Now that Congress has passed major tax reform and the details have emerged, great uncertainty remains about how the tax bill will impact the housing market. The bill will disproportionately affect expensive coastal and urban markets – including the D.C. region.

Three major provisions affect the housing market under the new tax plan, which was passed by Congress in December and signed by President Donald Trump just before Christmas: 1) the mortgage interest deduction (MID), 2) state and local property tax (SALT) deduction, and 3) the standard deduction.

The MID will now be capped at $750,000, down from the previous cap of $1 million. The new tax law also limits SALT deductions on a homeowner’s federal liability to $10,000. However, the new law nearly doubles the previous standard deduction to $12,000 for single filers and $24,000 for joint filers.

It is important to note that tax repercussions are just one of many elements influencing homeowners and the overall housing market. There are multiple factors involved when buying a home, and tax implications are only one part of this decision.

MORTGAGE INTEREST DEDUCTION

The tax reform law caps the limit on deductible mortgage debt at $750,000 for loans taken out after Dec. 14, 2017, which is down from the $1 million cap allowed in the previous tax law. Under the new plan, homeowners with existing mortgages above $750,000 can continue to deduct the interest, but new homeowners cannot. The impact this change has on the region can be estimated by analyzing active listings, recent home sales and home valuations.

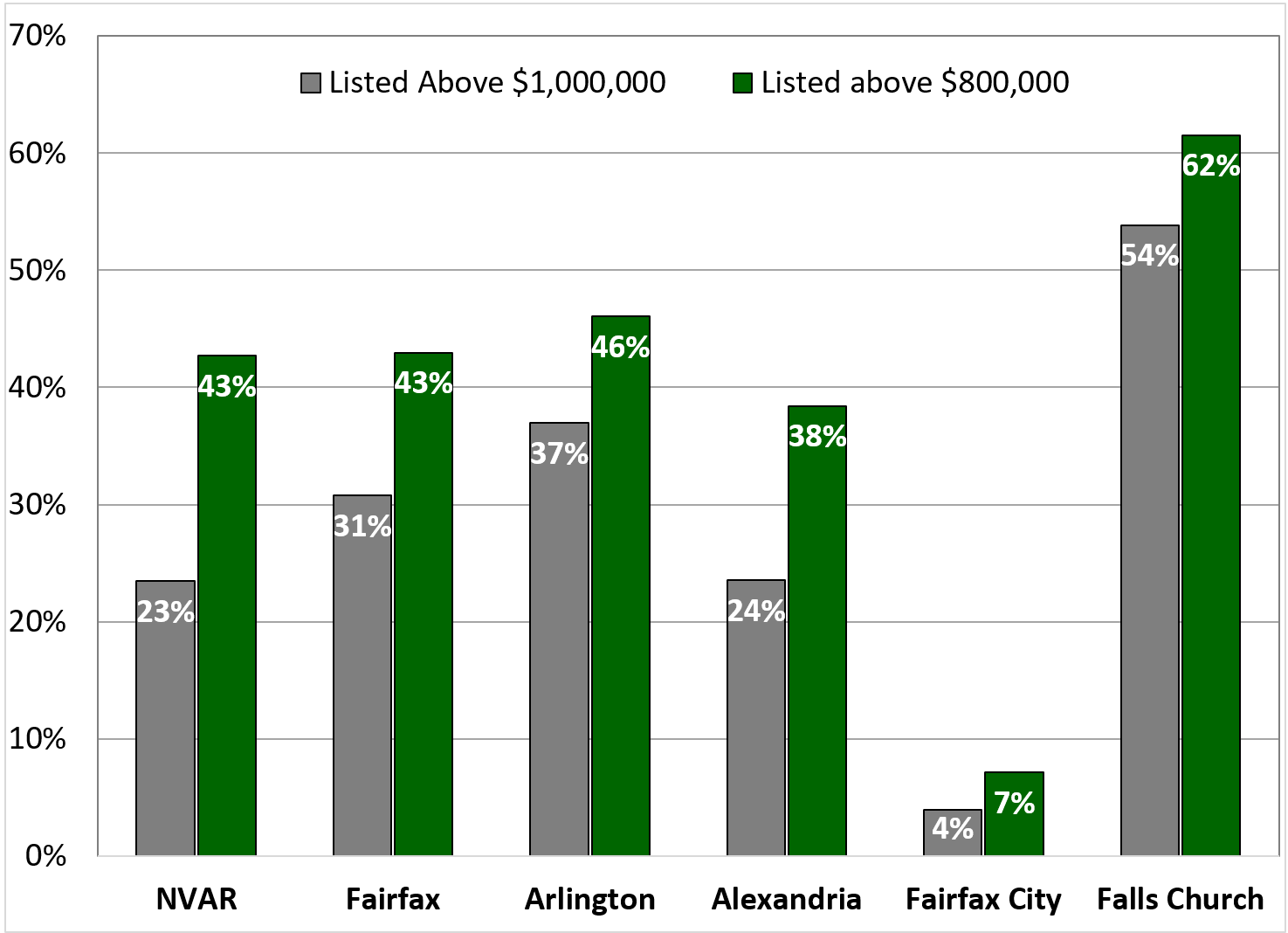

Figure 1: Percent of Active Listings by List Price as of January 2018

Source: Bright MLS. Statistics calculated 2/5/2018

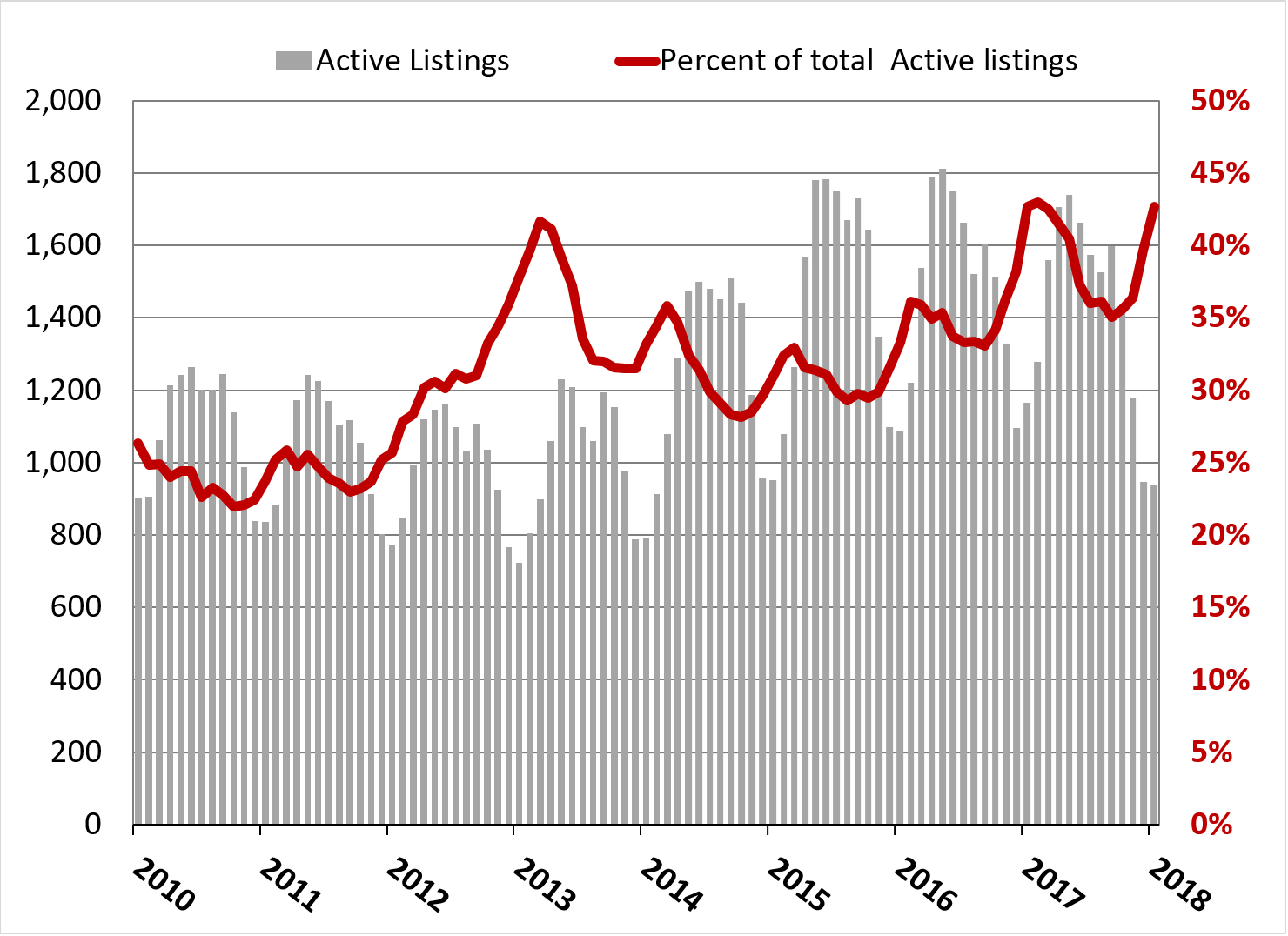

As of January 2018, there were 937 homes on the market in the NVAR region (consisting of Arlington, Alexandria, Fairfax, Fairfax City and Falls Church) listed for more than $800,000. These listings account for 43 percent of the region’s active listings (Figure 1). This is the total number of homes that would be affected under the new tax plan if they were to be purchased and mortgaged at the listing price. It is important to note that most homebuyers will not take out a mortgage for the entire listing price, therefore the numbers presented here are intended to provide relative scale. Under the previous cap of $1 million, 667 homes for sale would be affected. This means the lowering of the MID cap resulted in an additional 270 homes currently on the market whose owners would not be able to deduct the full mortgage interest on their new homes. This number will likely continue to rise with current median home sales reaching record highs. The proportion of homes listed for greater than $800,000 has increased by nearly 10 percentage points in the past three years and 15 percentage points in the past eight (Figure 2).

