How cash buyers are influencing the market.

One of the most visible after-effects of the national economic recession of 2008 and 2009 was the proliferation of investors paying cash to acquire residential properties. Initially, most cash transactions involved distressed properties that were sold via foreclosure or short sale. Over the past four years, while the backlog of bank-mediated transactions has dwindled, the volume of cash purchases has not. RealtyTrac research shows that in July 2013, 40 percent of all homes sold in the U.S. were cash sales, with the cash market being driven by a combination of investors, retirees and vacation home buyers.

The continued prevalence of cash buyers has contributed to higher prices for homes and difficulties for would-be buyers to obtain financing for purchases.

CASH SALE TRENDS IN NORTHERN VIRGINIA

As with the U.S. as a whole, Northern Virginia experienced a spike in the number of foreclosures and short sales during 2008 and 2009. In October 2009, 29 percent of all residential sales in Northern Virginia were either foreclosures or short sales, as reported by RealEstate Business Intelligence (RBI).

Four years later, in October 2013, just 3.2 percent of sales in the area were bank-mediated. Despite the dramatic reduction in the number of distressed property sales in the region, the overall number of cash sales has actually continued to increase. The characteristics of these sales have changed considerably since 2009, though.

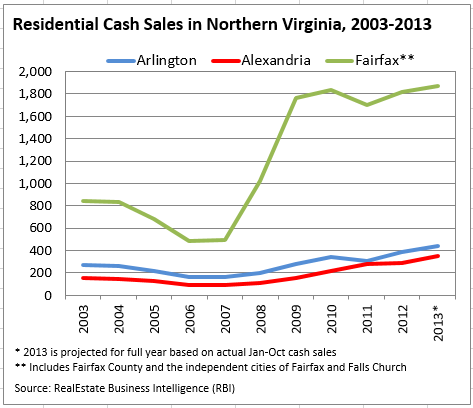

In 2006, at the peak of the previous housing cycle, there were just 739 cash sales of residential properties in Northern Virginia. This figure tripled over the next three years: in 2009 there were 2,205 cash sales. Most of the increase in cash sales activity occurred in Fairfax County, where the number of cash sales shot up from 457 in 2006 to 1,709 in 2009, a 274 percent increase. Significant increases also occurred in Arlington (+75 percent) and Alexandria (+66 percent) between 2006 and 2009.

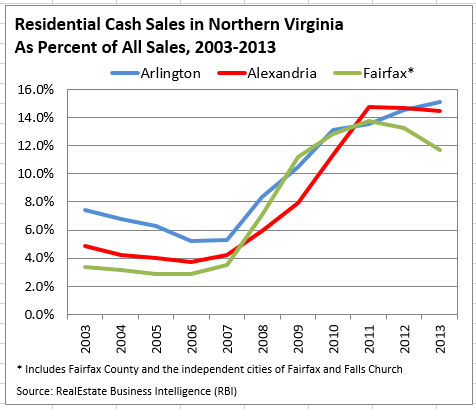

The influence of cash buyers on the regional housing market has continued to be strong since 2009. The total number of cash sales in Northern Virginia increased another 13 percent between 2009 and 2012.

Based on sales activity from January to October, 2013, it is expected to increase for the entirety of 2013. The influence of cash buyers has gained strength in Arlington and Alexandria: cash sales accounted for 15 percent of sales in each jurisdiction between January 2012 and October 2013.

CASH SALES BY PRICE AND UNIT TYPE

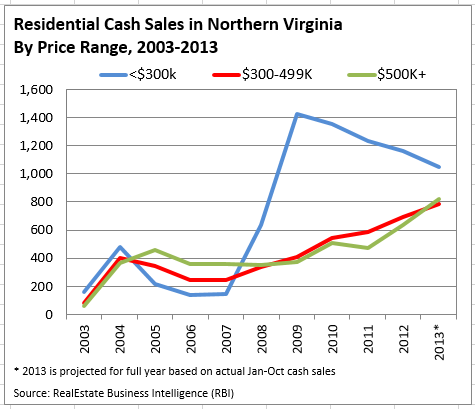

The pace of cash sales has diverged greatly in Northern Virginia for units at different price points. During the boom period of the mid-2000s, the number of cash purchases among lower-, mid-, and higher- priced units were roughly comparable: between 2003 and 2007 there was an average of 229 cash sales for units that sold for less than $300,000, compared with 265 for units in the $300,000-499,999 range and 320 for units sold for $500,000 or more.

The number of cash sales of sub-$300,000 units began to increase sharply in 2008, peaked at 1,427 in 2009, and has decreased slightly every year since then. There were 876 cash sales for units sold under $300,000 from January to October 2013, which projects to about 1,050 for the year.

