A LOOK BACK at 2018 economic performance paints a positive picture for many – but will it continue?

The federal tax reform bill passed in December 2017 dramatically lowered corporate income tax rates and, to a lesser extent, lowered personal income taxes. This put more cash in hand for investors and most households and likely contributed to consumers’ positive view of their current economic conditions.

"Expect housing prices to increase but the overall number of units for sale and sold in the NVAR region to decrease. This will mean increased competition among residential brokers."

In March 2018, the party continued with the passage of a federal budget that included about $800 billion in new spending. This sparked hiring by government contractors in the D.C. region, particularly those involved in defense and security. The unemployment rate continued to drop, and by the fall there was broad evidence that tight labor markets were finally driving employers to increase salaries and wages for most workers – though the inflation-adjusted increases in earnings remain small on average. This good news was somewhat offset by rising uncertainty over trade policies, slowing global economic output, volatility in the stock market, and a growing consensus that the current economic cycle had hit its peak and would begin a slide towards eventual recession.

As the year came to a close, Northern Virginia got the biggest economic news to hit this region in more than 20 years. Amazon picked Crystal City for half of its HQ2 that will eventually lead to 25,000 new jobs. Still, for Realtors® in Northern Virginia, 2018 will be recorded as a tough year to be in a profession that navigates families through their most important financial decision: buying or selling a home.