Figure 2: Active Listings With List Price Greater Than $800,000 Over Time

Source: Bright MLS. Statistics calculated 2/5/2018

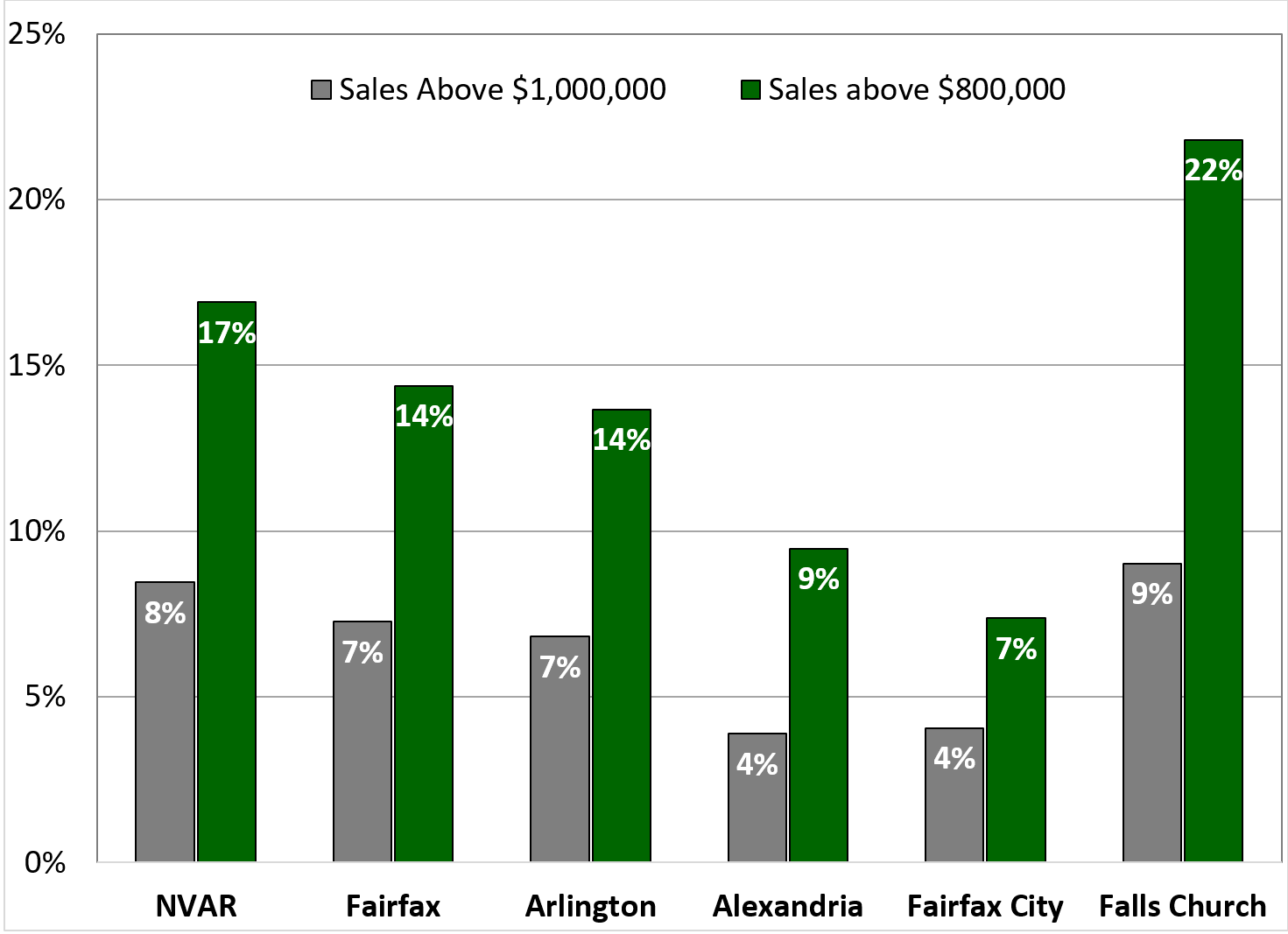

Looking back to 2017, 3,707 homes sold for $800,000 or greater. These homes represent 17 percent of all homes sold in the NVAR region (Figure 3). This is up from 8 percent of homes sold under the previous MID cap of $1 million, and as a result an additional 1,855 homes would have been affected if the new lower MID cap had been in place last year. If sales growth continues at its current pace, we expect there will be nearly 4,000 homes sold in 2018 that would have been eligible for the full mortgage interest deduction but no longer will be. Therefore, buyers will have less incentive to purchase those homes.

