The condominium market in the Washington region has been performing well over the past two years, with strong price growth between 2012 and 2014. The average condo sales price for the Washington metro area in 2014 was $331,400, which was up 4 percent from 2013 and 12 percent from 2012. The condo market in the NVAR region (Arlington, Alexandria, Fairfax County, Fairfax City, Falls Church) has been uneven in the past three years. The average condo sale price in the region only increased by 1.2 percent and the median price was up just 2.5 percent. The sales pace did increase, though, with 16 percent more condos sold in 2014 than in 2012. At the outset of 2015, the future of the Northern Virginia condo market remains uncertain. This article examines the stories behind the numbers and identifies areas of opportunity in the region’s condo market.

OVERALL MARKET PERFORMANCE

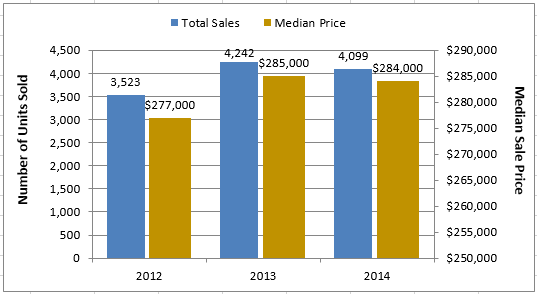

There were 4,099 reported sales of condominium or cooperative units in the NVAR region in 2014, with a median sale price of $284,000. The sales pace was down slightly from 2013 but up 16 percent from 2012. The median sale price of condo units in 2014 was down very slightly (-0.4 percent) from 2013 and up 2.5 percent from the 2012 median of $277,000. The median days on market for sold units has fluctuated but remained very low: 22 days in 2012, 13 days in 2013, and 24 days in 2014.

PERFORMANCE BY JURIDICTION

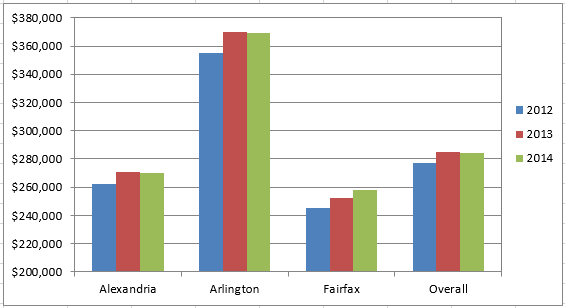

Among the three primary jurisdictions in the region, condo prices are far higher in Arlington than in Alexandria or Fairfax. The median condo sale price in Arlington in 2014 was $369,000, compared with $270,000 in Alexandria and $258,000 in Fairfax. Median prices in Alexandria and Arlington followed the same pattern as the region, with increases in 2013 and very slight declines in 2014. The market in Fairfax performed better, with the median price increasing by 2.9 percent in 2013 and another 2.4 percent in 2014.

BUILDING TYPES

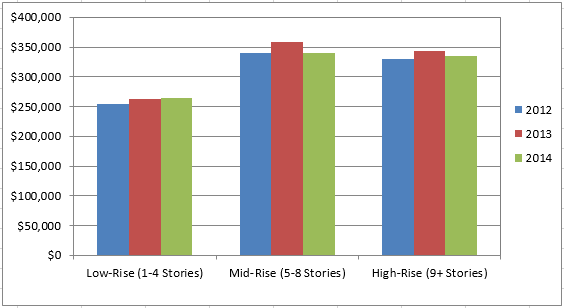

More than 57 percent of condo units sold in Northern Virginia in the past three years have been in low-rise (1-4 story) buildings. The low-rise share increased from 54 percent of sales in 2012 to 60 percent in 2014. Units in mid-rise buildings (5-8 stories) accounted for 10 percent of sales and high-rise (9+ stories) units accounted for 32 percent of sales. The shares of mid- and high-rise units each declined between 2012 and 2014.

"Among the three primary jurisdictions in the region, condo prices are far higher in Arlington than in Alexandria or Fairfax."