SLOWING JOB GROWTH, LOW UNEMPLOYMENT

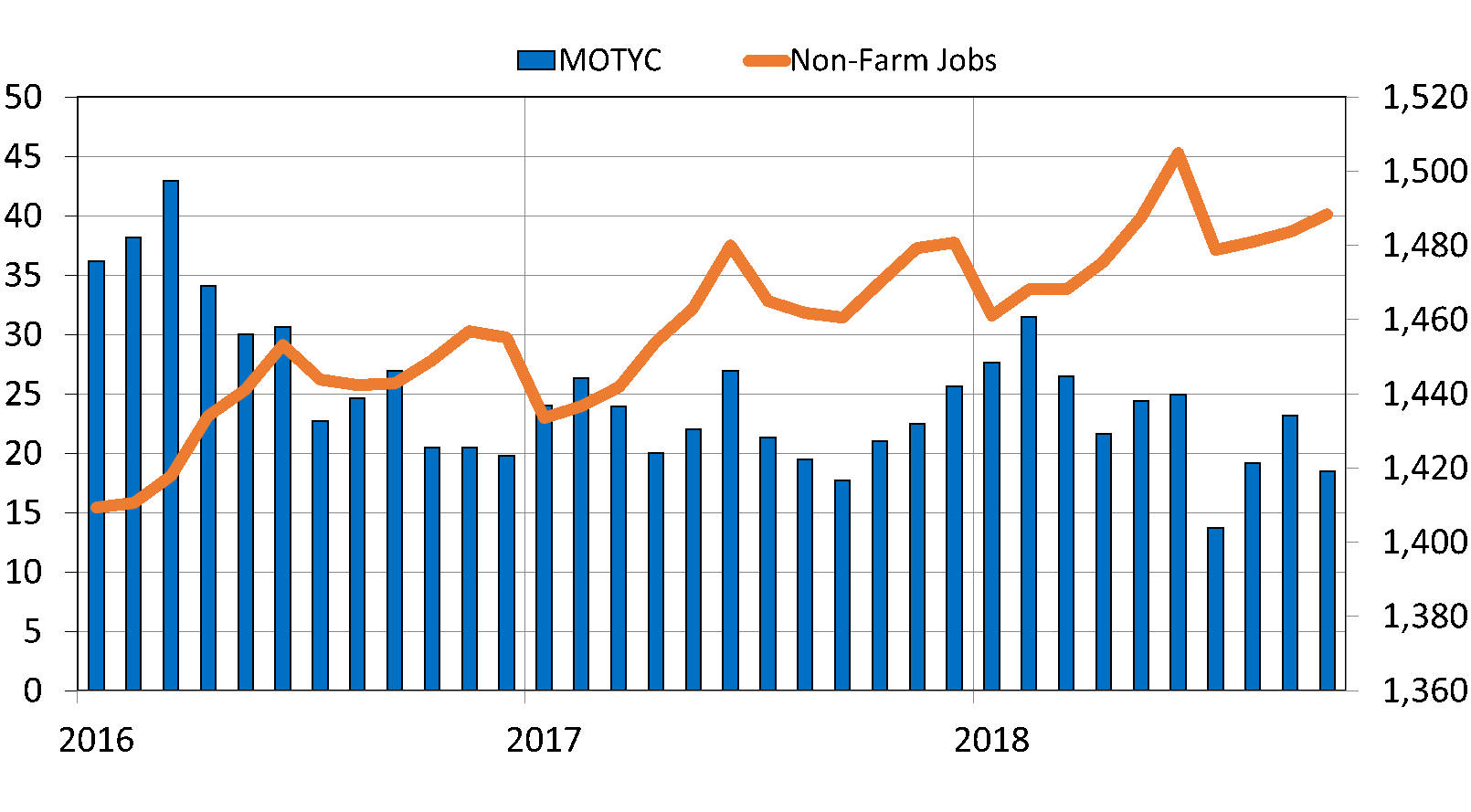

The Northern Virginia region, which includes the counties of Arlington, Clarke, Fairfax, Fauquier, Loudoun, Prince William, Spotsylvania, Stafford and Warren, and the cities of Alexandria, Fairfax, Falls Church, Fredericksburg, Manassas and Manassas Park, continues to grow (Figure 1). The region had over 18,000 net new jobs in October 2018 compared to October 2017. The volatility shown in Figure 1 exists because these data are not seasonally adjusted, which means they reflect shifts in summer employment, holiday season hiring, etc. The pace of growth has slowed since the first quarter of 2018 but remains strong.

