SF, compared with $289/SF for townhouses and $367/SF for condo units.

Many new homes have been slow to sell, as the average Days on Market for this sample of sales was 140 days. Among the major jurisdictions, Arlington had the fastest sales pace, with an average DOM of 109 days, while Alexandria and Fairfax both averaged about 150 days.

HOW DOES THIS RELATE TO THE OVERALL MARKET?

The market for newly built homes is a small component of the overall housing market in Northern Virginia: it accounted for just 3 percent of all MRIS-reported sales during the period of analysis. Though it is small, the new home market is quite distinct from the resale market.

“The market for newly built homes is a small component of the overall housing market in Northern Virginia: it accounted for just 3 percent of all MRIS-reported sales during the period of analysis. Though it is small, the new home market is quite distinct from the resale market."

While the median price for new homes in the region topped $900,000, the median price for all homes was less than $500,000. Another difference is that new homes take far longer to sell than do existing homes: the average DOM for new homes was 140 days compared with 37 days for all homes. Given the high price point of most of the new product, the high DOM figures for new homes are not surprising.

The implications of these statistics are clear: almost all of the new for-sale housing being built in Northern Virginia is at the top end of the market, leaving virtually no new product of any type that is attainable for most of the marketplace. Even among condo units, the median price of new units is in excess of $400,000, and few new condo units are even available.

Thus, the vast majority of buyers are limited to competing for resale units and, as local Realtors® are well aware, the resale inventory has been at historically low levels over the past few years.

WHAT DOES THE FUTURE HOLD?

Northern Virginia is facing a potential crisis in terms of the limited availability of housing. Our research at the Center for Regional Analysis projects that job growth is poised to return to the region in the next year or two, which will drive additional demand for housing.

Looking further ahead, we project that, in order to provide enough housing for the region’s workforce over the next 20 years, the NVAR region will need to add an average of 5,800 housing units per year. At present, we are only adding about 3,500 units per year. More critically, most of the new housing is only affordable to buyers at the top of the market, forcing many families to rent or to move to outlying areas.

“If new units are built to serve more markets, the pace and volume of sales will increase substantially.”

As a region it is imperative that we diversify our housing stock so that there are more opportunities for all types of households. This must include for-sale product that appeals to empty nesters, as much of the region’s existing inventory is controlled by homeowners over the age of 50 who may no longer need their single-family homes.

It must also include flexible units that allow for multi-generational families to live on one property. Realtors® have a vested interest in this effort: if new units are built to serve more markets, the pace and volume of sales will increase substantially. Otherwise, the market for new homes will continue to be dominated by a small number of high-dollar sales.

David Versel is a Senior Research Associate at the George Mason University Center for Regional Analysis