Who They Are, Where They’re Moving and What They’re Buying

By Terry L. Clower and Keith Waters

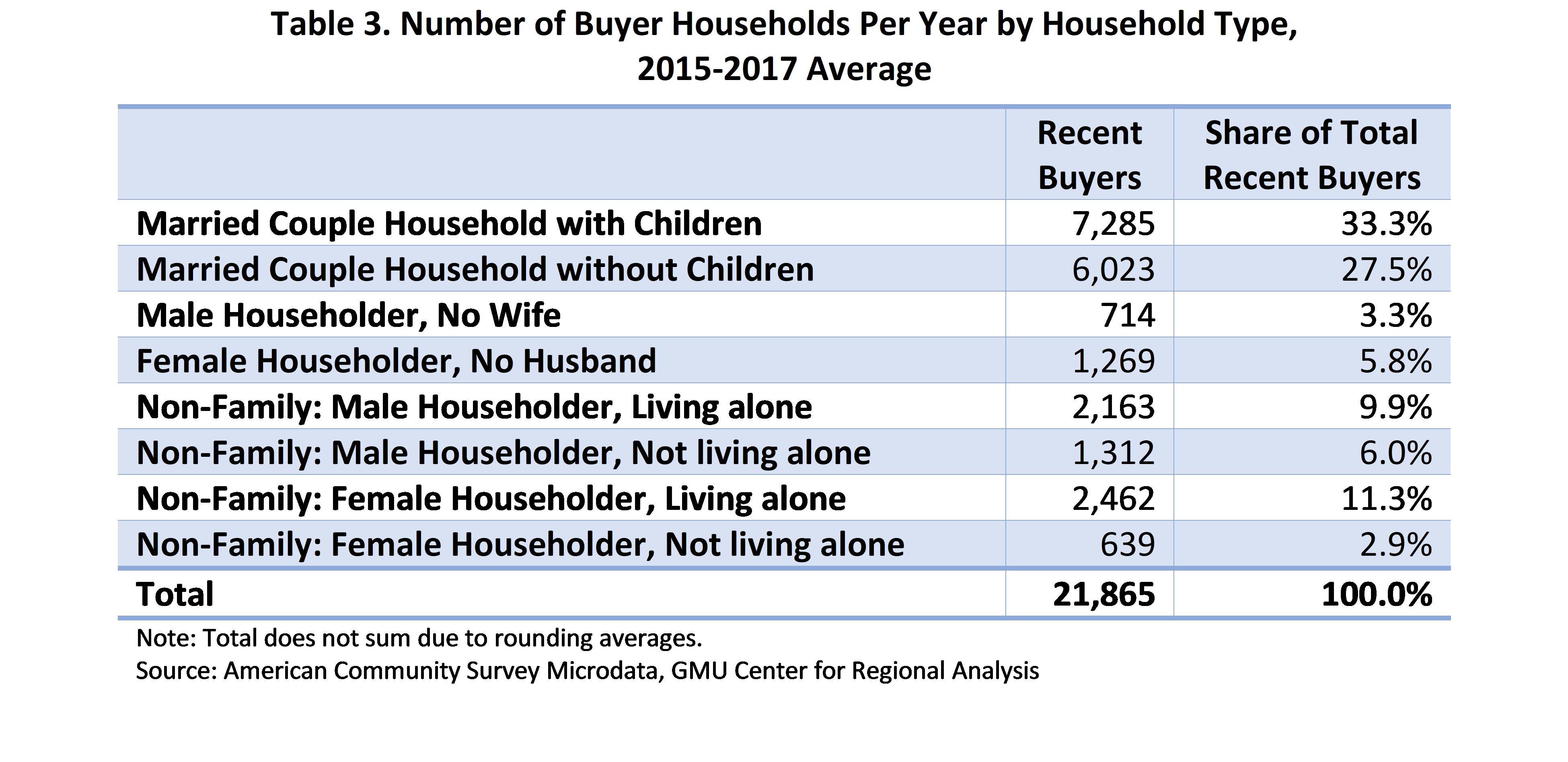

EACH YEAR BETWEEN 2015 TO 2017, almost 100,000 households moved in the NVAR region, which represents about one in six total households. Of the households that moved, an average of 21,865 bought a home. The housing choices made by these households significantly impacted the region’s housing market.