Figure 1. Job Change January 2016 to October 2018, Northern Virginia (in thousands)

Source: Bureau of Labor Statistics

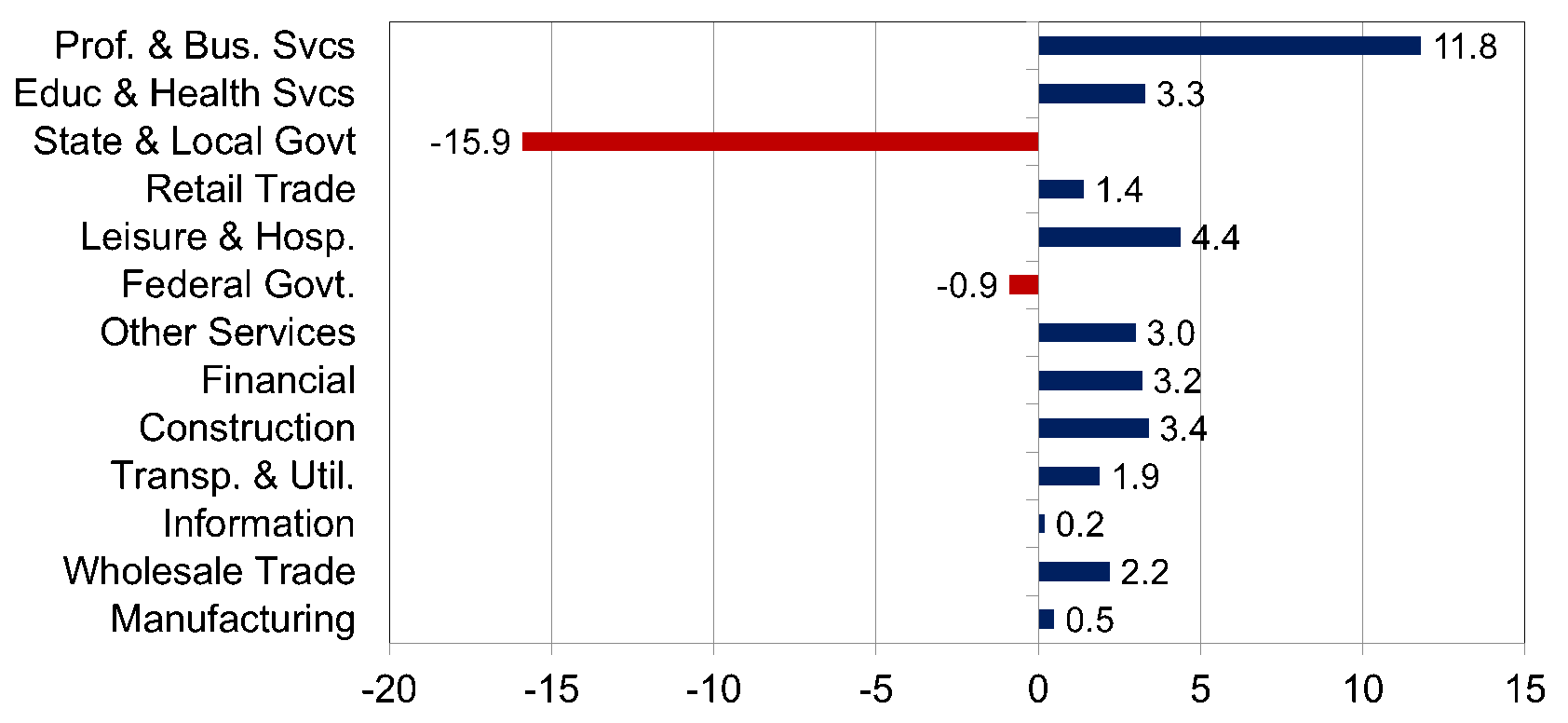

The local area enjoyed the fruits of congressional largess with Professional and Business Services employment growing by almost 12,000 jobs between October 2017 and October 2018 (Figure 2). This is the sector of the economy that represents most government contractors. However, the private business side of this sector is also growing, and data suggest that the region is reducing its dependence on the federal government for economic growth with particular success in computer-related services (cyber security and data centers) and a growing bio-technology sector.