Figure 3: Percent of Home Sales by List Price in 2017

Source: Bright MLS. Statistics calculated 2/5/2018

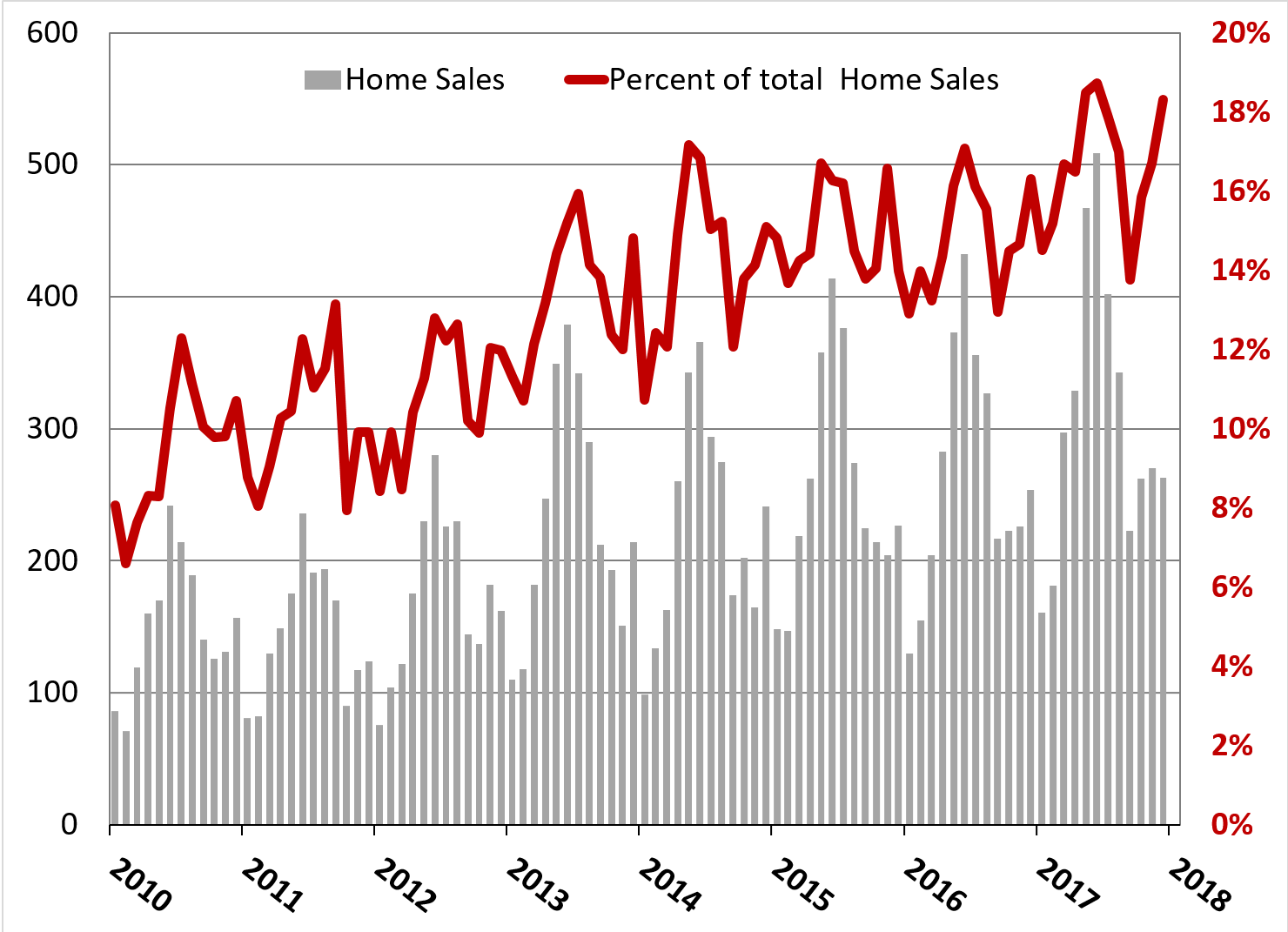

As home sales have crept up over the past eight years since the recession, the percent of those homes that were sold for more than $800,000 has increased dramatically (Figure 4). Much of this increase is due to the region’s overall increase in home prices, but growth of higher priced homes has far outpaced the number of lower priced homes. Between 2010 and 2017, the average annual growth rate of homes sold for more than $1 million was 10 percent compared to just over 5 percent for those between $500,000 and $1 million. Prices declined 1.7 percent for those less than $500,000.

Figure 4: Home Sales With Sale Price Greater Than $800,000 Over Time

Source: Bright MLS. Statistics calculated 2/5/2018

Current home valuation data can give another view at the scale of impact that the MID may have in the coming years by providing a representation of the current housing stock. Value here is measured by the U.S. Census American Community Survey Program and is an average over five years from 2011 to 2016. Value is the homeowner’s estimate of how much the property would sell for on the current market.

