Lower Priced Inventory Remains Lean

The housing market in the NVAR region had robust increases in closed sales in 2015 compared to 2014, using data through October of each year. However, price growth has been modest, with most of the gains resulting from the mix of closed sales. Inventory continued its rise although the rate of growth lessened in the fall. Both job growth and new construction trends indicate that the existing homes sales market will continue its upward trajectory into 2016.

ECONOMIC TRENDS

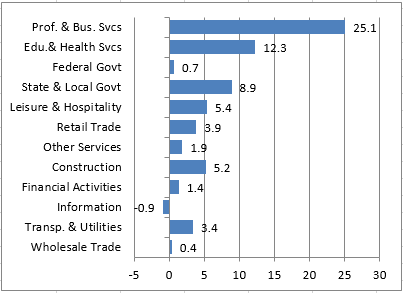

The Washington region, which includes the District, five counties in Maryland, 17 jurisdictions in Virginia and Jefferson, West Virginia, continued to have strong job growth relative to 2014. Between October 2014 and October 2015, the region added 67,100 jobs, including 25,100 Professional & Business Services jobs. This is the largest year-over-year gain for Professional & Business Services jobs since 2005. Job growth within Northern Virginia was also strong, and 31,900 jobs were added between October 2014 and October 2015, including large gains in Professional & Business Services (+9,100).

Between September 2014 and September 2015, the unemployment rate in every jurisdiction in the NVAR region declined. The NVAR jurisdictions continue to have unemployment rates that were significantly lower than the Washington region's rate of 4.3 percent: Arlington was 2.8 percent, Falls Church City was 3 percent, Alexandria was 3.2 percent, Fairfax City was3.2 percent, and Fairfax County was 3.3 percent.

NEW CONSTRUCTION

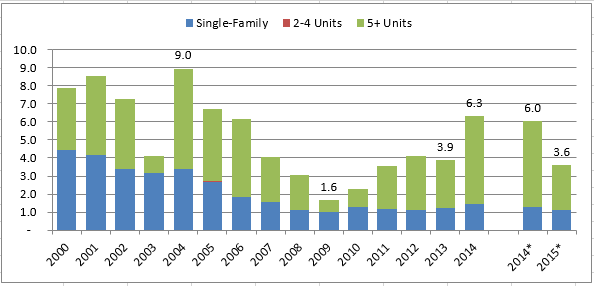

New construction in the NVAR region slowed in 2015. Through October 2015, 3,602 building permits were issued, which is 40.4 percent fewer than during the same period in 2014. Multi-family buildings with five or more units primarily drove the decline (-47.7 percent), but permits for single-family units also decreased (-14.7 percent).

The total number of building permits issued in 2014 was the highest total since 2005, but nearly all gains since 2009 have been from multi-family units. Single-family construction has been subdued since 2008, in part due to limited land availability. While new construction in 2015 was not on track to exceed 2014, it is likely that it will surpass its 2013 level.

EXISTING HOME SALES

CLOSED SALES

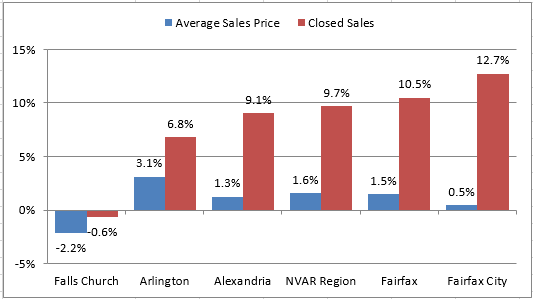

Closed sales in the NVAR region increased 9.7 percent in the first 10 months of 2015 compared to the same period in 2014, but were below their 2013 levels. Fairfax City (+12.7) and Fairfax County (+10.5 percent) led the region in growth. Only Falls Church City had fewer closed sales during this period, and decreased 0.6 percent, or by one sale.

“Closed sales in the NVAR region increased 9.7 percent in the first 10 months of 2015 compared to the same period in 2014, but were below their 2013 levels."

The ZIP Codes with the largest gains were 22202 which includes Aurora Hills and Crystal City (+42.8 percent), 22066 which includes Great Falls (+29.7 percent), and 22032 which includes neighborhoods to the east of George Mason University between Main Street and Braddock Road (+27.0 percent).

