A Five-Year View of the Northern Virginia Market

It is hard to believe, but 2014 marks Year Five of the Northern Virginia economic recovery. With the benefit of four full years of data on the region’s housing market, it is a perfect time to take a look back at where we have been, how things have changed over the past four years, and what we should expect in the next two years.

2010 AND 2011: SLOW AND UNEVEN IMPROVEMENT

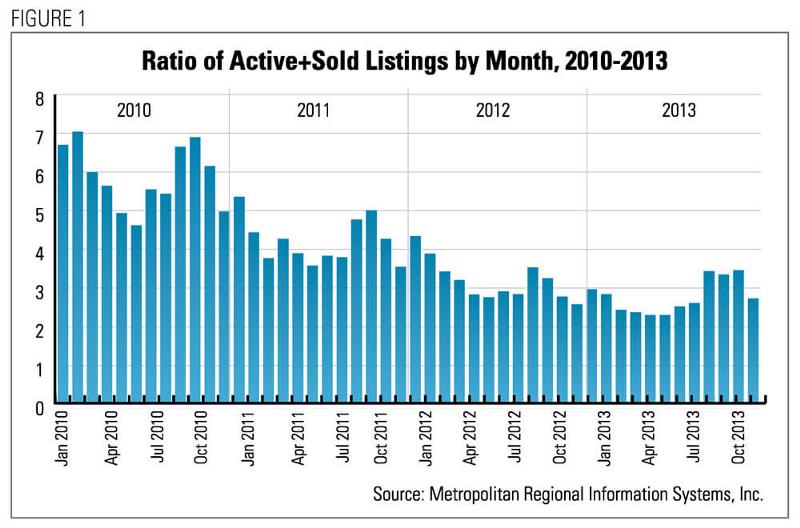

Four years ago, the region’s housing market was just beginning its climb back from the devastation of the national economic recession. The Northern Virginia housing market (which includes Arlington County, Fairfax County, and the independent cities of Alexandria, Fairfax, and Falls Church) had suffered through a very difficult period: from 2007 to 2009 the average sale price in the region declined by 20 percent and the ratio of active listings (including units sold in the preceding month) to sales had increased from about 2:1 in early 2007 to 9:1 in mid-2008.