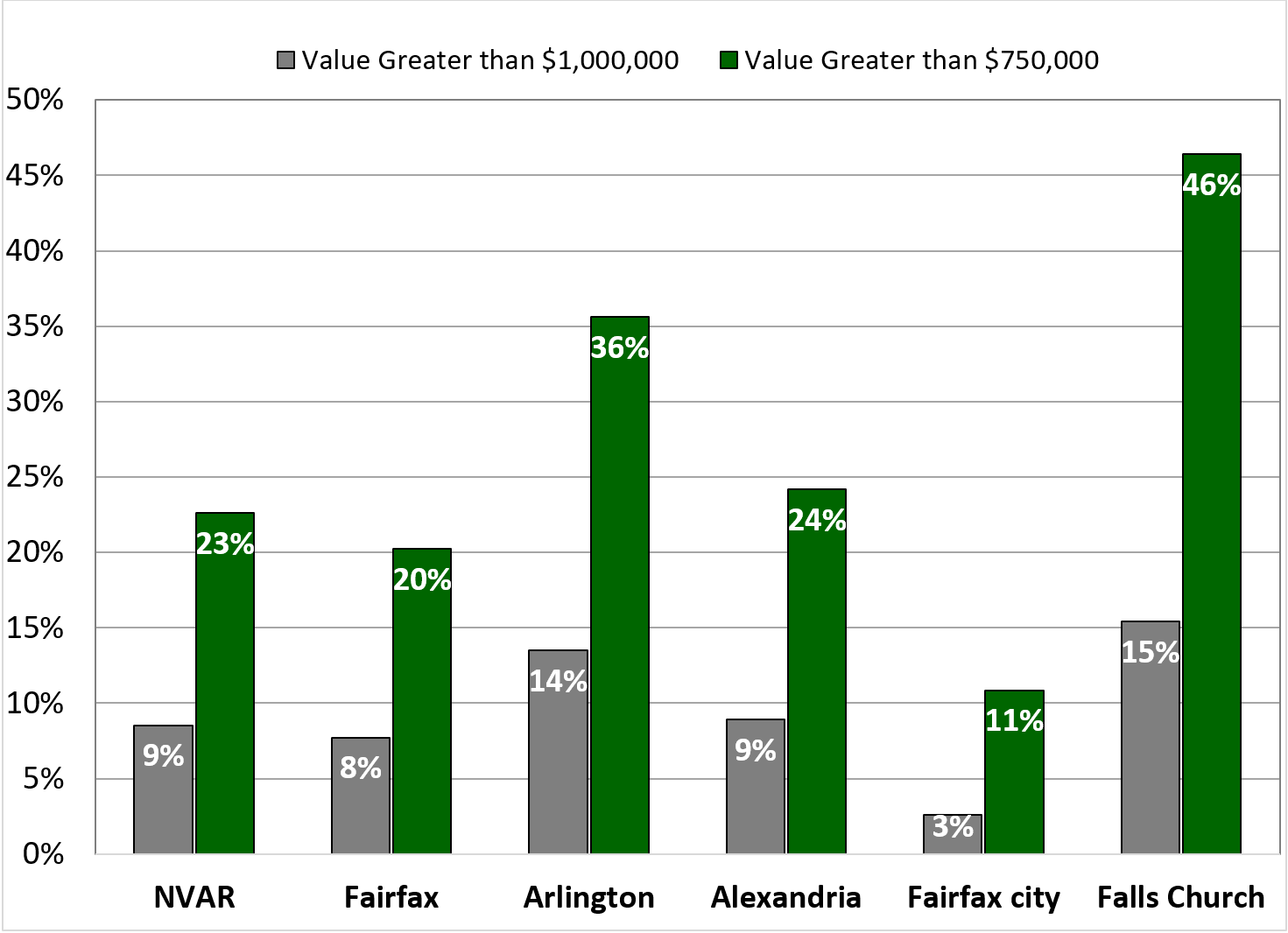

Of the NVAR region’s nearly 350,000 owner-occupied households, almost 23 percent, or 78,579 homes, are valued greater than $750,000 (Figure 5). Just under 50,000 of these homes are valued between $750,000 and $1 million, which means two-thirds of those homes will be additionally impacted by the decrease in the MID cap. This may decrease the potential incentive for purchasing by 50,000 homes, or 14 percent of the NVAR region’s entire housing market – assuming the houses are listed at their value.

Figure 5: Homes by Property Value, NVAR Region, 2016

Source: U.S. Census Bureau, American Community Survey 5-yr 2011-2016

Actual mortgage data from the region tells the same story. According to real estate data and analytics firm ATTOM Data Solutions, Virginia, Maryland, and D.C. are among the 15 jurisdictions with the highest percentage of mortgages above $750,000 in 2017. Two jurisdictions within Virginia had the highest percentage of loans above that threshold of $750,000: 27 percent of Falls Church homes and 20 percent of Arlington homes.