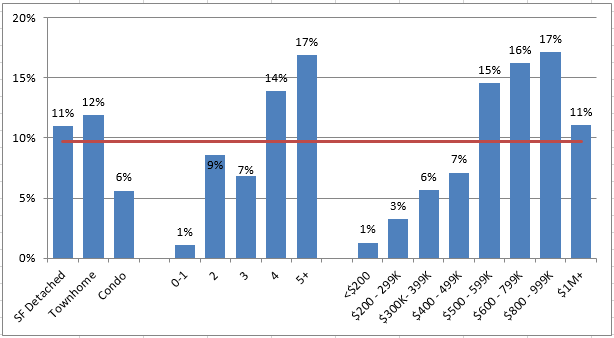

The demand for townhomes and single-family detached homes outpaced that for condo units. Closed sales of townhomes increased 11.9 percent between the first 10 months of 2014 and 2015, compared to an increase of 9.7 percent for all housing types. Single-family detached homes rose nearly as much, 11 percent, during the same period.

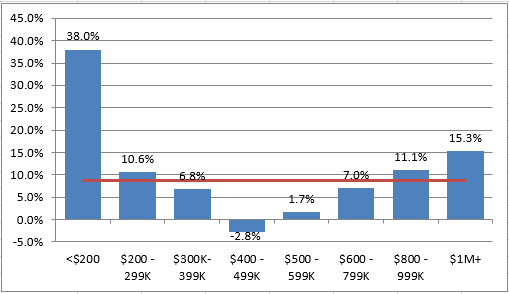

Also shown in Figure 4, homes with four or more bedrooms had larger increases in closed sales than smaller homes. Similarly, homes with sales prices of $500,000 or higher had sharper growth in 2015 than homes with lower sales prices.

AVERAGE SALES PRICE

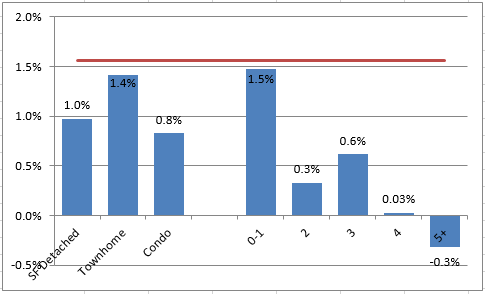

The mix of sales drove the overall price gains. Of the housing types, townhomes had the sharpest increase in the average sales price (+1.4 percent).

The average sales price for studios and one-bedroom homes increased 1.5 percent and led in growth. The average sales price for homes with five or more homes declined slightly, (0.3 percent), while that for four-bedroom homes was nearly unchanged (+0.03 percent).

Of the jurisdictions, Arlington led in sales price growth (+3.1 percent). Falls Church City was the only jurisdiction with a lower average sales price and declined 2.2 percent. The ZIP codes with the sharpest increases were 22206, which includes Fort Belvoir (+18.8 percent), 22209 which includes Rosslyn (+12.7 percent), and 20124 which includes Clifton (+11.0 percent).

INVENTORY

In October 2015, inventory reached its highest October-level since 2008 with 5,572 active listings. Compared to October 2014, inventory rose 8.7 percent. The gains slowed somewhat in the fall, and the first half of 2015 had double-digit year-over-year increases in inventory.

Condo properties and smaller homes had slightly faster growth in inventory between October 2013 and October 2015, which may reflect the quicker sales pace of the single-family detached homes, townhomes and larger homes.

Homes priced between $300,000 and $800,000 lagged the growth in active listings in October 2015. Overall, the NVAR region had 3.3 months of supply as of October 2015, which was unchanged from October 2014 but higher than the October-levels between 2009 and 2013.

Despite the October growth, inventory was relatively low, particularly for specific price-points. Homes in the $300,000 to $800,000 price range had fewer than three months or supply. Combined with the weak growth in active listings, going forward, inventory in this price range may be tight.

OUTLOOK

National economic trends remain strong, with both job gains and gross domestic product growth beating expectations. It seems increasingly likely that the Federal Reserve will raise rates, which may slow the rate of home sales . For the NVAR and Washington region, the economic conditions and slowed price growth will act as countervailing forces that may lessen the impact of rising rates.

Jeannette Chapman is a research associate at the George Mason University Center for Regional Analysis