Year-End Economic Briefing Forecasts What Lies Ahead in the Northern Virginia Market

While 2015 did not deliver the expected economic surge, 2016 is predicted to be the best year of the decade, according to Dr. Stephen Fuller. He presented his year-end analysis at the NVAR Small Broker Forum on Dec. 9.

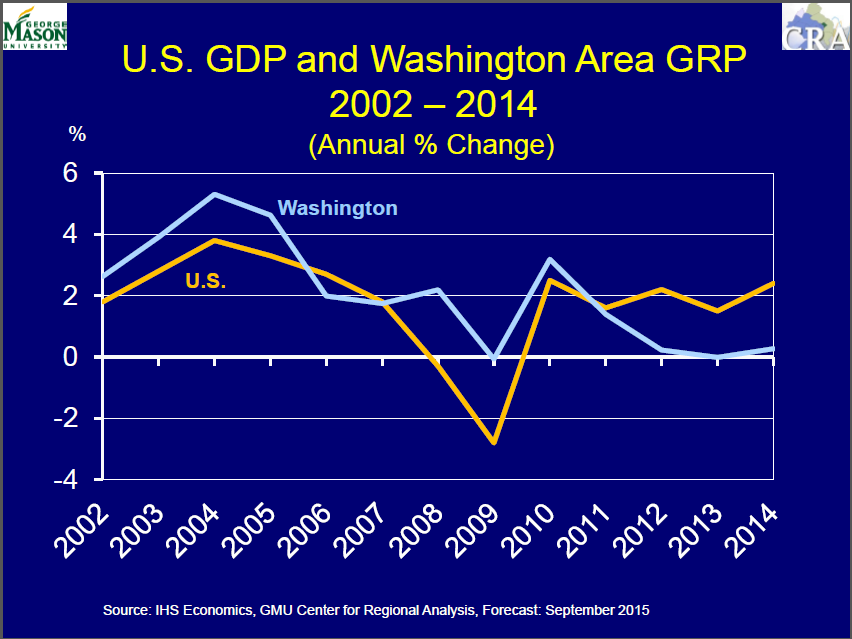

The Washington metro region, like the rest of the nation, continues its recovery cycle from the Great Recession, the third longest of the 12 such cycles since World War II, according to Fuller. “By the time the next president is sworn in, it will be the second longest,” Fuller said. And there will be another downturn, he predicts.

THE NEXT BUBBLE

“There’s one bubble right now – low interest rates,” said Fuller. “Money is too cheap.”

Reviewing the Institute for Supply Management Manufacturing Index, Fuller noted that it went negative in 2015. Given the strength of the dollar, there is less global interest in purchasing U.S. products, he explained. Typically the Federal Reserve considers lowering interest rates when this happens, Fuller said. “But the Fed has no wiggle room on monetary policy, because the interest rate is close to zero,” he added. “Rates must go up so that they can come down!”

Fuller predicted that there was an 80 percent chance that interest rates would increase by ¼ percent on December 16. In fact, the Fed did institute that increase. This could have the effect of bringing mortgage rates above 4 percent, he said. “Rates are expected to rise four times in 2016 – maybe ¼ percent each time.” Fuller noted that there would be some lag for the mortgage interest rates to follow suit.

Interest rate uncertainty has contributed to wavering consumer confidence, Fuller explained. “Consumers have been mystifying to me,” he said. Despite the fact that lower oil prices have spurred short-term consumer spending, as consumers look forward, they are worried, he noted. “If they don’t think the future is better than the present, they’re not willing to take risks – like moving to a new house,” Fuller said.

BOOMERS WON'T BUDGE

Analysts are paying particular attention to homeowners aged 50 and older, Fuller noted. This group, the Baby Boomers, owns 32 million homes, he said, and they are not selling at the same age as their parents did. “We know it will happen,” Fuller said, “but they’re not ready yet.” These are the homes that the next younger age group will move into.

Several factors may be holding this group back, Fuller explained:

• Home equity –some Boomers’ homes are not yet as valuable as they would like

• Continued employment – they are working longer

• Uncertainty.

“The Washington region is no longer a company town, Fuller concluded. 'We need to figure out what is our brand? It needs to be a business brand.'"

JOBS AND GROSS DOMESTIC PRODUCT: A SEA CHANGE FOR THE DMV

In the Washington Metro region, economic growth is not following the national trend, Fuller noted. “We’ve gone through an adjustment because of a shift in our economy,” he said.

Fuller summarized federal spending trends in the DC Metro area between 2010 and 2014 as follows:

• Federal procurement outlays declined $11.2 billion (13.6 percent) between FY 2010 and FY 2014

• Federal employment has declined since peaking in July 2010, losing 23,700 jobs (6.1 percent)

• Federal payroll declined by $2.5 billion (6.4 percent) between FY 2010 and FY 2014, and will continue to decline as older workers retire and are replaced by younger workers.