HOUSEHOLD MOBILITY

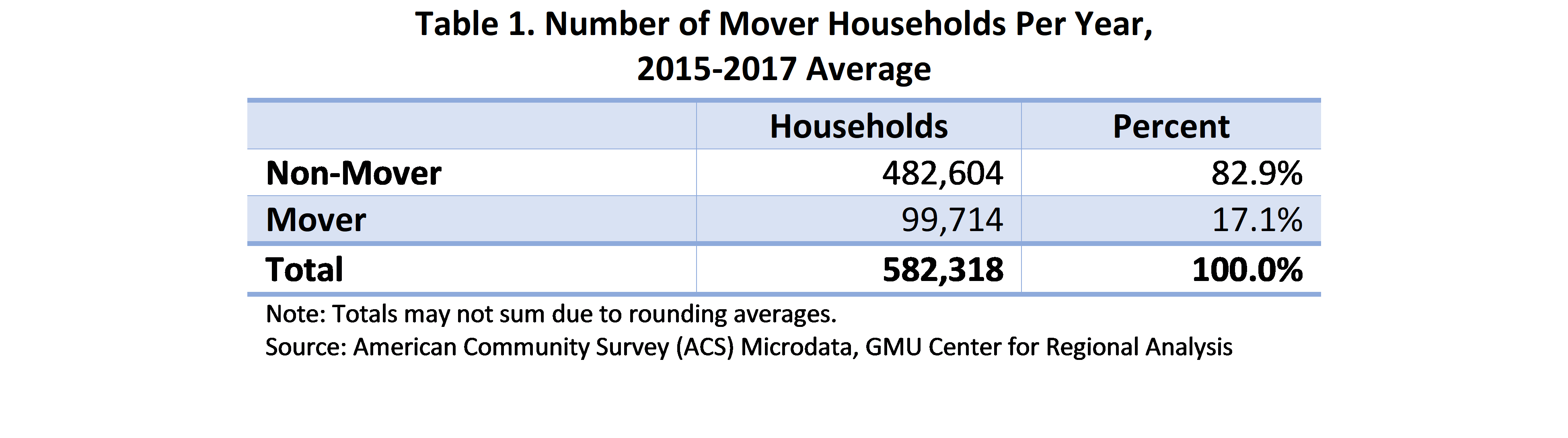

Between 2015 and 2017, an average of 99,714 households in the NVAR region moved into their location each year (Table 1). With an average of 582,318 households in the region each year during that period, the average mobility rate for the NVAR region was 17.1 percent.

