INVENTORY, MILLENNIAL HOMEBUYERS AND DIGITAL IDENTITY were just a few of the topics discussed at NVAR’s 2018 Finance Summit, hosted by the Real Estate Finance and Settlement Forum.

At the standing-room-only event, held at NVAR Fairfax headquarters on May 23, experts shared information and predictions about the latest finance trends impacting Realtors®, consumers and the future of the real estate market.

LOCAL AND NATIONAL MARKET OVERVIEW

The national unemployment rate is at an 18-year low and will continue to decline, according to Dr. Michael Fratantoni, chief economist and senior vice president of research and industry technology at the Mortgage Bankers Association.

However, Dr. Terry Clower, director of the George Mason University Center for Regional Analysis, said that despite low unemployment rates and a tight labor market, wages have not increased as expected.

“By and large, I don’t think companies are having to fight to keep their workers,” Clower said. “And until that happens, we may see these wage levels not really rise as much – even though other . . . economic conditions would suggest they should be rising relatively dramatically.”

Although a strong job market is fantastic when working with homebuyers, housing inventory remains low and home prices continue to rise, which is true nationally and locally, Fratantoni explained.

“We are just not putting up enough units to meet demand, and as a result, we are running into a huge affordability problem across the country – with home prices going up more than twice the rate of income,” he said.

The housing affordability issue is exacerbated by the fact that mortgage rates are at their highest in seven years, Fratantoni said. He predicted rates will reach 5 percent by the end of 2018.

For a closer look at the NVAR region, Clower presented a consensus forecast, which was created as part of GMU’s partnership with NVAR.

In Fairfax, Clower predicted a 6 percent year-over-year growth in median sales price, which could be attributed to high demand over supply. In addition, he predicted the total number of units sold in Fairfax will decline about 7 percent. Trends in Arlington were similar to Fairfax; however, Clower noted that the smaller the market, such as in Arlington and Alexandria, the less a pattern is discernable in the data.

Clower predicted a decrease in median sales price in Alexandria, which he said isn’t necessarily an indicator that market values are going down, but that smaller units are more likely to sell. He also forecasted an increase in the number of units sold in Alexandria.

“Keep in mind the differential here might be a matter of 20 units sold in a month or not even that many,” Clower said. “The difference here is so small that it’s hard to make a whole lot out of it. But nonetheless, there is going to be some increase in that market.”

Across all markets, Clower predicted a decrease in inventory on a three- or four-year trend.

However, Clower said he believes there will be market opportunities despite low inventory.

“Inventory and sales do not move in lock step,” Clower said. “Just because of low inventory doesn’t mean that you can’t have some sales.”