SALT DEDUCTIONS

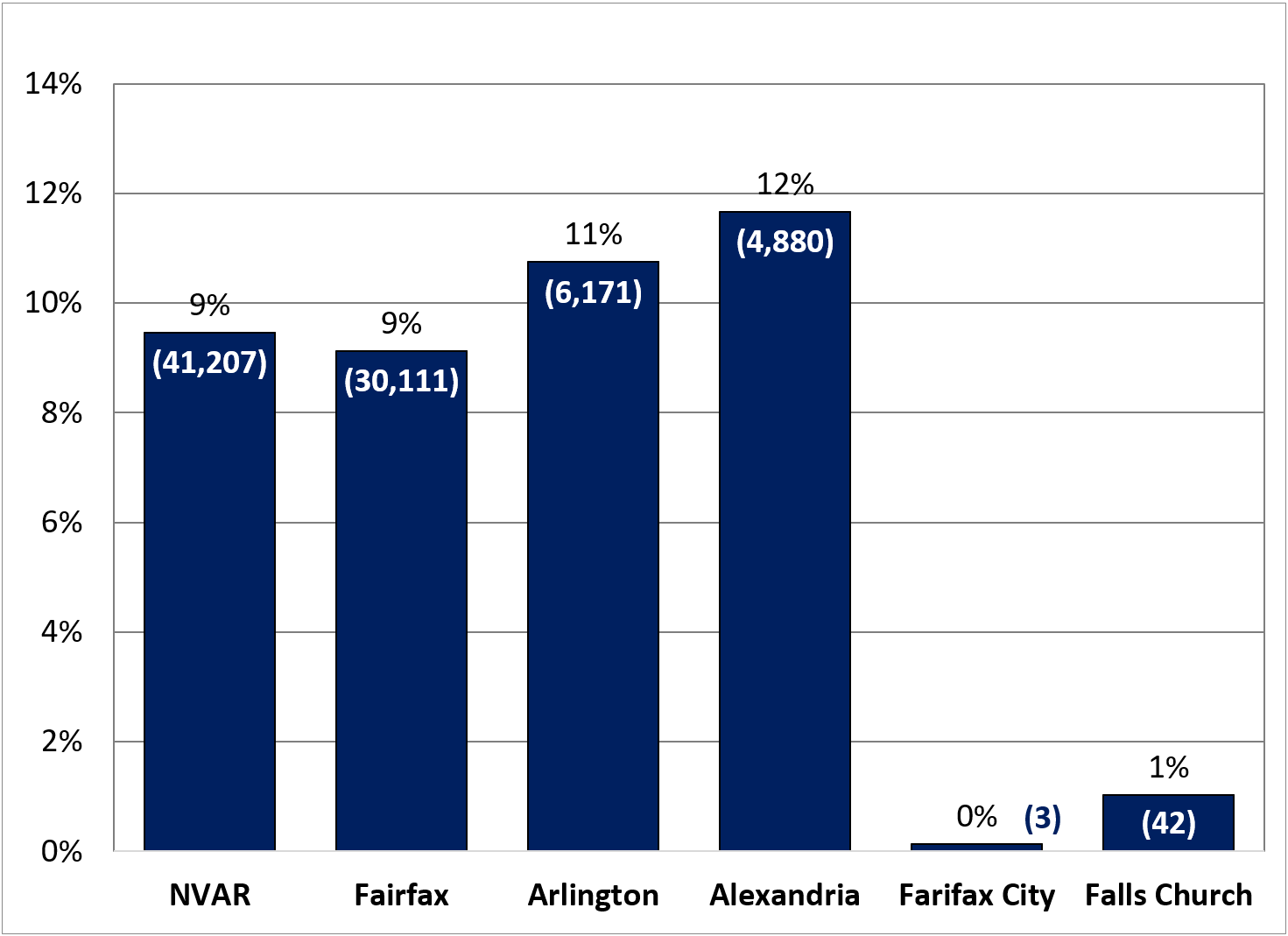

Under the current tax system, the amount of property taxes a homeowner can deduct is not capped. The new plan caps the deduction for state and local taxes at $10,000, adding another layer of complexity to its impact on the housing market. According to data from ATTOM, nearly 10 percent of homes in the NVAR region currently pay property taxes greater than $10,000 per year – a total of 41,207 households. Alexandria and Arlington have the greatest percentage of homeowners with property taxes in excess of $10,000, at 12 percent and 11 percent, respectively (Figure 6).

Figure 6: Single Family Homes and Condos Where the Most Recent Property Tax Bill Available Was More Than $10,000.

Source: ATTOM Data Solutions

This inability to deduct high state and local taxes could soften the housing market, but also create complications for local government finance. Homeowners, especially those with highly valued properties, may choose to live in places with lower property taxes or lower home value. Homeowners may also be more reluctant to support increases in local taxes that help pay for necessary services such as public safety, parks and schools, because they feel they are taxed enough.

STANDARD DEDUCTION DOUBLES: LESS PEOPLE WILL ITEMIZE

In addition to altering the MID and SALT provisions, the tax bill also doubles the size of the standard deduction. Taxpayers have the option of taking itemized deductions (such as MID or SALT) or the standard deduction. By drastically increasing the standard deduction, people may not be choosing to itemize. This legislation thereby may eliminate the incentives that MID and SALT deductions provide. The mortgage interest deduction and the ability to deduct state and local tax has long been seen as a strong incentive for families to purchase homes. Therefore, a rise in the standard deduction diminishes tax incentives for home buying. Where previous housing deductions may have nudged people into buying homes even when they may have been happier renting, this effect may not remain as strong.

Nationwide, The Tax Policy Center estimated that the percent of tax filers claiming the mortgage interest deduction would fall from around 21 percent of all taxpayers to just 4 percent due to the doubling of the standard deduction. A report by Zillow found that for 98 percent of home owners in the D.C. region, it made sense to itemize (by taking the MID and SALT deductions) under the old tax legislation.