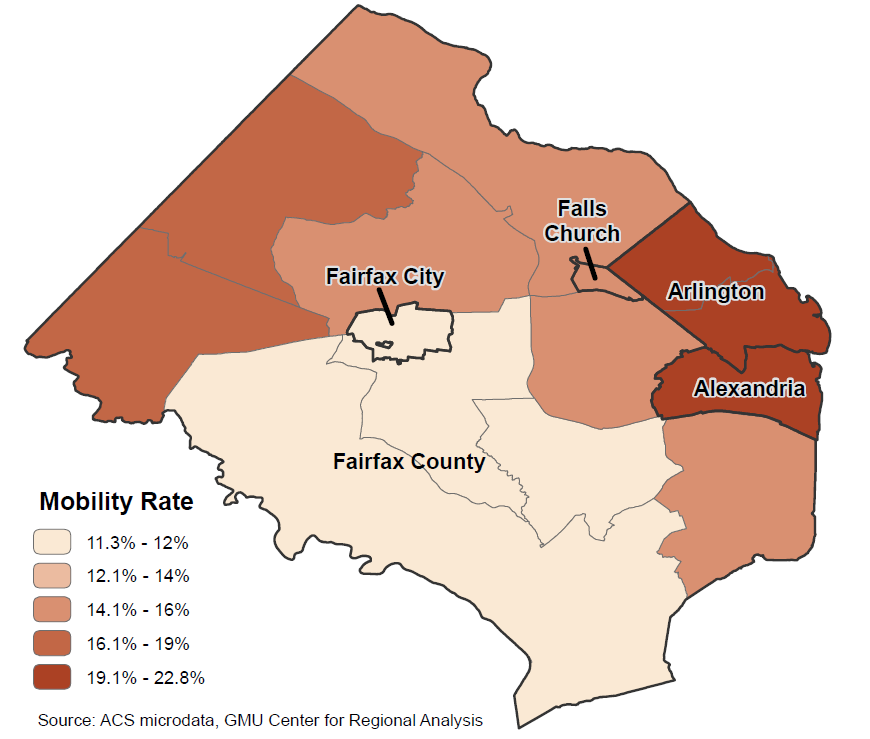

Mobility rates varied substantially across the NVAR region (Arlington County, Fairfax County, Alexandria City, Fairfax City and Falls Church City). Generally, communities closer to Washington, D.C. had a higher mobility rate than those farther away (Figure 1). The communities with the highest mobility rates between 2015 and 2017 were in Arlington and Alexandria, at about 22 percent. The areas with the lowest mobility rates were in the southern portion of Fairfax County, ranging from about 11 to 12 percent. The rate of household movers was higher in western Fairfax County, exceeding 16 percent of total households in that area.

Figure 1. Mobility in the NVAR Region, 2015-2017 Average

RECENT BUYERS

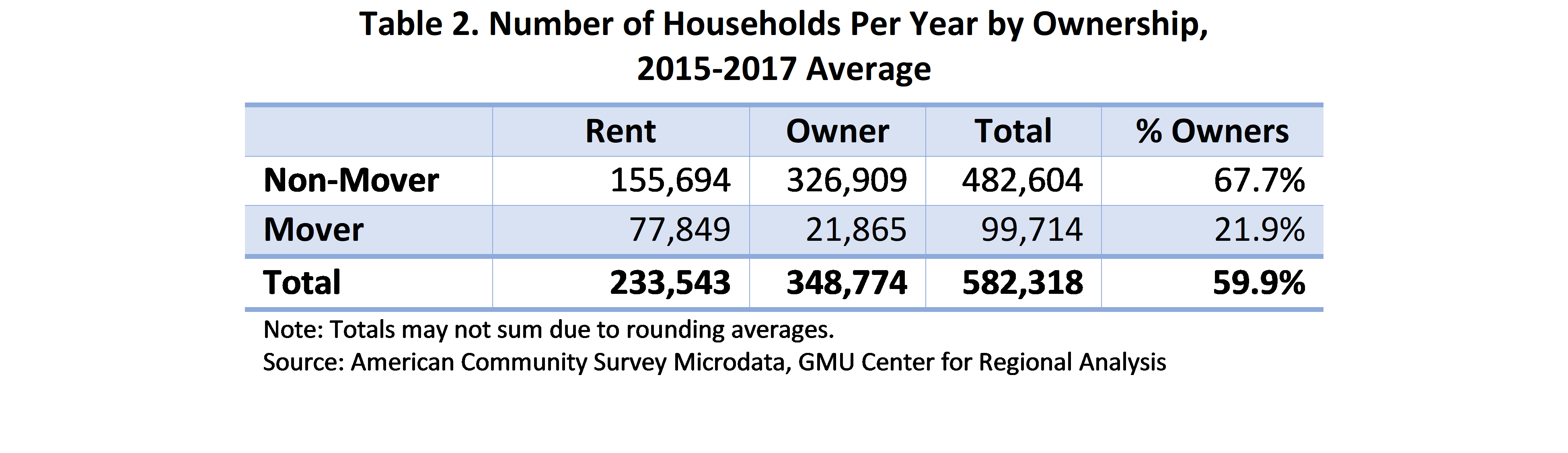

Renters are much more likely to move residence in any given year. Still, an average of almost 22,000 households each year are moving into a purchased home (Table 2). The analysis assumes that households that moved in the past year into residences they owned are mover households that bought their homes. While this definition of mover households includes households that moved into a second home they previously owned, such situations should not impact overall analysis.