Figure 2. Year-Over-Year Job Change, Northern Virginia

Ranked by Industry Size, October 2017 to October 2018 (in thousands)

Source: U.S. Bureau of Labor Statistics

Labor markets are extremely tight with the official unemployment rate remaining well below 3 percent. The only weakness is in government employment. Federal employment continues to drop largely due to a soft hiring freeze that prevents most agencies from replacing retiring workers. The data for October also shows a large decline in state and local government payrolls, but there may be some unusual seasonal effects that could ultimately be revised.

Overall, job growth in Northern Virginia for 2018 will be solid with total gains for the year expected to be about 20,000 jobs by the end of December.

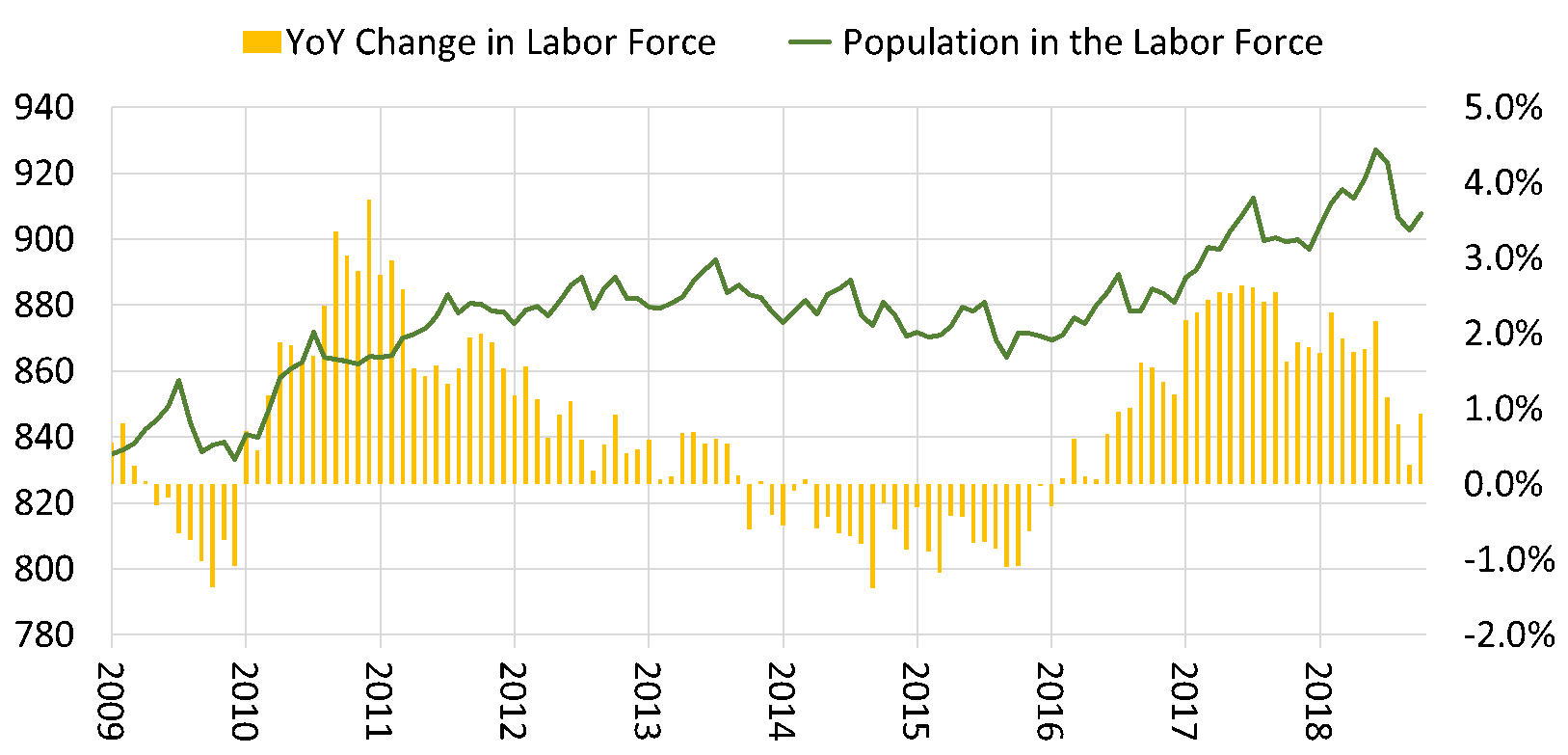

Despite the slowing growth of payroll jobs throughout the Northern Virginia region, the number of residents in the region’s labor force has continued to grow – though the pace of growth slowed dramatically over the summer of 2018 (Figure 3). The labor force includes residents of working age who are either employed or actively looking for a job. Gains in the labor force are related to discouraged workers (who lost their jobs in the downturn) re-entering the labor market, international migrants, and overall population growth. There are emerging concerns that federal immigration policies may be having a negative effect on our ability to attract international workers, which has implications for a wide range of local industries including construction, hospitality, health care and technology services.

