2016 NVAR Finance Summit Explores Interest Rates, Supply and More

A tightrope walk between interest rates and inflation, supply and demand, renters and buyers characterizes the issues raised at the May 18 Annual Finance Summit in Fairfax. Moderated by Syndicated Columnist Ken Harney of the Washington Post Writers Group, panelists conveyed news about real estate finance and homeownership to a full house.

NATIONAL OUTLOOK

Can the Fed increase interest rates without slowing the economy? This question was posed by Ken Fears, senior economist and director of regional economics and housing finance for the National Association of Realtors®. There is a familiar pattern to the nation’s economy, Fears noted. It appears to get traction, then slips. “This is what keeps interest rates low,” Fears said. “Higher interest rates – for the right reason – mean the economy is growing.” A rate increase is coming, Fears predicted – likely in July or September.

Low interest rates alone cannot support a robust housing market. At the national level, Fears said, “we’re significantly under-supplied.” Likening the current market for home sellers and home buyers to a game of musical chairs, Fears said, “For someone to come in, someone needs to leave.”

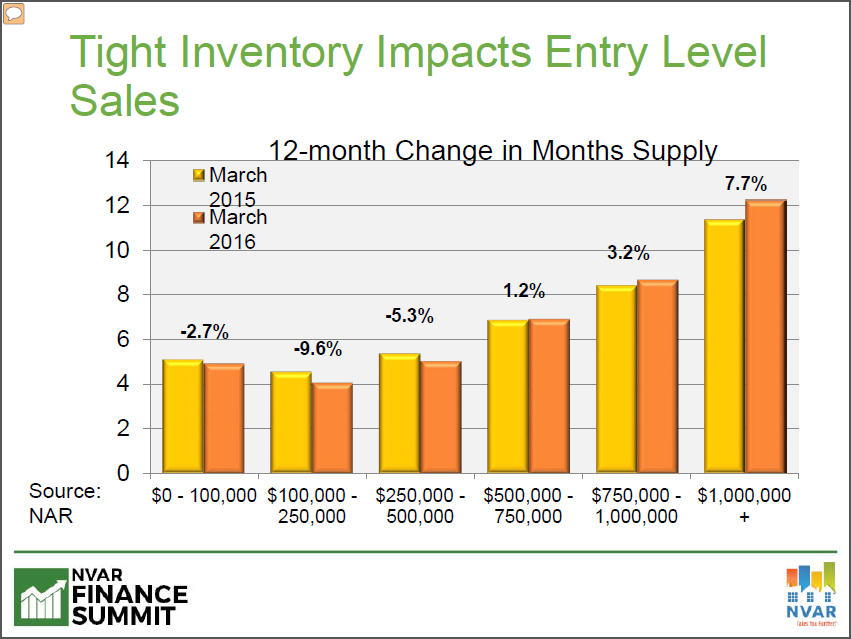

The number of new homes added to the market is not keeping pace with demand, and new construction is trending towards the upper end of the market. “We’re starved at the entry and middle sections of the market,” Fears said.

EMPLOYMENT AND AFFORDABILITY

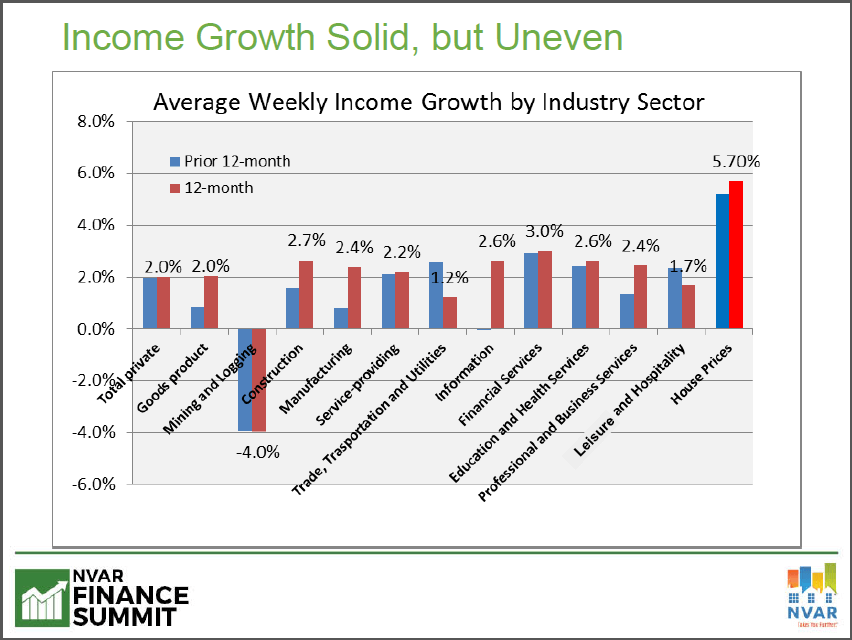

Nationwide, employment numbers are up across most sectors, but are not keeping pace with housing affordability. “House prices are growing twice as fast as incomes are growing,” Fears said.

Even if first-time buyers and previously-foreclosed “boomerang buyers” do return to the market, the FICO requirements remain high, Fears noted. There’s also a perception issue. “Buyers are putting overlays on themselves,” Fears said. Many still believe they need a 25 percent down-payment, which he explained, is not likely required by many lenders from qualified applicants now

OPTIONS FOR FIRST-TIME BUYERS

A perceived challenge for many first-time buyers is coming up with the down-payment. Washington Post real estate writer Michele Lerner reviewed some low down-payment options, including grants now available from the Virginia Housing Development Authority. Lerner recommended that Realtors® visit the Realtor® portal on www.downpaymentresource.com for information about down-payment options. “Put the link on your website,” Lerner advised.

