Northern Virginia Home Sales Climb in October as the Market Continues to Find Balance

Inventory Growth and Steady Demand Signal a Healthier Housing Environment Despite Federal Government Shutdown

FAIRFAX, Va. (November 12, 2025) Northern Virginia’s housing market demonstrated continued resilience in October, with key indicators reflecting growing balance between supply and demand, according to the Northern Virginia Association of Realtors® (NVAR). Closed sales, prices, and total sold volume all rose compared to the same month last year, while inventory levels expanded significantly — offering buyers more options in a still-competitive environment.

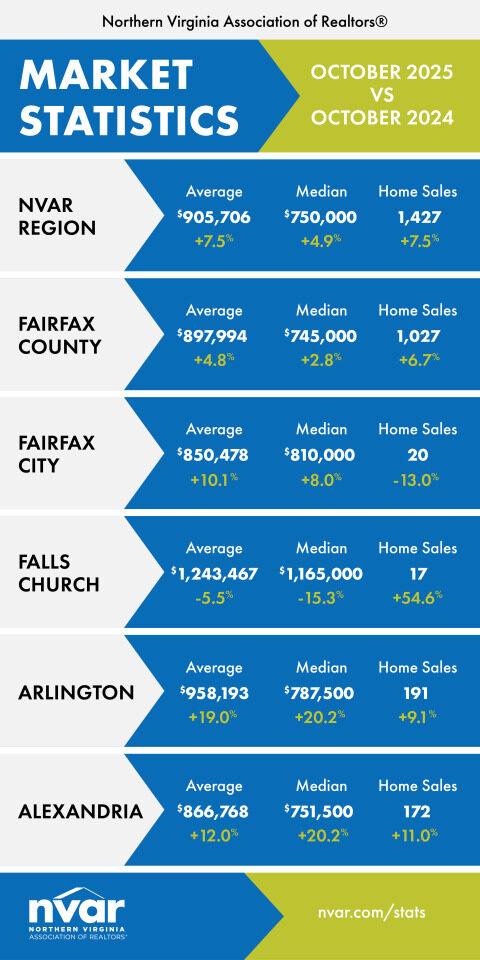

In October 2025, Northern Virginia recorded 1,427 closed sales, a 7.5% increase from October 2024. The total sold dollar volume climbed 16.5% year-over-year to more than $1.3 billion, reflecting both stronger transactional activity and higher price points. The median sold price rose 4.9% to $750,000, underscoring continued buyer demand for well-priced, move-in-ready homes across the region.

“The growth we’re seeing in both sales and dollar volume is a sign of steady confidence in Northern Virginia real estate,” said NVAR CEO Ryan McLaughlin. “Even as buyers adjust to mortgage rates hovering around six percent, the fundamentals of our market — strong employment, desirable communities, and economic diversity — remain incredibly solid.”

At the same time, housing supply is improving. The number of active listings reached 2,562 in October, a 42.2% increase compared to last year. The months of supply of inventory rose to 1.85, up 36.8% year-over-year, suggesting a gradual shift away from the extreme tightness that characterized the market in prior years. Homes spent an average of 27 days on the market, a 42.1% increase from last October, another indicator of returning balance.

“An increase in inventory gives both buyers and sellers a sense of breathing room,” said NVAR Board Member Christina Rice, Pearson Smith Realty. “While prices remain high, we’re seeing more flexibility and healthier negotiations, which ultimately create a more sustainable housing environment.”

The federal government shutdown that began on October 2 has introduced some uncertainty into the regional economy, though its immediate impact on housing has been limited. “While we’re monitoring how the shutdown may affect buyer confidence and transaction timelines, Northern Virginia’s housing market remains steady,” McLaughlin noted. “Northern Virginia’s strong base of public- and private-sector employers can help mitigate some of the short-term effects that often accompany a federal shutdown.”

As 2025 nears its close, Northern Virginia’s housing market continues to show stability amid a changing national landscape. “This year has been about adaptation — buyers and sellers alike are finding their footing in a market that’s becoming healthier and more predictable,” McLaughlin said. “That’s a very positive trend for our region.”