Figure 3. Residents in the Labor Force, Northern Virginia (in thousands)

Source: U.S. Bureau of Labor Statistics

HOUSING GROWTH REMAINS RESTRAINED BY LOW INVENTORY

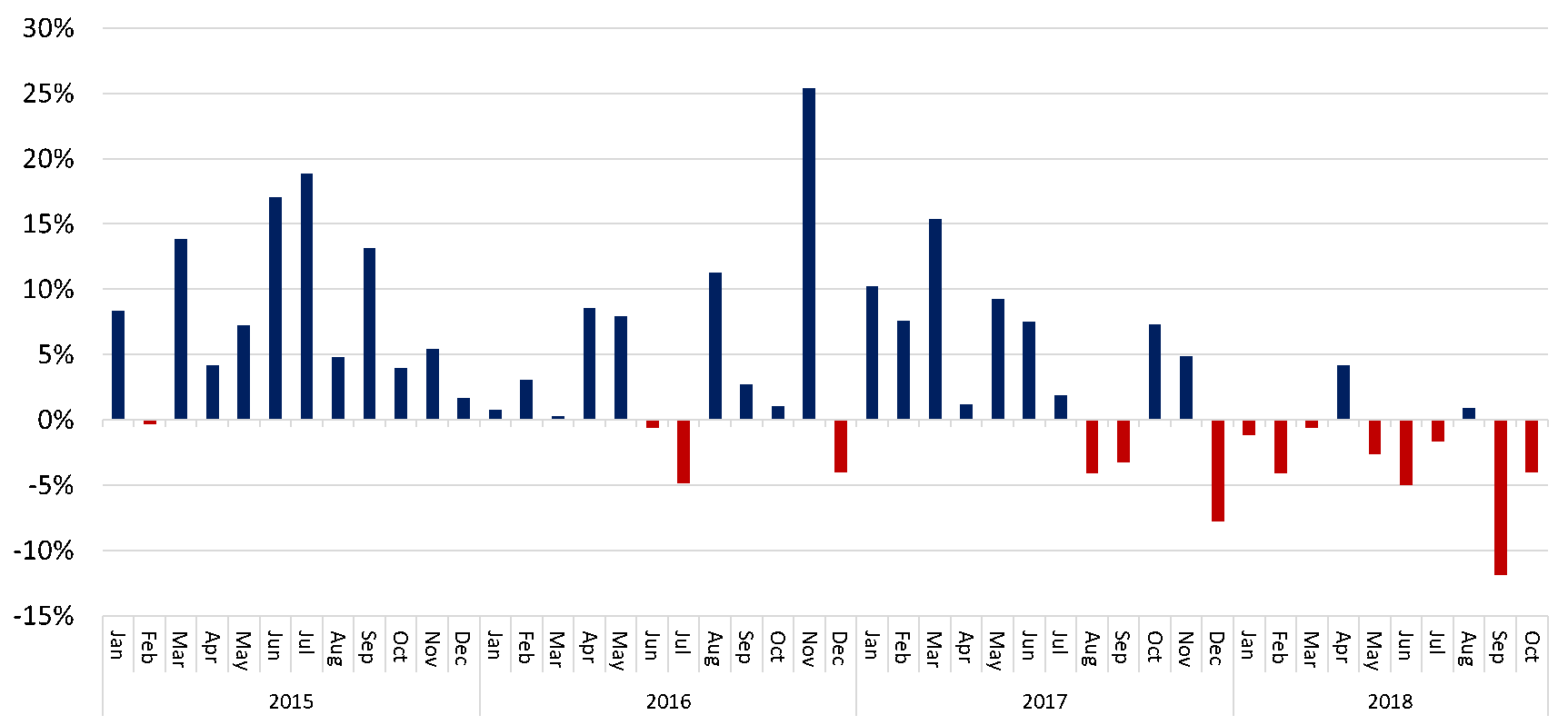

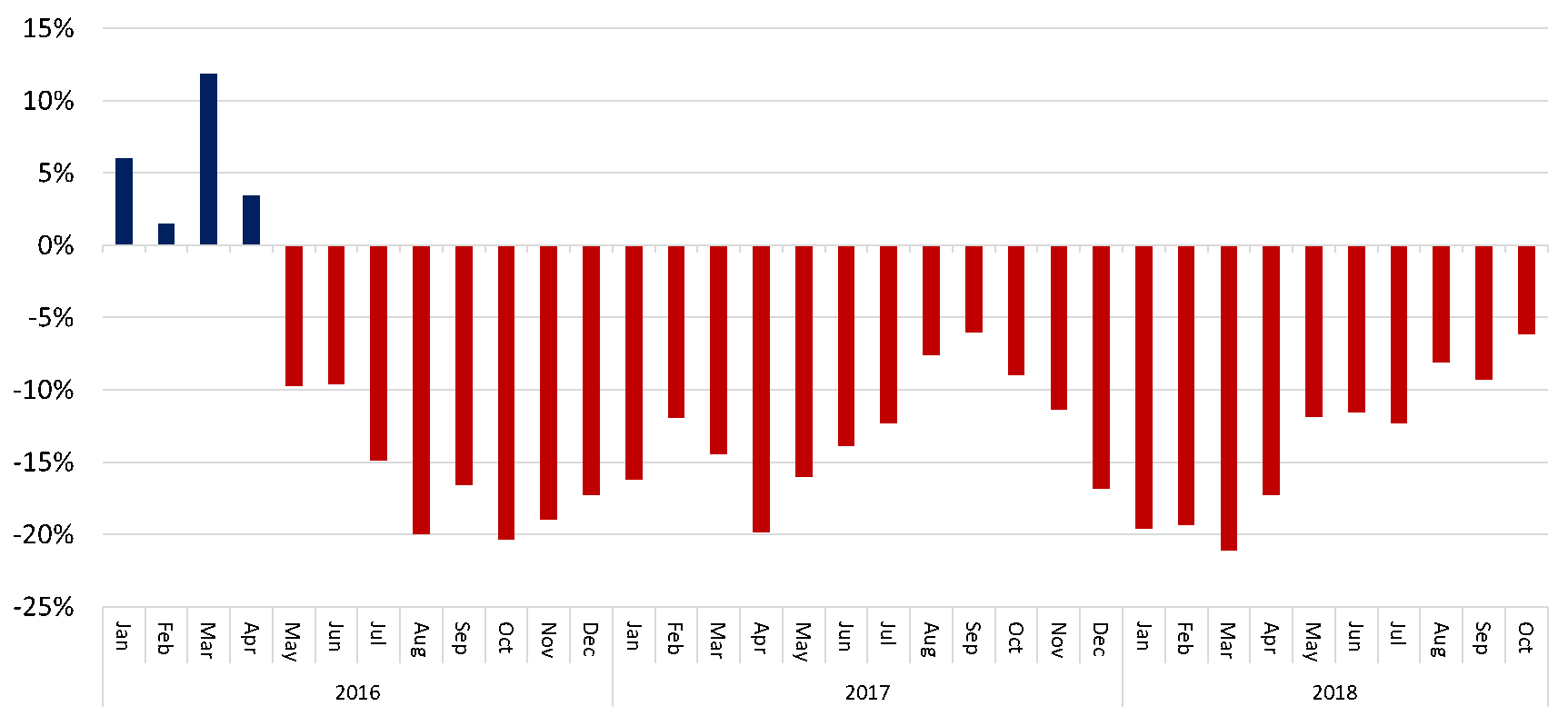

With job growth continuing and mortgage rates still below historic norms, one might reasonably expect the volume of home sales to be rising. Unfortunately, month- over-year data for units sold was negative in all but two of the first 10 months of 2018 with a precipitous drop of more than 12 percent in September (Figure 4). The reason is no secret – you need inventory to sell homes! Housing affordability and rising interest rates also play a part in declining market velocity.

Figure 4. Year-Over-Year Percent Change in Closed Home Sales, NVAR Region (Alexandria City, Arlington County, Fairfax City, Fairfax County, Falls Church City)

