Andrew Ackerman of The Wall Street Journal has reported that the federal government is about to backstop mortgages of more than $1 million for the first time in high-cost markets, reflecting the rapid appreciation in home prices.

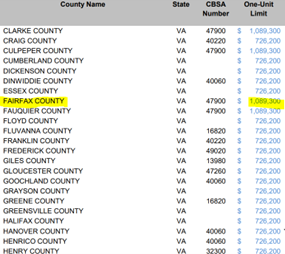

This is positive news for NVAR members, as Fairfax County is one of around 100 counties and county equivalents, out of more than 3,000 across the U.S., designated as a high-cost market. See Image 1 below for all counties in Virginia.

As reported, “Mortgage-interest rates have risen rapidly this year, cracking 7% for the first time in two decades. Many prospective home buyers have been unable to qualify for loans or had to cut their purchase budgets after higher rates pushed up their expected monthly costs by hundreds of dollars.”

The increase may make it easier and less expensive for borrowers purchasing one-unit homes, especially those near the one-unit limit. For further context, mortgages within the limits are known as conforming loans, generally coming with lower closing costs. They also require a smaller down payment than mortgages that exceed the limit (otherwise known as jumbo mortgages).

The efforts are being positively received in the industry, as mortgage bankers and real-estate agents say the new limits are needed to reflect higher home prices. There is a hope that the loan limit exceeding $1 million will provoke a needed policy discussion regarding the government’s footprint in the mortgage market.

Meanwhile, Ackerman reports that “Critics of Fannie and Freddie’s large role say borrowers who can afford million-dollar mortgages should be able to finance a home without government-backed financing.”

It is believed that housing affordability won’t be truly tackled until a long-term supply shortage of new homes is addressed.

Image 1