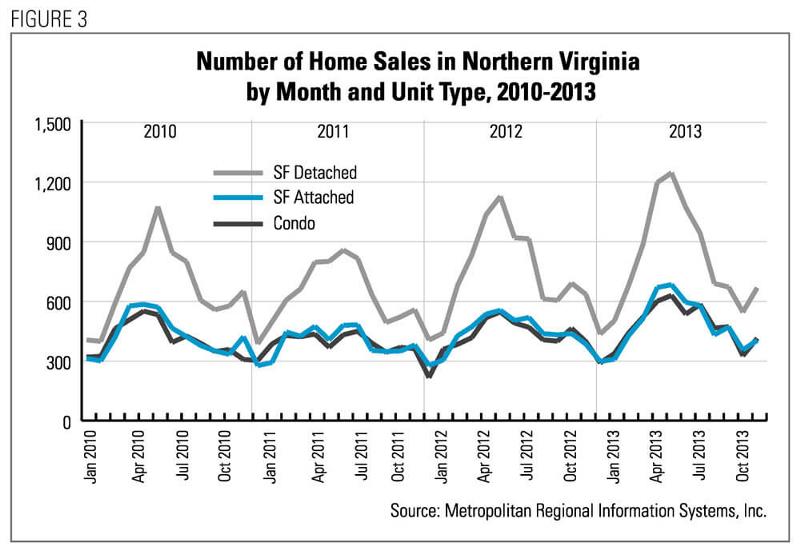

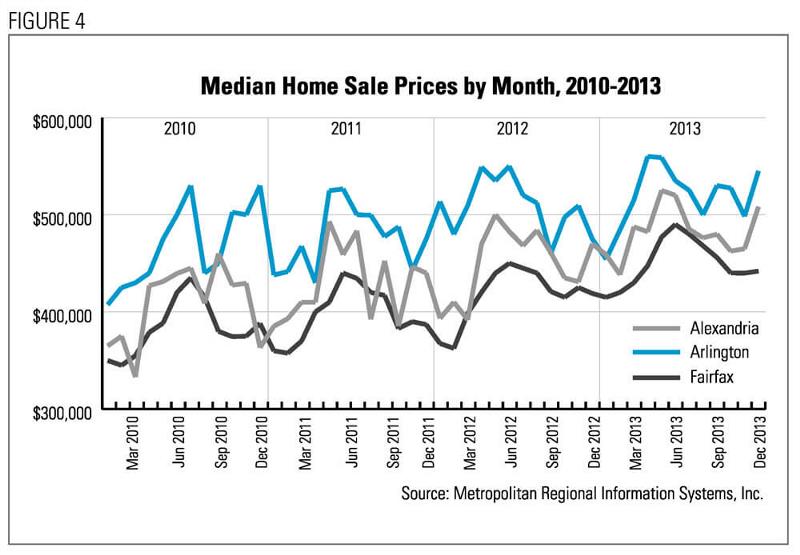

The first two years of the recovery were, at best, uneven. After strong increases in median sales prices and sales volume during 2010, these indicators were weaker in 2011. In both Arlington and Fairfax counties, the June (peak-month) median sales prices were flat from 2010 to 2011, though the June-to-June median price increased by about 5 percent in Alexandria. The overall volume of home sales in Northern Virginia declined by 10 percent from June 2010 to June 2011, consistently in all jurisdictions.

A major contributor to the sluggish market in 2010 and 2011 was the dwindling inventory of attractive properties. After peaking by the end of April 2008 at more than 12,000 active listings, the unsold inventory began a gradual decline and stood at 6,200 by April 2011.

As a result of the declining inventory, the ratio of active listings to sales began a sustained decline in early 2011. This ratio, which had peaked at about 9:1 in 2008 and was still at 7:1 in late 2010, has remained below 5:1 since February 2011.

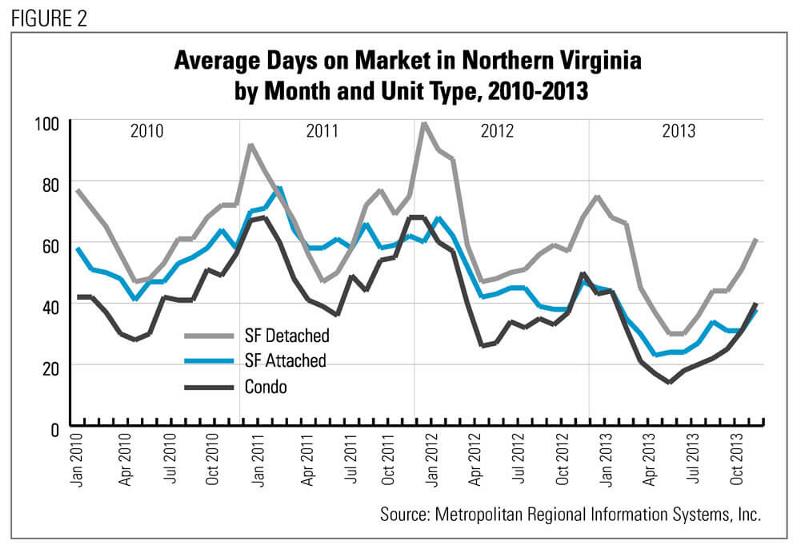

Trends in Days on Market (DOM) also reflect the uneven shape of the region’s housing recovery. Average DOM increased for all housing types from 2010 to 2011, an indication that many of the units remaining in the active inventory were simply not attractive to potential buyers. This was a particular issue for single-family units: average DOM increased from 77 in January 2010 to 99 by January 2012 for detached units and from 42 to 68 for attached units. The average DOM for condos increased sharply during 2010, but began a sustained decline in early 2011.

2012 AND 2013: STRONG, SUSTAINED GROWTH

After two years of a slow and uneven recovery, the Northern Virginia housing market began to rebound in earnest in early 2012, with all indicators showing a strong and sustained market over the past two years.

SALES VOLUME AND INVENTORY

After declining from 2010 to 2011, the number of home sales showed strong increases during 2012 and 2013 for all unit types. The number of single-family detached units sold during the peak month of June increased from 789 in June 2011 to 1,234 in June 2013, a 56 percent growth rate.