Source: Bright MLS. Statistics calculated 12/6/2018

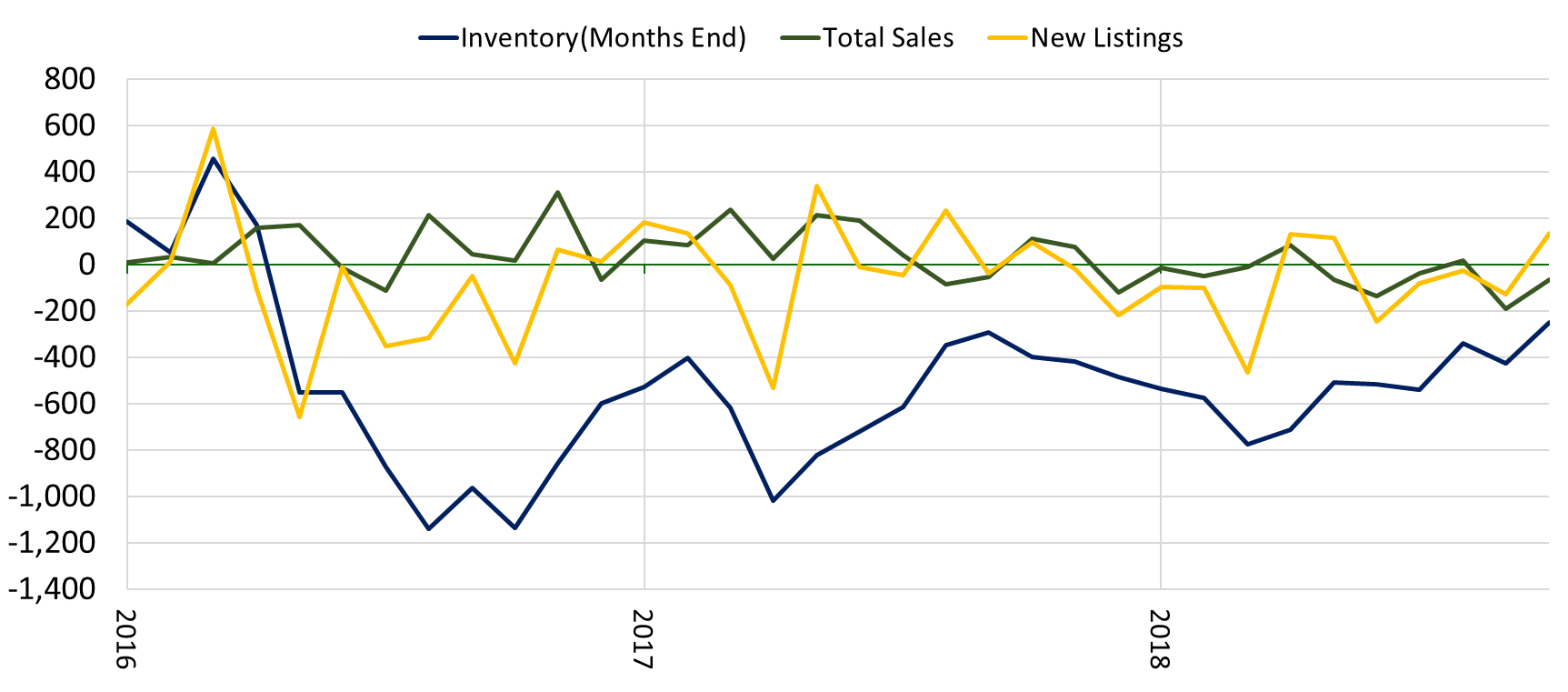

The number of active listings in the NVAR region, which includes Alexandria City, Arlington County, Fairfax City, Fairfax County and Falls Church City, continues its multi- year slide (Figure 5). The only good news is that the pace of decline has lessened somewhat since the beginning of the second quarter of 2018 due to lack of affordable move-up options; more senior households choosing to age-in-place; investors converting owner-occupied units to rental units; households choosing not to give up attractive mortgages; and lack of sufficient new for-sale home construction to meet the needs of a growing population.

Figure 5. Year-Over-Year Percent Change in Active Listings, NVAR Region

Source: Bright MLS. Statistics Calculated 12/6/2018

As shown in Figure 6, a dearth of new listings has created tight inventories that, in turn, have been a drag on total units sold for the last three years.

