Looking for a Realtor®?

Whether you are ready to buy or sell now or simply exploring your options, Northern Virginia Realtors® are the trusted experts you want by your side for likely one of the biggest financial decisions of your life.

Find the Realtor® right for you!

Realtor® Members

13,000

Service Providers

180+

Sales Volume

$16 Billion+

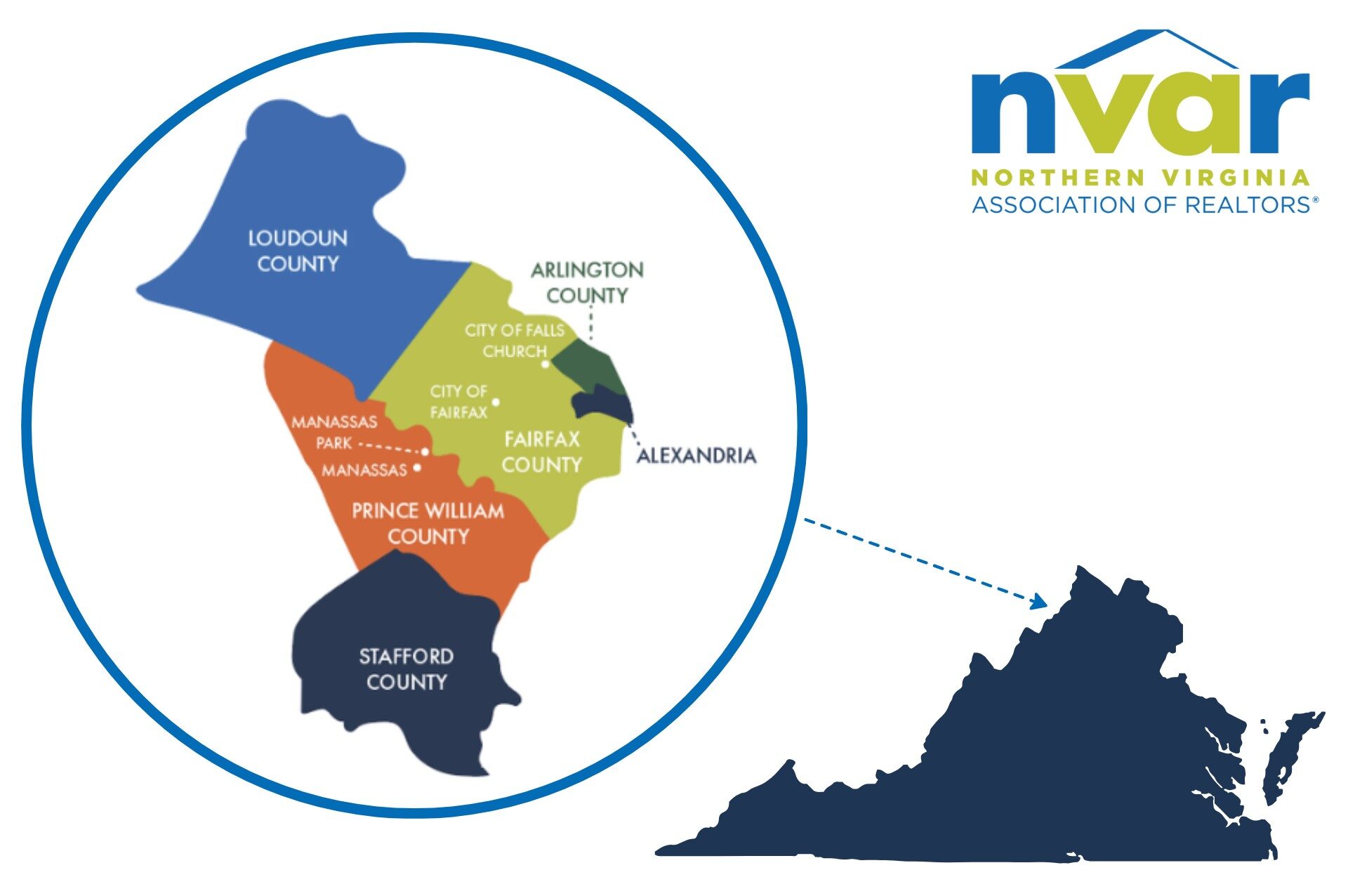

As Northern Virginia’s source of real estate knowledge, we serve the whole community. To best serve our members and the public, we tailor our messages specifically for you.

Why Hire a Realtor®

Expertise

Northern Virginia Realtors® are your market experts. They can guide you through complicated procedures and technical laws, regulations, and contract documents.

Connections

Northern Virginia Realtors® have access to a vast network of Service Providers. NVAR’s Service Provider members offer services and products that support Realtors® and their clients.

Commitment

Our Realtors® are committed to following the Realtor® Code of Ethics, NVAR’s Bylaws, and Lockbox Rules. Their responsibility is to the client, and they will always act in your best interest.

179 Ways Realtors® are Worth Every Penny

Want to learn more about the various stages of an average real estate transaction and the value Realtors® provide? Check out NAR’s 179 Ways here.

Real Estate Agent vs. Realtor®

A real estate agent is a licensed professional who assists clients in the buying or selling of property within their state. They are required to complete regular mandatory education.

A Realtor® is a real estate agent who is a member of the National Association of REALTORS® (NAR). Realtors® must follow a strict Code of Ethics and professional standards set by NAR, in addition to state requirements. When choosing to work with a Realtor®, you are making the decision to partner with a professional who will put you first!

Service Providers

Connect with NVAR’s Service Providers for all of your needs including: mortgage lenders, home inspectors, photographers, title and settlement companies, movers, and more!

Consumer Guides on Real Estate Hot Topics

The National Association of REALTORS® puts together guides to help you understand hot topics and evolving trends as a way to support you through your real estate journey.

First-Time Homebuyer Resources

Start your homeownership journey with confidence.

Whether you’re just exploring the market or ready to make an offer, these trusted tools and resources will help you understand your options, find the right home, and connect with a qualified professional every step of the way.

Begin your homebuying journey by connecting with a licensed real estate professional on Realtor.com. Search for experienced Realtors® in your area and explore current home listings to get a feel for the market.

Find a Realtor®

Stay informed with the latest housing trends. NVAR Market Stats offer up-to-date information on average home prices, inventory, median sales, and more — tailored to Northern Virginia.

Nestfully is a consumer-friendly home search platform supported by Bright MLS. You can browse homes for sale or rent, view listing details, and even use helpful tools like the built-in mortgage calculator. It’s a great place to start exploring the market alongside your Realtor.

Understanding fair housing laws is essential for all homebuyers. These protections ensure equal access to housing regardless of race, color, national origin, religion, sex, familial status, or disability.

Learn More

Virginia Housing offers a range of programs and resources designed to support first-time buyers. From down payment assistance to affordable loan options and homebuyer education courses, there’s help available for every step.

Learn More

If you have concerns about a Realtor®’s conduct, you can submit an ethics complaint through NVAR. We are committed to upholding the highest standards of professionalism and fairness in the industry.

Learn More About Ethics Resolution Options