Homeowners who are thinking about renting their current home when they buy a new home should take into consideration the rate at which renters move.

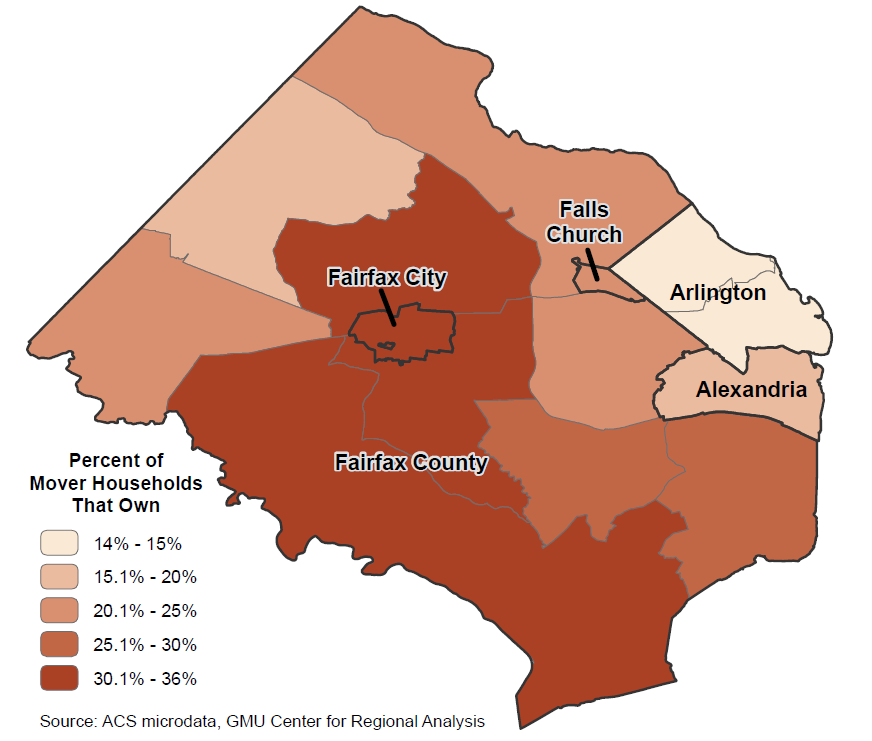

In general, the proportion of movers who are renters appears to be driven by proximity to D.C., which includes the more expensive areas, and the relative amount of rental and owner-occupied properties (Figure 2). Of mover households, the highest ownership rates were in the communities that extended from Vienna through Fairfax and down to Lorton, where more than 30 percent of mover households bought their homes. The western end of Fairfax County that surrounds Chantilly is an outlier, with households that moved to this sub-market being less likely than the region as a whole to have purchased their homes.

Figure 2. Percent of Mover Households That Own, 2015-2017 Average

RECENT BUYERS BY HOUSEHOLD TYPE

Mover households that bought their homes generally fell into one of three household types: married couples with children, married couples without children, and individuals living alone. These three household types accounted for 82 percent of all mover households that bought their homes.

Among household types, married couples with children accounted for the largest share of mover households that bought their homes. Each year from 2015 to 2017, an average of 7,285 married couple households with children bought a home; these households accounted for 33.3 percent of all mover households who bought their homes (Table 3). The second largest share of mover households who bought homes was married couples without children; these households accounted for 27.5 percent of all mover households who bought homes.