During the same period, the number of single-family attached sales increased 41 percent and condo sales increased 73 percent. Since 2011, inventory growth has not kept up with sales; the ratio of active listings to sales in June 2013 was about 2:1, and the ratio was still below 3:1 in December 2013.

DAYS ON MARKET (DOM)

After rising through 2011, average DOM for all property types declined sharply in both 2012 and 2013. The average DOM for all sales in 2013 was 38 days, compared with 62 in 2011, a decrease of 39 percent. Declines in DOM were consistent for all housing types, with all three types reaching post-recession lows in mid-2013.

The most striking figures occurred in the peak month of June 2013, when the average DOMs dropped to 30 days for single-family detached units, 14 days for single-family attached units, and 24 days for condos. Last year’s data clearly demonstrate that, during peak buying season, units are selling at a brisk pace.

MEDIAN PRICES

Median home sale prices regained strength during 2012 and 2013 in all three major jurisdictions in Northern Virginia (City of Alexandria, Arlington County and Fairfax County). Median prices increased the most in Fairfax County, where the median price level was up 11 percent from 2011 to 2013. Alexandria (6.5 percent) and Arlington (6.4) experienced slower growth during this period.

It is significant to note that median prices in all three jurisdictions are back to their pre-recession peak levels. Arlington reached its peak median sale price in April 2013; Alexandria’s was in May and the peak for Fairfax came in June. The 2013 median price peak in all three jurisdictions was in excess of $490,000. In all three jurisdictions, the 2013 peak levels were equal to or greater than their 2006 peaks. While these elevated prices could raise concerns, the low ratio of inventory to sales suggests that, unlike in 2007 and 2008, current price levels are sustainable.

2014 AND 2015: GROWING DEMAND, BUT CONCERNS ABOUT AFFORDABILITY AND SUPPLY CONTINUE

The short-term outlook for housing demand in Northern Virginia is strong. After two years of weak economic growth, due in large measure to uncertainties about the federal government, the region’s job situation should improve significantly: our forecast is for the Washington metro area to add about 125,000 jobs in 2014 and 2015, more than half of which will be in Northern Virginia. Considering that the area’s housing market was already performing quite well during two years of slower job growth, there should be ample demand for housing in the next two years.

“The ability of would-be buyers to afford homes in Northern Virginia is becoming an increasing concern. Even as home prices have eclipsed pre-recession levels, most of the new jobs added in the region in the past five years have been at lower wage levels, thus limiting the home buying power of the region’s workforce.”

The ability of would-be buyers to afford homes in Northern Virginia is becoming an increasing concern. Even as home prices have eclipsed pre-recession levels, most of the new jobs added in the region in the past five years have been at lower wage levels, thus limiting the home buying power of the region’s workforce. Rising interest rates also complicate matters: research (documented in “Is it time to say good-‘buy’ lease?,” July/August 2013 RE+VIEW magazine;

go.nvar.com/1304, pg. 24) found that an increase in interest rates from 3.5 to 7 percent would increase the payback period from buying a single-family home in Fairfax County from four to 11 years. The fact that local rental rates actually declined slightly in 2013, as reported by Delta associates, may also make some renters delay potential home purchases.

The supply of available housing also presents an obstacle. There are two inter-related dynamics to this issue: first, how much new construction there will be; second, how many current homeowners will be willing to sell their homes.

New construction in the region remains slow, with housing starts in the region during 2013 still about 50 percent below the level experienced during the early 2000s. Furthermore, most of the new construction in the region last year was for multi-family rental units. As a result, current homeowners who may want to sell their homes but remain in the region have few for-sale options.

While we expect the pace of construction to increase in 2014, construction will not reach its prior levels until at least 2016. In the interim, most current homeowners will stay put, thus limiting the supply of units in the resale market.

The sum total of these factors is that the housing market in Northern Virginia in 2014 should look a lot like the market in 2013: the combination of good (but not great) demand and limited inventory will lead to quick sales at elevated prices. In 2015 and beyond, though, the combined effects of higher interest rates, new construction, and low-wage job growth could negatively affect the region’s housing market. It is a wait-and-see market.

David Versel is a senior research associate at the George Mason University Center for Regional Analysis