Frigid winter winds shocked Northern Virginians earlier this year, but for commercial Realtors® the winds of change to our regional economy packed an even bigger punch.

The cold facts, as reported by Stephan Fuller, Ph.D., director of the Center for Regional Analysis at George Mason University, reveal that reduced federal spending policies have resulted in major changes in the Washington area economy, which can no longer rely on the federal government to keep it afloat.

“This is a private sector story now,” Fuller said in his speech at the 22nd Annual Cardinal Bank and George Mason University Economic Conference at the McLean Hilton in January entitled, “The Post-Federally Dependent Washington Area Economy.”

Federal jobs have dropped roughly 21,000 since their peak in July 2010, representing a lost payroll of $2 billion. As a result, the federal government now accounts for roughly 30 percent of the regional economy, down from its previous high level of 40 percent, according to Fuller.

While the private sector has been creating new jobs, most of the job growth has come in lower-paying leisure, hospitality and retail sectors. Its anemic growth rate placed Washington, D.C. third from the bottom among the top 15 job markets in the country.

Northern Virginia, however, continued to be the strongest economy in the region, and its unemployment rate of 4.9 percent placed it well below the national average of 7 percent.

Scanning the horizon for the next five years, Fuller predicted that Northern Virginia’s job growth rate would more than double from its level for the past two years of roughly 1.26 percent to a new level around 2.65 percent – if the private sector continues to grow. That should result in roughly 33,000 new jobs a year, still down slightly from the average of 36,000 new jobs created each year from 1990-2010, but up from the average of 21,500 new jobs created each year for the past three years.

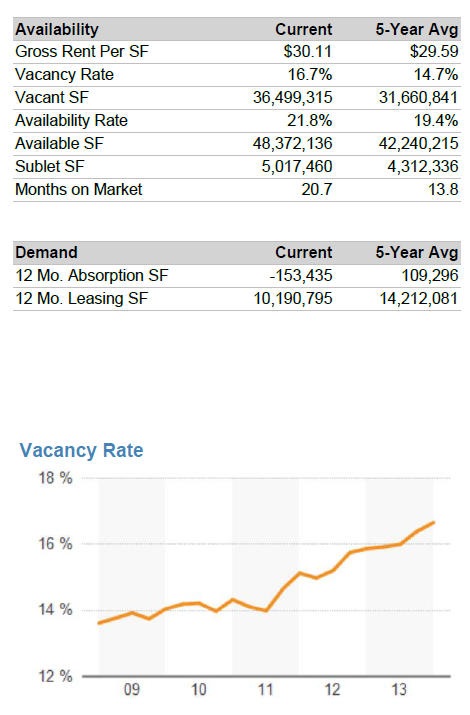

Commercial Realtors® can see the effects of the slow economic recovery in the Northern Virginia submarkets as office vacancy rates for 2013 continued to climb to the 16.7 percent level. among the bottom tier of markets nationally. This is well below the average vacancy rates for the past five years of 14.7 percent, according to market analystics generated by the CoStar Group, the leading commercial real estate information service.

“90 percent of the D.C. office absorptions occurred in the suburban markets, driven by growth in the technology and health care sectors.”

In Northern Virginia, vacancy rates for 2013 ranged from a low of 6.3 percent in the North Arlington/East Falls Church submarket to a high of 32.2 percent in Pentagon City. Rosslyn, which had shown the lowest vacancy rates in past years due to demand for office space from government agencies and their contractors, has now seen its vacancy rate rise to 25.1 percent.

Even though 245,221 square feet of office space was absorbed during the fourth quarter of 2013, vacancy rates remained high due to new office buildings coming on the market without tenants, including the combined 860,000sf of vacant space in the new office towers at 1812 N. Moore St. in Rosslyn and the Monument View building in Pentagon City.

According to CoStar’s analysis, while absorption has been essentially flat in the D.C. market for the past three years, 90 percent of the D.C. office absorptions occurred in the suburban markets, driven by growth in the technology and health care sectors.

Most of the increased demand, however, was for new ‘A’ rated office buildings. Vacancy rates for less attractive ‘B’ and ‘C’ offices remained flat during 2013. As expected, rent rates reflected the same demand, with slight increases in high demand areas such as Tysons and Reston where rates climbed above $34/sf.

Commercial Realtors® looking to the coming year have a variety of new issues to ponder. Among them are:

1. Will the market in Northern Virginia be strong enough to absorb the additional new projects currently under construction, totaling more than 5 million square feet, which are expected to be available by year-end 2014?

2. Will the opening of Metro’s Silver Line through Tysons to Reston spur economic activity along the new line, and how will that affect existing Metro corridors in Northern Virginia along the Orange, Blue and Yellow lines?

3. Will businesses and government agencies, which have reduced their own leased space by roughly 20 percent during the past 10 years, continue the trend of putting more people in less space by utilizing technological innovations to encourage shared workstations and telecommuting?

4. Will the federal government continue downsizing its workforce and office requirements in Northern Virginia?

5. Will Northern Virginia’s local economic development activity be successful in attracting non-government related businesses to the area?

6. Will projects such as the Columbia Pike Trolley or the renovation of the Springfield Mall deliver anticipated benefits to the regional economy and increase demand for commercial real estate?

7. What will happen to commercial real estate investment if interest rates begin to rise, causing the price of borrowing to become more expensive, and if inflation begins to reappear, encouraging landlords to increase rental rates?

Warmer spring breezes will bring a new season of opportunities and challenges for commercial Realtors®. While waiting for the ice to melt (no thaw in sight at press time), consider this advice inspired by hockey great Wayne Gretzky: we all need to learn to skate to where we think the puck is going, not where it’s been!