Households characterized by individuals living alone, both male and female, accounted for another 21.2 percent of mover households that bought homes. Female householders who bought were more likely to live alone than their male counterparts, which appears to be driven by the fact that male householders who recently moved into residences they owned were more likely to have non-related roommates.

MARRIED COUPLES WITH CHILDREN

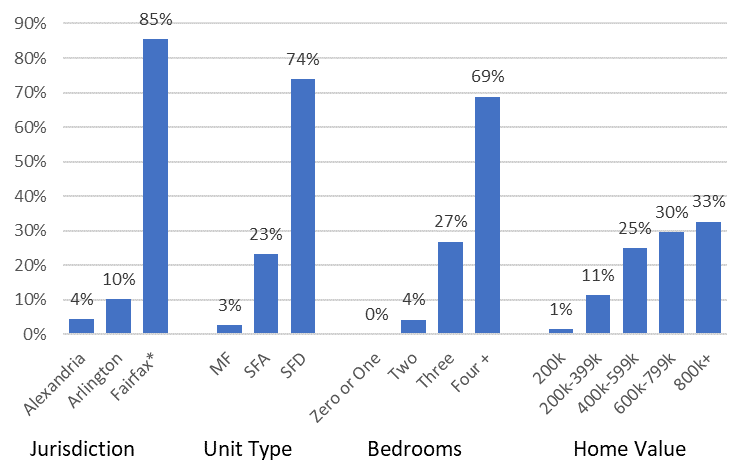

Households composed of married couples with children accounted for the largest share of mover households from 2015 to 2017 that bought their homes. These households bought overwhelmingly in Fairfax County, Fairfax City or Falls Church (85.3 percent), although this is expected given the geographic size of these markets (Figure 3). Married couples with children were far more likely to buy single-family detached homes (73.9 percent) than either single-family attached homes (23.3 percent) or multi-family homes (2.8 percent). Traditional home purchasing decisions still seem to apply to millennials with children.

Figure 3. Home Characteristics of Buyers: Married Couples with Children

NVAR Region, 2015-2017 Average

* Includes Fairfax County, Fairfax City, and Falls Church.

Note: Percentages may not sum to 100% due to rounding averages.

Source: American Community Survey Microdata, GMU Center for Regional Analysis

Married couples with children were also likely to buy bigger and more expensive homes. Almost all of these households (95.3 percent) bought a home with three or more bedrooms, with the majority of these homes having four or more bedrooms (68.8 percent). Nearly one-third (32.7 percent) of married couples with children that moved bought homes valued at $800,000 or more.

MARRIED COUPLES WITHOUT CHILDREN

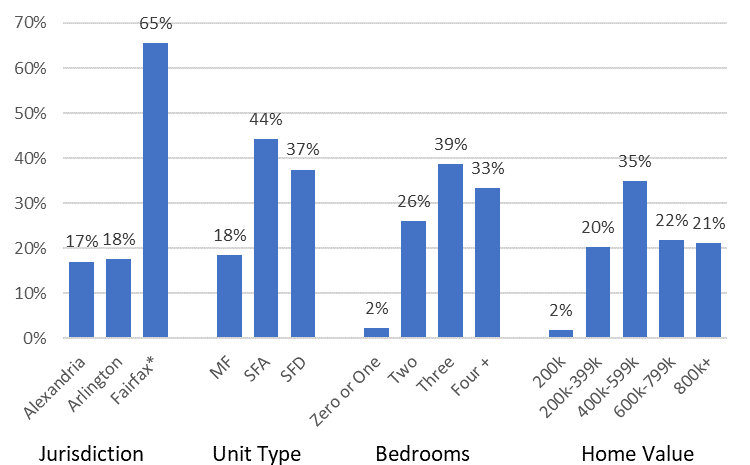

Between 2015 and 2017, households composed of married couples without children accounted for the second largest share of mover households that bought their home. Figure 4 shows that married couples without children bought primarily in Fairfax County, Fairfax City, and Falls Church (65.4 percent). However, married couples without children were far more likely to have bought in Alexandria or Arlington (34.6 percent) than married couples with children (14.7 percent). Married couples without children were more likely to buy a single-family attached home (44.2 percent) than a single-family detached home (37.4 percent) or a multi-family home (18.4 percent).