Figure 6. Sales, New Listings and Inventory, NVAR Region

Source: Bright MLS. Statistics calculated 12/6/2018

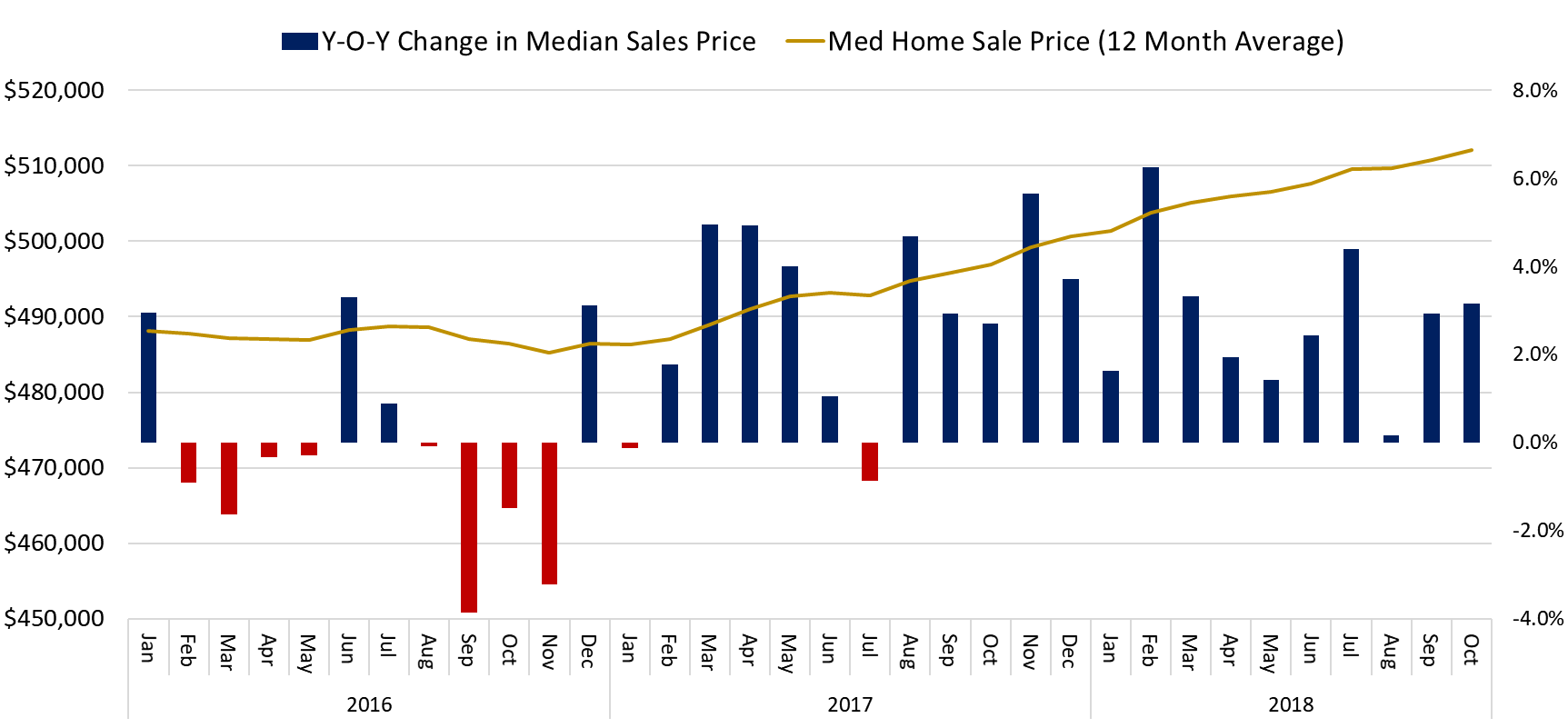

Tight inventories have helped boost sales prices, particularly in popular neighborhoods with highly-ranked schools. However, the increase in the median price of houses sold has remained modest (Figure 7). Remember, the median price is the middle price: half the homes sold for more than the median price and half sold for less than the median price. The Center for Regional Analysis (CRA) uses the median price instead of average price to prevent the sales of very high-end or very low-end homes from distorting the data. The good news is that the rise in median sales prices has stabilized since mid-2017. The overall sales price of homes has now returned to the pre-recession peak – not adjusted for inflation.

Figure 7. Median Home Sales Price, NVAR Region

Source: Bright MLS. Statistics calculated 12/6/2018

Housing affordability remains one of our biggest challenges in Northern Virginia and in the D.C. metro region overall. Many local leaders are worried that the lack of reasonably affordable homes may become a drag on our area’s ability to attract and retain young, highly skilled workers and their families.

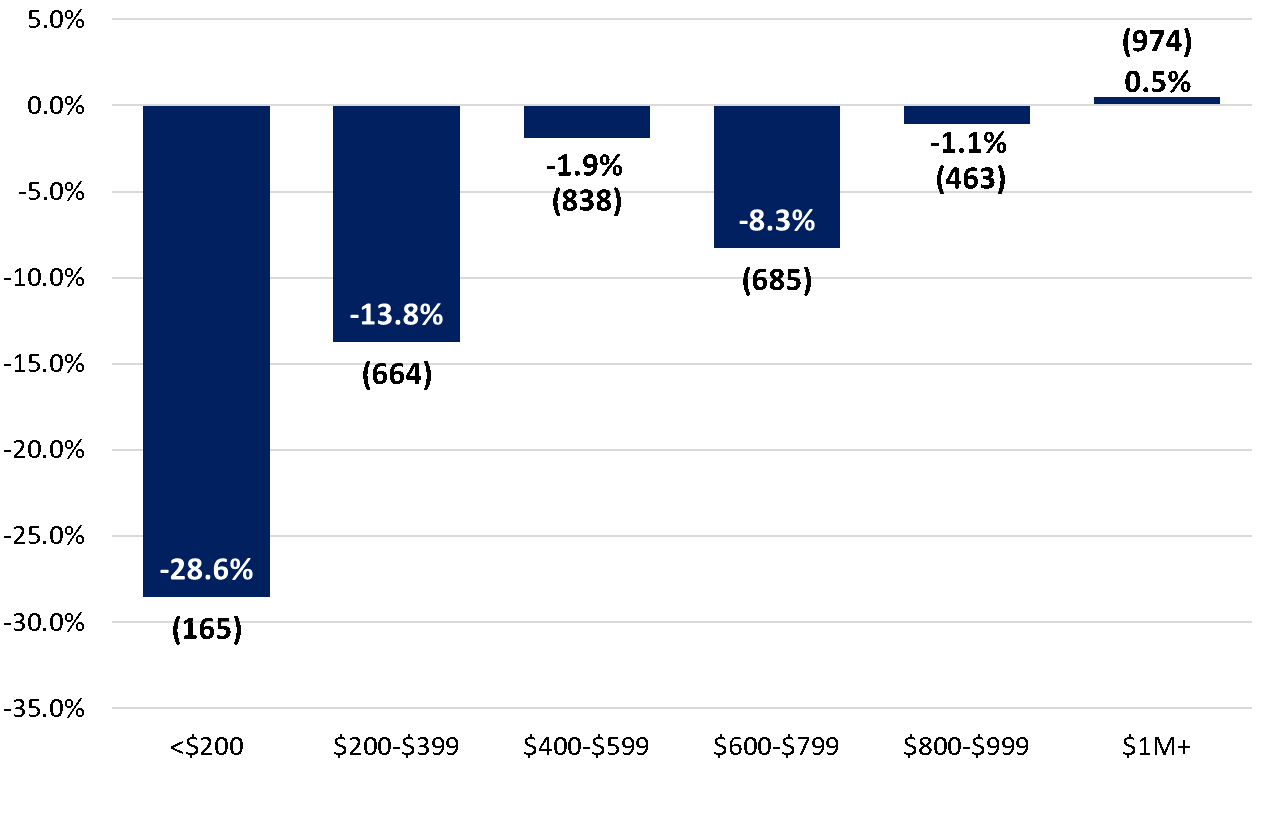

As shown in Figure 8, the biggest declines in inventory in the NVAR region have been for lower-priced homes – starter homes for millennial families and working families in service occupations, including teachers, fire fighters, trades, etc. Year-over-year, we have seen huge declines in the availability of homes for sale priced below $400,000.