The median sale price for low-rise units in 2014 was $265,000, which was up 3.9 percent from 2012, but still well below the median prices of units in taller buildings. The median price of mid-rise units was actually the highest at $340,000, but it was unchanged from 2012. The median price of high-rise units in 2014 was $335,000, up just 1.7 percent from 2012.

AGE OF UNITS

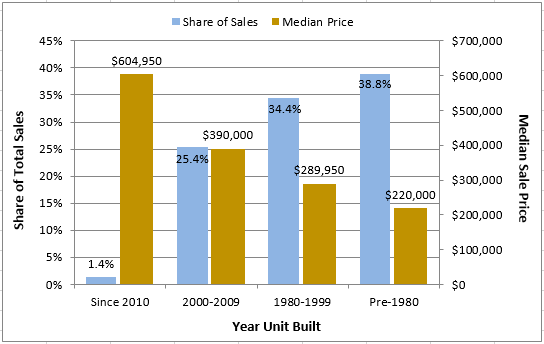

The age of condo units has a strong relationship with sales prices, and the lack of newer units in the market has been a likely contributor to the slow growth in prices. Among all condo units sold in Northern Virginia in 2014, just 1.4 percent had been built since 2010, and 73 percent were built prior to 2000 (Figure 4). The median sale price of units built since 2010 was $604,950, compared with $390,000 for units built from 2000-2009, and less than $300,000 for units built prior to 2000. Older units built before 1980 represented 39 percent of all sales and had a median sale price of just $220,000.

CONDO MARKET BY ZIP CODE

The 10 ZIP code areas in Northern Virginia with the highest median condo prices share several characteristics: close-in location, proximity to employment centers, and—thanks to the new Silver Line—accessibility to Metro. Five of the 10 top ZIP codes are in Arlington, and just two are outside the Beltway—22182 and 22102, both of which include parts of Tysons Corner. Interestingly, half of the most expensive ZIP codes had median price decreases between 2012 and 2014, and the fastest increase was just 7.3 percent in 22201 (Court House/Clarendon). The median price declined nearly 10 percent in both 22209 (Rosslyn) and 22046 (Falls Church).

The ZIP codes with the most rapid increases in median sale prices between 2012 and 2014 tend to meet one of two descriptions. The first group includes close-in locations that are experiencing revitalization in the surrounding area such as Merrifield, Arlandria, Seven Corners, Del Ray/Potomac Yard, and Annandale. The second group takes in undervalued suburban areas where condo prices had been depressed, including: Centreville, West Springfield, Chantilly, and Mount Vernon/Woodlawn. In spite of rapid price growth in these 10 areas, the median condo sale price for 2014 was still below $300,000 in nine of them, and below $200,000 in four of them.

The ZIP codes with the most rapid increases in median sale prices between 2012 and 2014 tend to meet one of two descriptions. The first group includes close-in locations that are experiencing revitalization in the surrounding area such as Merrifield, Arlandria, Seven Corners, Del Ray/Potomac Yard, and Annandale. The second group takes in undervalued suburban areas where condo prices had been depressed, including: Centreville, West Springfield, Chantilly, and Mount Vernon/Woodlawn. In spite of rapid price growth in these 10 areas, the median condo sale price for 2014 was still below $300,000 in nine of them, and below $200,000 in four of them.

"There is likely a great deal of unrealized value for older units in Metro-friendly areas..."

AREAS OF OPPORTUNITY

There has been little new condominium development in the region over the past few years, as it has been limited by the strong rental housing market and the difficulty in obtaining financing for new condo units. The lack of new supply will continue to drive demand towards older condo units, particularly as the prices of single-family houses and townhouses continue to be out of reach for many buyers.

Many areas around Northern Virginia are poised to experience stronger interest in their existing condo units. Units located near the region’s Metro corridors will continue to prosper, so there is likely a great deal of unrealized value for older units in Metro-friendly areas like Reston, Huntington, Springfield, and Vienna. There should also be continued price increases in other areas that have already experienced strong price growth, such as Annandale, Centreville, and Mount Vernon. Commercial sections of these areas are undergoing positive changes too. The large inventory of low-cost condo units in these locales presents an opportunity for buyers and investors alike.

David Versel is a senior research associate at the George Mason University Center for Regional Analysis