Under the new law, it only makes sense for 64 percent of D.C. homeowners to itemize rather than take the standard deduction.

INVENTORY IMPACT

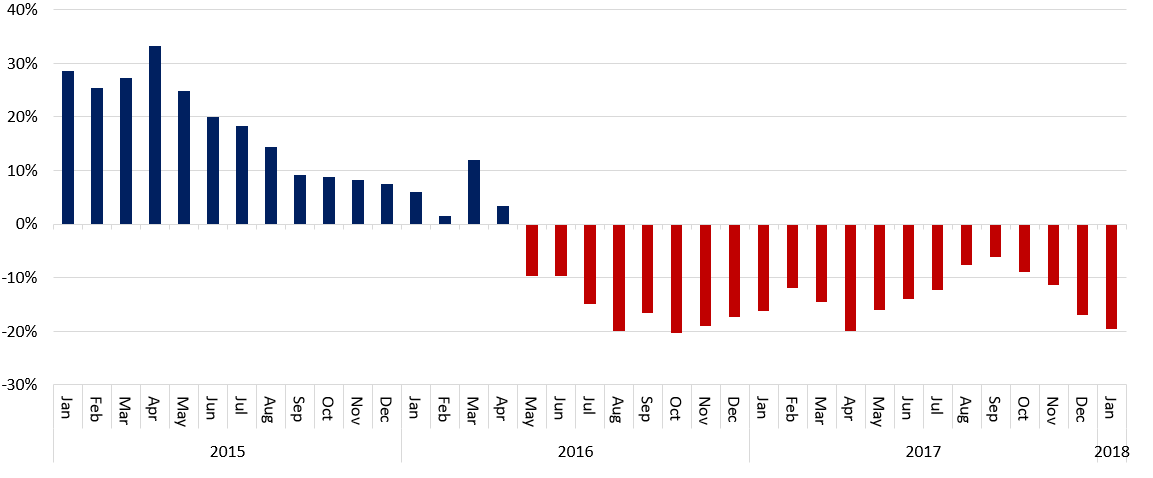

Tight inventory is undoubtedly one of the region and nation’s largest concerns, and this tax bill will likely complicate the issue further. The inventory of homes in the NVAR region continues to decline – as of January 2018, 2,195 homes were on the market, a decline of 20 percent from the year prior (Figure 7).

Figure 7: Year-Over-Year Percent Change in Active Listings, NVAR Region.

Source: Bright MLS. Statistics calculated 2/5/2018

Moving forward, it is difficult to predict how housing supply will be impacted. The provision protecting the MID for existing mortgages may keep homeowners in their houses longer, further restricting inventory. However, the inability to completely deduct property taxes could trigger a sell-off in high tax regions such as NVAR. In addition, many potential sellers may wait to watch the market after the new law takes effect.

The change will not only affect buyers of more expensive homes in high tax regions, but may also have a negative impact on new and first-time homebuyers. The tax deduction cap exclusively on new mortgages serves as a further deterrent for housing turnover and limits the already tight inventory of affordable homes. Those ready to vacate less expensive starter homes are less likely to move up the housing ladder and free up inventory for new homebuyers. The doubling of the standard deduction means fewer people will itemize, which could result in people opting for a less expensive house, because they are not able to write off as much as they used to. This could further crowd the market at the lower end.

EXPECT LITTLE LONG-TERM EFFECT: TAX CONSIDERATIONS ARE ONLY ONE INFLUENCE ON THE HOME BUYING DECISION

Many of our region’s homebuyers and current homeowners will experience an increase in their home- related tax liabilities, either because they would be able to deduct less mortgage interest, less property taxes, or both. It may seem that the bill will only influence wealthy homeowners, but as home prices rise in the NVAR region, a growing number of homes will be affected.

How will the market look moving forward? Demand may fall somewhat for higher-priced homes because there will be fewer tax incentives to buy a home. Concurrently, supply on the higher end is likely to be reduced due to the preservation of the MID in existing mortgages, which could drive down inventory. Whichever market force is stronger will dictate whether prices rise, fall or stagnate.

With a change comes uncertainty, and initially activity may slow due to the psychological impact. Fortunately, the tax bill provisions directly affecting homes was far less detrimental than was expected. If the regional economy remains strong and uncertainty subsides, we may experience a softening in housing prices and sales, but do not expect housing values to decline any time soon.