Among units that sold for more than $300,000, the number of cash sales did not spike, but instead has increased steadily each year since 2007. Between January and October 2013 there were 686 cash sales for units sold for $500,000 or more and 656 for units sold between $300,000 and $499,999. This pace projects to about 800 cash sales in each category for the year.

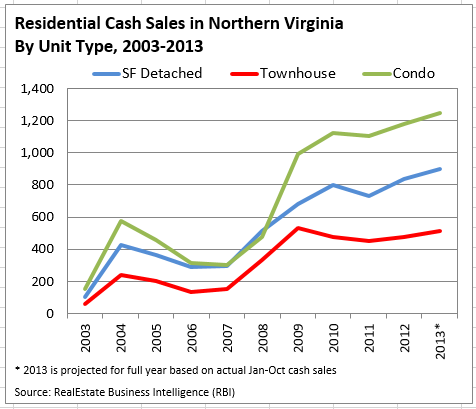

There has also been a recent divergence for cash sales among the three primary unit types—single-family detached, townhouse and condo—though this did not occur until 2009. As recently as 2008 there were more cash sales of single-family detached homes in Northern Virginia (514) than of condos (477).

The number of condos sold via cash sale more than doubled in 2009, and has continued to increase since then. There were 1,041 cash sales of condos between January and October 2013, projecting to more than 1,200 for the year.

By comparison there were 750 single-family detached cash sales from January to October 2013, projecting to 900 for the year. There have consistently been fewer cash sales of townhouses in the region than the other unit types, and the pace of townhouse cash sales has remained flat since 2009.

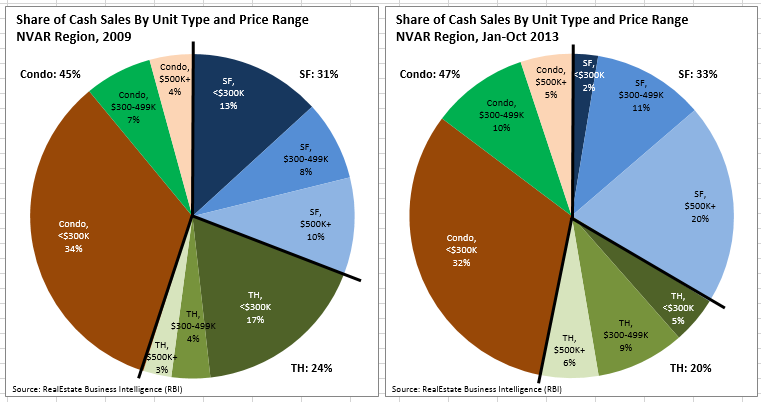

These shifts in the patterns of cash sales by price and unit type have dramatically altered the profile of the cash sale market in Northern Virginia, specifically for single-family units. In 2009, at the bottom of the market, 30 percent of cash sales in the area were for single-family units priced below $300,000 (17 percent townhouses, 13 percent detached).

From January to October of 2013 just 7 percent of all cash sales in the region were of single-family units of less than $300,000. Meanwhile the share of single-family sales (both detached and townhouses) in excess of $300,000 relative to all cash sales has increased from 25 percent in 2009 to 46 percent in 2013.

Interestingly, while the characteristics of single-family cash sales have shifted from 2009 to 2013, the profile of condo cash sales has not changed much. The shares of the total cash sale market for each price range of condos remained stable between 2009 and 2013, with a slight decrease in the share of sub-$300,000 units and slight share increases for higher-priced condos.

IMPLICATIONS OF CASH SALE TRENDS

Cash buyers are continuing to play a central role in the Northern Virginia housing market, albeit a different role than they played during the recession. At that time, they were primarily investors looking to acquire distressed and/or undervalued properties.

“Looking ahead, all signs point to continued demand from cash buyers.”

Today, many cash buyers in the region are targeting higher-end, single-family properties, and these buyers are more likely to be affluent, older homeowners than investors. The more attractive property type for cash investors is lower-priced condominiums, which still account for about one-third of all cash sales in Northern Virginia.

Looking ahead, all signs point to continued demand from cash buyers:

• Escalating home prices will drive investors to keep buying and should push current homeowners to sell their homes and apply the equity to their new homes.

• Limited inventory in the market will ratchet up pressure on buyers to make cash offers to speed up closings.

• Rising interest rates will make financing more expensive and create an incentive to pay cash.

• The region’s tight rental housing market makes condos and townhouses attractive to investors.

For all of these reasons, cash buyers are expected to continue to have a strong influence on the Northern Virginia housing market through at least 2015.

David Versel bio, photo