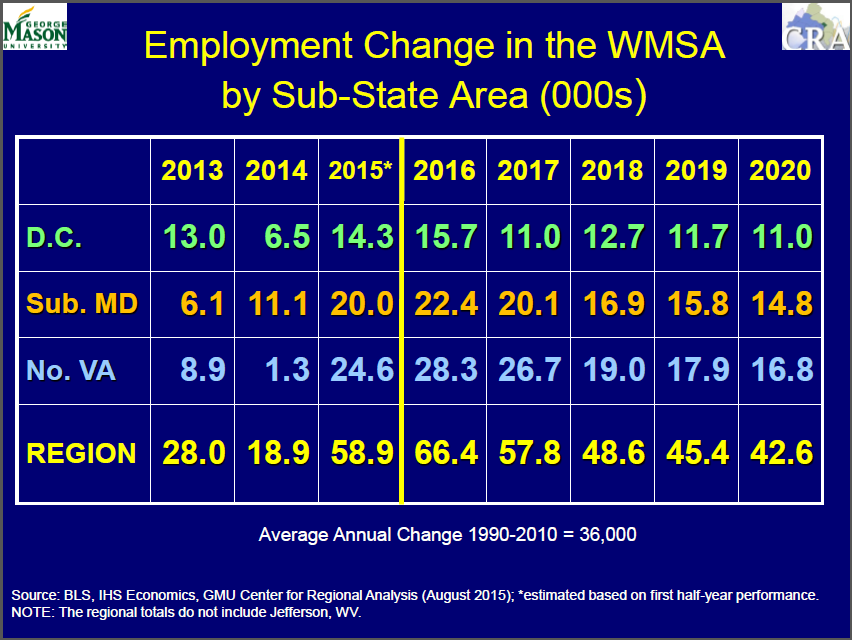

As the epicenter of government spending, Northern Virginia needs to diversify its economy, he explained. The biggest sectors – Professional & Business Services and Education & Health Services – are adding the most jobs – 15,000 out of a total 31,900 new jobs between Sept. 2014 and Sept. 2015. “We need to learn to do what we know how to do – for someone else,” Fuller said. “The future has to be in private spending.”

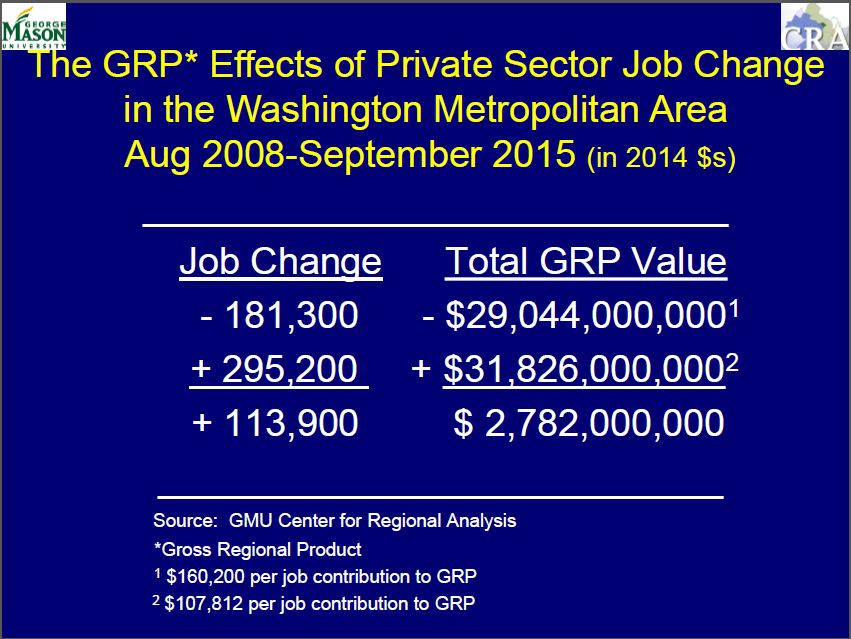

Despite recent job growth in the Washington Metro region, the jobs added are worth less in terms of contribution to the Gross Regional Product than jobs that were lost – which has implications for the housing market, Fuller explained. “We need to gain a lot of jobs just to break even,” Fuller said. “The jobs we’re adding support the rental market,” he noted.

The region created better jobs in 2015 than in 2014, Fuller said – primarily in the higher-paying Professional & Business Services category. And 48 to 50 percent of the total regional growth was in Northern Virginia. “The whole region is not at potential yet, and Northern Virginia is not fulfilling its promise” he added.

Fuller expects that Northern Virginia will do better than other parts of the region due to a larger Business to Business sector with relationships outside of the region. “We’re more entrepreneurial,” he said.

Summarizing a recent GMU analysis of local business needs for the future, Fuller said that talent was cited most often. Work changes all the time, and “we need to be able to upscale our workforce,” he said. Other factors ranking high among local business leaders: affordable housing, transportation, mobility and collaboration among jurisdictions.

The Washington region is no longer a company town, Fuller concluded. “We need to figure out what is our brand? It needs to be a business brand.”

Ann Gutkin is the NVAR Communications Director.