Local Housing Market, Economy To track Upward

The beginning of 2017 has seen steady economic growth and moderate increases in home sales and prices within the Northern Virginia Association of Realtors® region (comprised of Alexandria City, Arlington County, Fairfax County, Fairfax City and Falls Church City). Regional job growth—albeit at a slower annual rate than the beginning of 2016—continues to boost demand. Housing inventory is extremely tight, likely maintaining high prices and suppressing growth in closed sales. Supply is expected to continue contracting while stagnating sales and pushing up home prices.

REGION ADDING HIGHER WAGE JOBS SLOWER THAN LAST YEAR

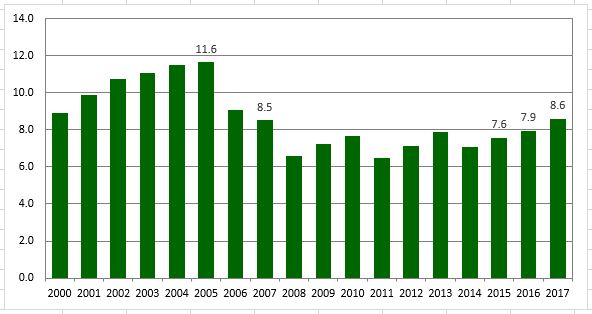

After adding employment throughout 2015, Northern Virginia’s (defined as Arlington, Clarke, Fairfax, Fauquier, Loudoun, Prince William, Spotsylvania, Stafford and Warren counties and Alexandria, Fairfax, Falls Church, Fredericksburg, Manassas and Manassas Park cities) job growth stalled in the second half of 2016 in.

Job growth rebounded slightly during the first quarter of 2017, however, employment growth was down 1.2 percentage points to 20,400 jobs added between April 2016 and April 2017. Employment gains typically spur increased home sales volume, provided there are a sufficient numbers of jobs in high-growth sectors and positive demographic and migration trends.

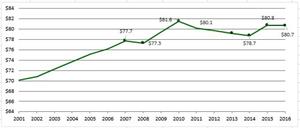

The average wage in the NVAR region has risen since 2014. Between 2015 and 2016, the average annual wage decreased 0.1 percent to $80,700 when adjusted for inflation. This is slightly above the 2010 peak of $80,800, reaching a new record high.

Among NVAR jurisdictions, Arlington’s wage growth was the highest at $89,952, an increase of 43 percent over the past two years. Based on the sector composition of job growth in the first four months of 2016, average wages should continue to rise throughout the region.

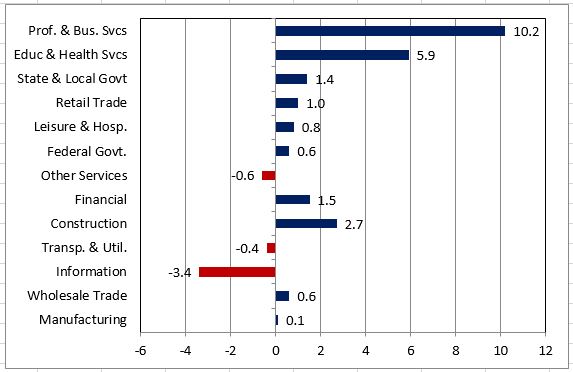

Growth in the high paying professional and business services sector continues to spur regional wage growth. The 2016 average annual wage in this sector was $108,087, comprising half of the region’s job growth in the past year—50.1 percent between March 2016 and March 2017.

Nevertheless, the region continues to add jobs in lower-paying sectors. For instance the Leisure and Hospitality sector — which typically creates relatively low-wage (annual average of $24,000 in the NVAR region) and part-time and seasonal jobs—added 3,700 jobs between March 2016 and March 2017, and as of April, this is the 4th largest industry super sector. If job growth in lower-paying sectors continues to rise, sales growth may become constrained. Workers in these sectors will not be able to afford the relatively high home prices prevalent throughout Northern Virginia.

NET DOMESTIC OUTMIGRATION SLOWS REGIONAL POPULATION GROWTH

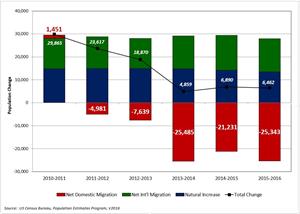

As an area adds jobs and attracts workers, it is important to look at the characteristics and components of population change, which involves migration (domestic and international) and natural increase (births minus deaths). The NVAR region’s population growth remained relatively slow, growing at a rate of 0.4 percent between 2015 and 2016; the region added 6,462 new residents during this time period. This is a significantly slower pace of growth than during the 2010-2013 period, but an apparent new normal regional pace since 2014.

More than any other factor, net domestic out-migration has slowed the region’s population growth. —This is a persistent trend, as the region has lost more domestic residents than it has gained since 2011. In 2016, over 25,000 more people left the NVAR region than moved into the region from elsewhere in the US. This exodus raises concern about the affordability and attractiveness of living and working within the region, and poses a significant threat to the residential real estate market.

Although migration has slowed, the region remains relatively young. According to the US Census Bureau’s 2015 population estimates, 37 percent of the NVAR region’s working age population (18-64) are millennials (age 18-34), mirroring the national average.