“There is definitely flexibility out there,” Lerner said. Community banks, credit unions and portfolio lenders can often work with people faced with low credit scores or a thin file, she explained. This option may be a good choice for those borrowers who are able to make a bigger down-payment or who have cash reserves. Such lenders will look at a potential borrower’s rental, insurance, car and utility bill payments, Lerner said.

Although there’s often a perceived stigma attached, “housing counselors can help anyone – no matter what their income level or financial background,” Lerner said.

Joe Nelson, senior vice president and mortgage division manager with Chain Bridge Bank in McLean, noted that “subprime is back.” These loans are technically found in what are now called non-Qualified Mortgage products, he explained. “It’s worth exploring for some clients,” he said. Based on measures in place now by the Consumer Financial Protection Bureau, the terms of non-Qualified loans are explained and documented in detail, unlike subprime loans that were granted during the housing boom. “Community banks are one of the best and biggest sources of non-QM loans,” Harney added.

MORTGAGE CREDIT: BIG CHANGES ON THE HORIZON

Important “back room” changes in credit are unfolding that have not been well-publicized, Harney explained. In 2014, the Federal Housing Finance Agency instructed Fannie Mae and Freddie Mac to begin looking at alternatives to outdated credit scoring models, he said. Minority groups, new immigrants and first-time buyers are among those who have been adversely affected by existing FICO models, he noted.

Fannie Mae is exploring a requirement to use “trended credit data” in Designated Underwriting, which will measure a potential borrower’s actual utilization of available credit, Harney said. Originally slated to take effect on June 25, 2016, at press time Fannie Mae had announced a delay of this metric to September 24, 2016. Under traditional reporting, lenders only see a snapshot in time, and not payment trends, Harney explained. Trended credit data shows whether a potential borrower is a “revolver” – one who constantly runs up balances – or a “transactor,” who pays off the balance each month, he said.

“The second half of 2016 will be all about supply, supply, supply and rates, rates, rates.”

“Credit industry research has shown that transactors, all other credit factors being equal, are better credit risks,” Harney said. “This is important information for underwriters and for lenders.”

Harney also discussed the Vantage Score, a competitor of FICO used by the large banks outside of the mortgage space. Vantage is a joint venture of the three credit bureaus. “What’s been noteworthy,” Harney said, “is that they’ve been ahead of FICO in going with rental payments and other non-traditional reporting items. They’ve been lobbying for improved scoring using nontraditional data.”

NORTHERN VIRGINIA HOUSING MIX

“Northern Virginia is becoming less and less of a suburban single-family market than ever before,” said David Versel, senior vice president with Delta Associates, a commercial research firm in Washington, D.C. Those Realtors® who get in front of this trend now will have a leg up on their competitors, he advised.

The Washington area is adding jobs, which will drive continued housing demand, Versel explained. “Here’s where there’s a bit of a disconnect,” Versel said. “In the good old days, around 35,000 units were added each year, and the vast majority were single-family.” In the last five to six years, the ratio is almost 50-50, he noted. “Too little single-family housing is being produced.”

The median price of new homes in the Arlington, Fairfax, Alexandria region is $1.1 million, Versel said. With so little single-family housing being produced, few potential buyers will be able to qualify for the limited inventory of affordable single-family homes.

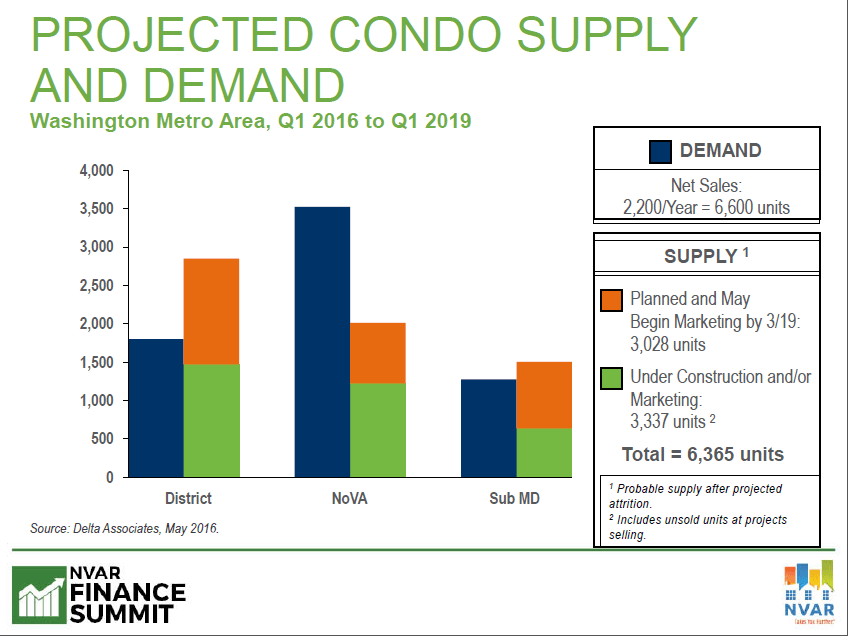

Most housing demand will be for multi-family units, mainly around Metro, Versel said. In two to three years, condo development will have a resurgence, he predicted. Due to a lack of appropriate sites, much of this development may occur in older commercial areas.

“Limber up your condo-selling muscles,” Versel advised.

Fears’ prediction: “The second half of 2016 will be all about supply, supply, supply and rates, rates, rates.”