A WAVE OF MILLENNIAL HOMEBUYERS

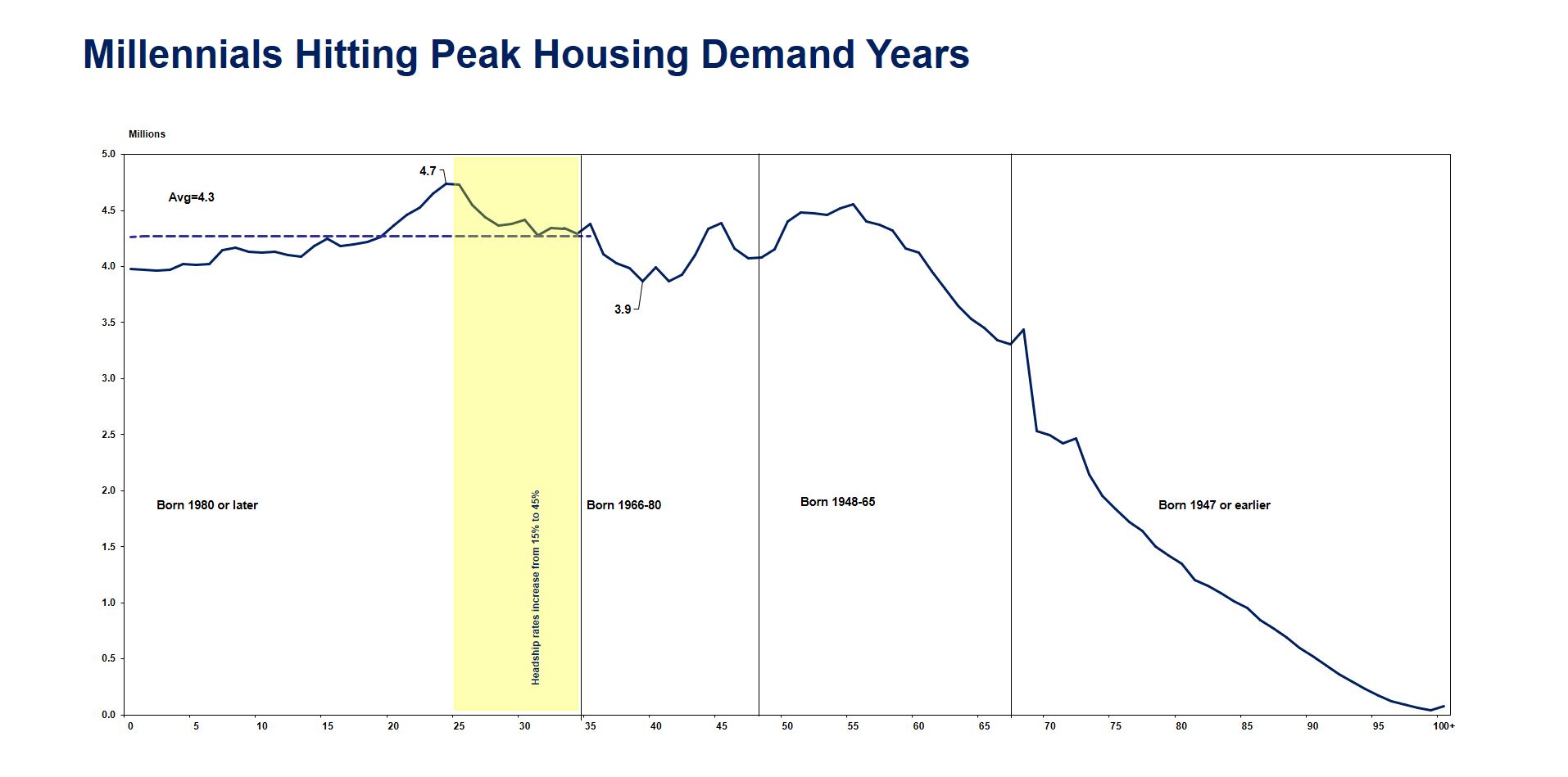

Roughly 4.7 million people in the United States are 25 to 26 years old and just beginning to form their own households (see chart below). Since 31 to 32 years old is peak first-time buyer age range, this upcoming wave of millennial homebuyers is significant in today’s market, Fratantoni explained.

Source: Mortgage Bankers Association

“If you take nothing else from this room, this is a simple reason for why you are in a good business – at least for the next six or seven years,” Fratantoni said.

Attracting and retaining millennial households is critical to the vitality of Northern Virginia’s economy and housing market, said Susan Dewey, executive director of the Virginia Housing Development Authority (VHDA).

According to Dewey, VHDA has noticed that millennials are moving out of the region.

The challenges for these buyers include: low inventory of starter homes, increased competition in the lower price range, and a student debt burden that often prevents millennials from saving enough to afford a home, Dewey said. However, according to Fratantoni, the student debt burden isn’t as substantial as the financial press portrays.

As this new wave of homebuyers prepare to hit the market, Fratantoni and Dewey both discussed solutions available to help address millennials’ needs, such as student debt repayment plans, VHDA’s Mortgage Credit Certificates and VHDA’s Down Payment Assistant Grant Program.

Presenter Susan Dewey, executive director of the Virginia Housing Development Authority (VHDA) (second from left), joins other VHDA team members who attended the Finance Summit. VHDA was one of four NVAR Strategic Partners sponsoring the May 23 event. Representatives from Access National Bank, Great Jones Capital and Vesta Settlements were also on hand to share information with attendees.

Presenters (l-r) Dr. Terry Clower of the GMU Center for Regional Analysis, Matt Thompson of Capital One and Dr. Michael Fratantoni of the Mortgage Bankers Association, take audience questions at the end of the program.

TECHNOLOGY AND DIGITAL IDENTITY

Essential to every transaction is trust in identity, explained Matt Thompson, director of business development at Capital One.

Whereas physical commerce is built on a photo ID and face-to-face interaction, digital commerce relies on identity information that can be easily obtained and stolen.

“This past year saw the most data breaches and negative impacts to U.S. consumers, when it comes to their data, in history,” Thompson said.

For Realtors®, proof of identity, credit and financial assets in a secure and transparent manner are vital to the transaction process, he said.

According to Thompson, a type of fraud that has been on the rise and could affect first-time homebuyers is synthetic identity fraud. Synthetic identities are fake identities created with an individual’s social security number and other fake information, which are then used to open fraudulent accounts and make purchases.

“They [young identity theft victims] going to end up 18, 20 [years old] and apply for a loan for the first time to realize that their credit history has been stolen,” Thompson said.

To protect against this type of identify fraud, Thompson advised consumers to freeze their credit, which new legislation recently made free.

“Why this is a big deal is that it is actually the biggest proactive measure you can take in order to protect yourself,” Thompson said.

Other significant trends he discussed were digital payment apps; technology companies moving to obtain banking licenses; the expectation of real-time payments; and the expansion of ecommerce into more products and industries.

Fratantoni praised Realtors® for their adaptation to new technology, as the industry becomes digital and consumers expect a speedy and efficient transaction process.

To watch a video of the Finance Summit, please visit

facebook.com/nvar.realestate. PowerPoint presentations are available at

NVAR.com/finance.