However, millennials account for 47 and 40 percent of Arlington and Alexandria’s working age population, respectively. Since newcomers tend to be young, they are more likely to rent, and will have less impact on the for-sale housing market, thereby suppressing the potential for greater sales volume. The uncertainty lies in whether young residents decide to stay in the region long-term and transition into homeowners, and if they can afford to do so.

PRICES ARE UP, INVENTORY IS TIGHT, SALES ARE LEVELING OFF

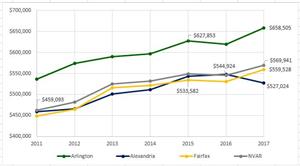

Average Sales Price

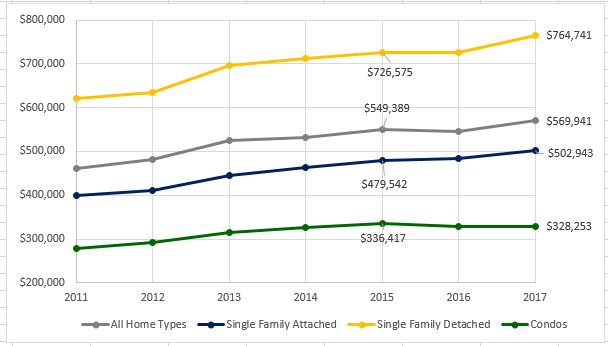

Extra demand for housing from added regional jobs combined with low inventory drives up sales volume and pushes prices upward. Average existing home sale prices for all regional jurisdictions and property types have now surpassed their pre-recession peak, with no sign of slowing.

After leveling off midway through 2016, the average NVAR region sales price rose moderately in the first five months of 2017. Compared to the same timeframe in 2016, the 2017 average sales price through May has increased 4.6 percent overall.

This is the highest average sales price in recorded history at $569.941. Property segment average price growth was led by single-family detached homes (5.4 percent) and single-family attached homes (4 percent), while condo prices remained steady.

Among the NVAR jurisdictions, Arlington had the sharpest increase in average sales price, rising 6.2 percent during the first five months of 2017 compared to the same timeframe in 2016. Fairfax County also saw an increase in average sales price (5.5 and 1.1 percent respectively during this period). The region’s three other jurisdictions had declining sales values: Falls Church (-8.2percent), Alexandria (3.8 percent).

High price points can have negative impacts. Even if a region is adding jobs, new workers might choose to remain renters if the cost of homeownership exceeds rental prices.

High home prices can also suppress the for-sale real estate market if burdensome debt prevents renters from becoming home buyers. Others are locked into their mortgages, preventing them from upgrading their housing arrangements. This keeps available inventory low, perpetuating the cycle by putting more upward pressure on home prices.

INVENTORY AND CLOSED SALES

Inventory has declined from the previous year for 13 straight months beginning in May 2016. This trend contributes to the sporadic, but generally stagnant, closed-sales growth. The anticipated 2017 spring inventory recovery was down from previous years, as February and March inventory growth compared to 2016 remained at -12 percent and -14.5 percent respectively. Active listings in May stood at 4,300, a decline of 16.1 percent from May 2016.

Closed sales in the first three months of 2017 increased moderately from the year before – rising 15.4 percent in March. April and May saw closed sales numbers more consistent with 2016 values. Expect inventory to remain tight moving into the second half of the year, as existing home sales growth continues to outpace new listings.

As it becomes increasingly difficult for buyers to find a suitable home, low inventory can also suppress demand. Evidence of this has been seen during the beginning of 2017 with sporadic growth in sales numbers. In April, new listings fell 13.4 percent. Although we have not seen an extreme influence, weak inventory growth may moderate the potential for additional sales going forward.

During the first five months of 2017, the total number of closed sales was 1.6 percent higher than during the same period in 2016. Compared to 2016, condo sales led the growth, rising 10.2 percent. Single-family detached homes had 9.9 percent more sales, and single-family detached properties had 3.7 percent more sales.

All jurisdictions in the NVAR region had more closed sales in the first five months of 2017 compared to the same period in 2016: Fairfax City (+32.5 percent), Falls Church (+45 percent) Alexandria City (+8.6 percent), Arlington County (+ 13.7 percent), and Fairfax County (+ 6.4 percent).

NEAR-TERM REGIONAL OUTLOOK

The NVAR region will likely continue to benefit from steady economic growth. Sustained increases of high wage jobs, particularly in the professional and business services sectors, should signal a rise in average wages and thus housing demand producing a steady sales volume increase in 2017.

However, persistently tight inventory levels are likely to suppress home sales growth and contribute to a gradual increase in home prices through the remainder of the year. Relief from the constricted housing market that faces the region and much of the nation depends on whether wage growth can keep up with price growth.

As wage and incomes rise, residents may be more able – or willing – to upgrade their existing housing situation or become first-time home owners. It is important to understand that regional growth in specific employment sectors, as opposed to overall job growth, is a reliable wage growth indicator. Job increases in higher wage sectors (i.e. professional and business services) will be a boost to wages and available income, while lower wage sector growth will have the opposite effect.

Spencer Shanholtz is a research associate with the George Mason University Center for Regional Analysis.