Figure 8. Change in Inventory by List Price, October 2017-2018, NVAR Region

Source: Bright MLS. Statistics calculated 12/6/2018

NEW CONSTRUCTION STILL FOCUSED ON THE RENTAL MARKET

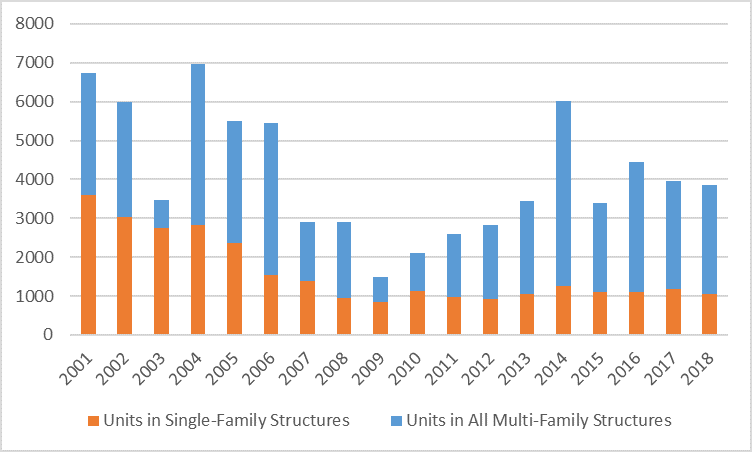

Focusing on new construction, Figure 9 shows that local governments have not meaningfully increased the issuance of new single-family construction permits in more than 10 years. The most recent data are for September 2018. The growth in multi-family permits has been dramatic and largely driven by rental units near Metro rail stations. In the first nine months of 2018, permits were issued for 2,782 multi-family units and just 1,061 single-family units. The share of single-family permits has been depressed since the housing bubble burst in 2007. Importantly, even though millennials are forming households later than previous generations, most still prefer single-family homes, especially single-family detached homes, for raising children.

Recent news reports suggest that rental units continue to dominate local housing development. The Ballston submarket expects that over 900 new apartments will be delivered in 2018. Some leaders have blamed low housing construction levels on the 2016 changes to Virginia law affecting developer proffers to local governments. Regardless of the causes, the pace of rental rate increases suggests that developers will continue to target that market segment for new construction.

Figure 9. Building Permits Through October by Year, NVAR Region

Source: U.S. Census Bureau, U.S. Department of Housing and Urban Development

2019 HOUSING MARKET WILL BE MORE OF THE SAME

CRA’s outlook for 2019 suggests that the residential real estate business will remain challenging due primarily to a lack of listings. (Details may be found in the NVAR/George Mason University Housing Market Forecast that is available at NVAR.com/marketstats.) The economy will continue to grow in 2019, but the pace of growth is expected to slow.

There could be some modest impacts of Amazon HQ2 by the third quarter of 2019 as the first phase of hiring gets underway – to be counted in the hundreds of jobs, not thousands. The easiest prediction to make for the coming year is that many homeowners in Alexandria and Arlington will believe their asking price for a home will have risen dramatically by Amazon’s announcement. Managing client expectations is always among Realtors®’ greatest professional challenges. Neighborhood-specific boosts in home prices related to Amazon’s Crystal City investment are expected – some of which will come from investors seeking to convert owner-occupied units into rental properties, which could further exacerbate inventory challenges. Home prices will rise but will remain constrained by mortgage qualification limits and rising interest rates. Currently, CRA’s expectation is that the Federal Reserve Bank will increase interest rates 50 to 75 basis points (0.5 to 0.75 percent) during 2019, but these increases may not be fully reflected in mortgage rates. Mortgage markets will continue to see demand for U.S. based investment instruments as a f light-to-quality strategy in response to volatile equity markets and concerns about Brexit and Chinese economic performance. Still, expect 30- year fixed mortgage rates (conforming and government) to be about 5 percent by next fall.

Expect housing prices to increase but the overall number of units for sale and sold in the NVAR region to decrease. This will mean increased competition among residential brokers. Those who succeed in 2019 will be the agents who are deeply informed about their local markets, are keenly aware of overall economic trends, and are up-to-date on new trends and approaches to serving their clients.

Terry Clower is the director of the George Mason University Center for

Regional Analysis.

Keith Waters is a research associate with the George Mason

University Center for Regional Analysis.