Married couples without children were also more likely to buy smaller, less expensive homes than married couples with children. The plurality of married couples without children who bought a home chose homes with three bedrooms. While a third of married couples without children bought homes with four or more bedrooms, 68.8 percent of married couples with children bought homes with four or more bedrooms. Married couples without children also bought less expensive homes; the largest share bought homes valued from $400,000 to $599,999.

Figure 4. Home Characteristics of Buyers: Married Couples without Children

NVAR Region, 2015-2017 Average

* Includes Fairfax County, Fairfax City, and Falls Church.

Note: Percentages may not sum to 100% due to rounding averages.

Source: American Community Survey Microdata, GMU Center for Regional Analysis

INDIVIDUALS LIVING ALONE

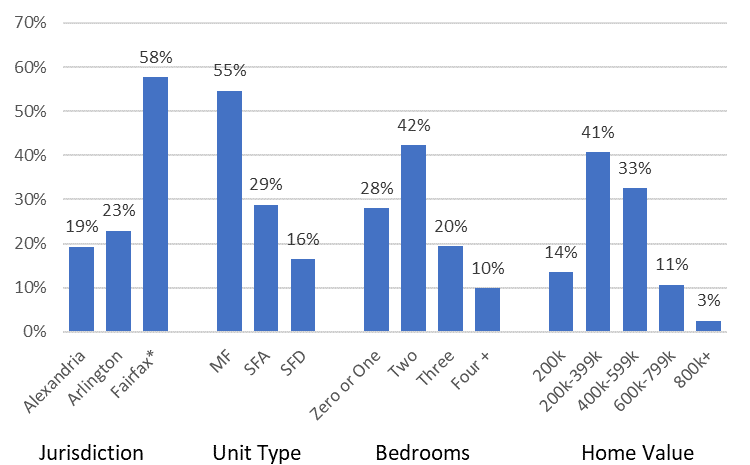

The third largest mover household type that bought a residence from 2015 to 2017 was individuals living alone. Like married couples with and without children, most of these households bought in Fairfax County, Fairfax City or Falls Church (Figure 5). However, these single-individual households were more likely than married-couple households to buy in Arlington (22.3 percent) or Alexandria (19.3 percent). The majority of individuals living alone bought a unit in a multi-family building (54.7 percent) and were unlikely to have bought a single-family detached home (16.5 percent).

As would be expected, individuals living alone bought smaller, less expensive homes. Nearly three-quarters (70.5 percent) bought homes with two bedrooms or fewer. The largest share of individuals living alone bought homes priced from $200,000 to $399,999.

Figure 5. Home Characteristics of Buyers: Individuals Living Alone

NVAR Region, 2015-2017 Average

* Includes Fairfax County, Fairfax City, and Falls Church.

Note: Percentages may not sum to 100% due to rounding averages.

Source: American Community Survey Microdata, GMU Center for Regional Analysis

OUTLOOK

While the housing preferences of the three largest household types were, perhaps, to be expected, the groups may begin to compete with one another for homes in coming years. As the population of the NVAR region continues to grow, land available for development will become increasingly scarce. The lack of developable land will perhaps become most acute for the building of single-family detached homes sought by married couples with children. Given this, it may be reasonable to expect the homes purchased by married couples with children and without children to have fewer bedrooms and be either attached or multi-family units, though perhaps not less expensive than single-family homes. This may also contribute to the continued out-migration of young family households to the outer reaches of the metro area.

Housing availability for growing households and new, incoming workers to the region will remain a key component of continued economic growth in Northern Virginia. Successful Realtors® should be tracking the trends and preferences of these potential buyers in the coming years.